INDIA-CHINA ECONOMIC RELATION

2020 JUN 30

Mains >

International relations > India and Neighbours > India-China

WHY IN NEWS:

- India has banned a total of 59 apps that are linked to China on the grounds of ensuring safe cyberspace in the country.

HISTORY:

- India has deep trade relations with China since the official resumption of trade with it in 1978

- In the year 1984, India and china entered into a Trade Agreement, which provided them with the status of Most Favored Nation (MFN)

- India and China signed the Double Taxation Avoidance Agreement (DTAA) in1994. (DTAA was revised in 2018)

- With China’s accession to World Trade Organization (WTO) in 2001, our bilateral trade received a further impetus.

- In 2003, Bangkok Agreement was signed, which offered some trade preferences to each other.

- In 2003, India and China entered into an agreement to initiate open border trade via the Silk Route.

- The rapid expansion of India-China bilateral trade since the beginning of this century propelled China to emerge as our largest goods trading partner by 2008.

AN OVERVIEW OF TRADE IN GOODS AND SERVICES:

- Bilateral trade between India and China increased from $38 billion in 2007-08 to $89.6 billion in 2017-18.

- While imports from China increased by $ 50 billion, exports increased by $2.5 billion during the same period. This has widened India’s trade deficit

- In 2019-20, 5% of India’s exports were destined for China, while only 3% of China’s came to India. Also, 14% of India’s imports were from China, while only 0.9% of China’s were from India.

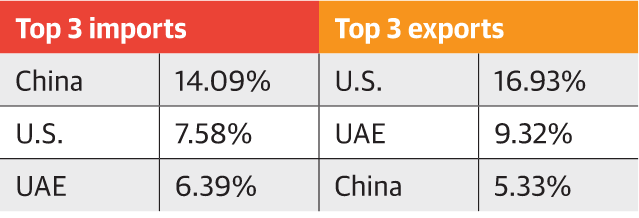

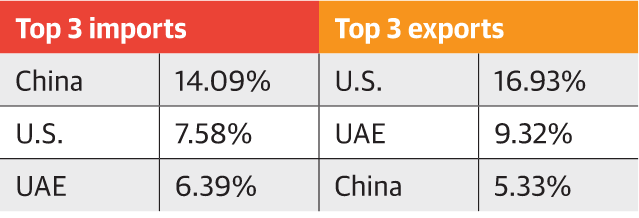

India’s top three trading partners (in 2019-20):

- China accounts for a sizable portion of India’s top imports, especially where intermediate products or components and raw materials are concerned.

- It has also been the top exporter of products like electrical machinery, nuclear reactors, organic and inorganic chemicals, fertilisers as well as vehicles accessories.

- In several cases, China’s contribution is much higher than the second-largest exporter countries of these products to India.

- China also accounts for 45 per cent of India’s total electronics imports.

- A third of machinery and almost two-fifths of organic chemicals that India purchases from the world comes from China

- Automotive parts and fertilisers are other items where China’s share in India’s import is more than 25 per cent

- Several of these products are used by Indian manufacturers in the production of finished goods, thus thoroughly integrating China in India’s manufacturing supply chain.

- For instance India sources close to 90 per cent of certain mobile phone parts from China.

- Tourism:

- Mainland China was the eighth-largest market for India in 2018 with nearly 3% share in total arrivals. More Indian tourists visit China every year than Chinese that come into India.

- Banking:

- Many Indian banks have established their presence in mainland China in the last few years. But most of the bank branches are in the process of closure for commercial reasons.

- Industrial and Commercial Bank of China(ICBC) and Bank of China (BoC) has banking operations in India

- Films:

- India-China MoU on ‘audio-visual coproduction’ was signed in 2014. ‘Xuan Zang’ was the first co-production film between India and China. In recent years, Indian movies such as Dangal, Secret Superstar, Hindi Medium, Andhadhun etc, registered great success at the Chinese box office.

ISSUES IN TRADE WITH CHINA:

- Widening trade deficit:

- From 2008 to 2018, imports from China increased by $ 50 billion, while exports increased by $2.5 billion. This has widened India’s trade deficit

- Trade with China constitutes more than 40% of India’s total trade deficit.

- The growth of trade deficit with China could be attributed to two factors:

- Chinese exports to India rely strongly on manufactured items to meet the demand of fast expanding sectors like telecom and power, while India’s exports to China are characterized predominantly by primary products

- Exports of some value-added products like electrical machinery, auto components, marine products, drugs and pharmaceuticals have started, but these products are still sub-optimal on account of restricted market access by China

- Dumping:

- Dumping refers to the practice of exporting goods at a price lower than their market value in the originating country

- India’s anti-dumping duties on Chinese goods are being evaded by misclassification of products

- Government of India is reluctant to review the effectiveness of anti-dumping measures undertaken by it.

- Illegal imports and smuggling:

- The value of seized smuggled goods from China was Rs 1,024 crore in 2016-17.

- Directorate of Revenue Intelligence (DRI), India’s chief anti-smuggling intelligence and investigations agency, works in a challenging environment with a small workforce.

- Unfair trade practices:

- Chinese goods are much more competitive than Indian goods. Chinese competitiveness is mainly the outcome of the efforts and support of the Chinese Government

- China is not recognized by WTO as a market economy mainly because of the lack of transparency in its trade policy.

- A large number of Chinese companies which are dominant player in exports are Government controlled enterprises.

- While China has been long accused of manipulating its currency to maintain export competitiveness, it has also been found guilty of unfair trade practices like export subsidies that are in contravention to WTO regulations

- Parliamentary committee on commerce finds that Chinese Government gives export rebate to the tune of 17% to their exporters.

- Lack of competitiveness of Indian industry:

- Apart from WTO non-compliant trade measures, Chinese competitiveness is also led by an enabling policy environment wherein the Government has made considerable interventions in ensuring that all the factors of production iare available at the cheapest cost to its manufacturers

- Lending rates: The lending rates in China are very industry friendly while in India, the banks offer one of the highest lending rates to the industry. Our industry is borrowing anywhere between 11 and 14% while the Chinese are getting loans at 6%.

- Logistic costs in China are one of the lowest in Asia and much lower than India. The Chinese cost of logistics is 1% of their business. In India, it calculates to 3%.

- Cost of electricity: The effective cost of electricity in India is anywhere between twelve and fourteen rupees which is higher in comparison to China.

- In short, India suffers cost competitiveness by almost 9% to their competition with China on account of energy, finance and logistics.

- Heavy reliance on Chinese imports for raw materials in certain sectors:

- Pharmaceutical industry:

- India imports two-thirds of its active pharamaceutical ingredients, or key ingredients of drugs, from China.

- Solar Industry:

- 84% of the solar requirement of the National Solar Mission is met through imports from China.

- The Parliamentary committee on commerce noted that import prices of such commodities in India are lower than their import prices in Japan and Europe, suggesting that Chinese goods are being dumped in Indian markets.

- Misuse of FTAs:

- India has free trade agreements (FTAs) with Least Developed Countries such as Bangladesh.

- Chinese fabric is manufactured into garments in Bangladesh, and imported at cheap rates into India

- Impact on MSMEs:

- Poor quality Chinese products dominate the unorganized retail sector, largely affecting domestic MSMEs

- Health concerns:

- Some of Chinese imports contain items that involve severe public health concerns.

- For example most Chinese firecrackers contain potassium chlorate, a highly explosive chemical which is banned in India.

- Job loss:

- A number of industries that have been adversely affected by the import of Chinese goods are labour intensive.

- These industries have traditionally been large employment generators in India (e.g., textiles) or are likely to become so (e.g., solar industry)

- For example; a number of MSMEs have had to close down, particularly manufacturers of stainless steel due to Chinese import.

- Poor enforcement of quality control:

- Delays in firming up the Quality Control Orders (QCO) by the Government helps the Chinese industry monopolise its low quality goods in the market.

- While the consumers buy shoddy Chinese products, the Indian industry, especially, MSME units are forced to close their shutters

- Tax collection:

- Downsizing or closing down of units in India will naturally affect tax collections and impinge upon the Make in India programme.

- Affects banking sector:

- Closure of industry will also stress the banking sector which already is reeling under the burden of huge NPAs

- Environmental concerns:

- Low-quality Chinese imports also have an adverse impact on the environment.

- For instance, import of impure chemicals affects the environment, and results in low quality agrochemicals (pesticides) thus affecting Indian farmers.

INVESTMENT:

- Growth in bilateral investment has not kept pace with the expansion in trading volumes between the two countries.

- While both countries have emerged as top investment destinations for the rest of the world, mutual investment flows are yet to catch up.

- Cumulative Chinese investment in India till the end of September 2019 amounted to US$5.08 billion.

- Cumulative Indian investment in China until September 2019 is US$ 0.92 billion.

- However, these figures do not capture investment routed through third countries like Singapore, Hong Kong, etc. especially in sectors such as start-ups etc. which has seen significant growth in Chinese investment.

- In India, China’s tech giant companies and venture capital funds have become the primary vehicle for investments in the country – largely in tech start-ups.

- This is different from other emerging markets where Chinese investments are mostly in physical infrastructure.

- Chinese FDI into India is small, but its impact is already outsized, given the increasing penetration of tech in India

- Alibaba, Tencent and ByteDance rival the U.S. penetration of Facebook, Amazon and Google in India

- Chinese investments in Indian start-ups:

- Chinese tech investors have put an estimated $4 billion into Indian startups

- As of March 2020, 18 of India’s 30 unicorns are Chinese-funded. It includes Flipkart, Byju’s, Paytm, Ola etc.

- There are three reasons for China’s tech depth in India:

- First, there are no major Indian venture investors for Indian start-ups. Indian start-ups rely disproportionately on overseas venture capital (VC) funding. China has taken early advantage of this gap

- Second, China provides the patient capital needed to support the Indian start-ups, which like any other, are loss-making. The trade-off for market share is worthwhile.

- Third, for China, the huge Indian market has both retail and strategic value.

- Indian Companies in China:

- Many Indian companies have started setting up Chinese operations to service both their Indian and MNC clientele in China.

- Most of them are operating in manufacturing sectors (pharmaceuticals, auto-components, wind energy), IT and IT-enabled services, trading, banking etc.

- Most of the Indian companies have a presence in Shanghai, which is China’s financial centre.

- Some of the prominent Indian companies in China include Aurobindo Pharma, Infosys, TCS, Reliance Industries etc

- Chinese companies in India:

- More than 100 Chinese companies have established operations in India.

- Many large Chinese state-owned companies in the field of machinery and infrastructure construction have won projects in India and have opened project offices in India.

- Many Chinese electronic, IT and hardware manufacturing companies are also having operations in India. These include Huawei Technologies etc.

- A large number of Chinese companies are involved in EPC projects in the Power Sector.

- In recent years, Chinese mobile companies have achieved remarkable growth in India. Chinese smartphones brands, led by Xiaomi, Vivo and Oppo, are market leaders in India with an estimated 72% share put togethe

ISSUES WITH CHINEASE INVESTMENT:

- Insufficient data:

- Chinese funds and companies often route their investments in India through offices located in Singapore, Hong Kong, and Mauritius.

- For example, Alibaba Group’s investment in Paytm came via Alibaba Singapore Holdings Pvt. These don’t get recorded in India’s government data as Chinese investments

- Data security issues:

- Chinese apps harvest more than normal amounts of data as compared to other social media apps, posing security concerns for India

- A study conducted by Arrka Consulting in India23 shows that Chinese apps in India ask for 45% more permissions than the number of permissions requested by the top 50 global apps

- Chinese companies such as Alibaba and Tencent have their own ecosystems, which include online stores, payment gateways, messaging services, etc. An investment by a Chinese firm can pull the Indian company into this ecosystem, which may mean loss of control over data

- Propaganda/influence/censorship:

- Investments in Indian social and other media as well as startups could lead to a subtle push toward the Chinese narrative on bilateral issues and disputes with India, a shift to a more favourable depiction of China and suppression of criticism.

- For instance, TikTok censors topics that are sensitive to the Chinese government

- Malware:

- Chinese apps have always raised suspicions about cyber espionage attempts and security risks in India.

- The Ministry of Electronics and Information Technology reportedly sent notices to TikTok, Bytedance and Helo apps, seeking a response to its data privacy concerns about these apps being used to commit unlawful activities

- Platform control:

- The Internet is split into two major camps: the ‘traditional’ open internet dominated by Western companies, Facebook, Amazon, Netflix and Google (FANGS) and the ‘closed’ Chinese internet – almost an intranet – which restricts outsiders and is closely monitored and controlled by the state.

- Companies like Alibaba and Tencent are enablers and beneficiaries of this system

- If Alibaba, Tencent and other Chinese tech majors replicate their internet ecosystems in India, this can create a systemic risk.

- An ecosystem such as this controls access to end-users; it means other companies (retailers, financing firms and media) will have to follow the standards/technologies prescribed to them

INSTITUTIONAL MECHANISMS FOR ECONOMIC COOPERATION:

- Joint Economic Group (JEG) was established in 1988, to discuss trade cooperation issues. So far 11 JEGs were held with the last one held in Delhi in March 2018

- Strategic Economic Dialogue (SED) was established in 2010, to discuss macro-economic cooperation

- NITI Aayog - Development Research Center of China (DRC) Dialogue was established in 2015, to discuss global economic cooperation issues

- India-China Financial Dialogue is held annually since 2005

- India is founding member of Chinese led Asian Infrastructure Investment Bank (AIIB)

- India and China are members of BRICS led New Development Bank (NDB)

- Social Security Agreement: With the steady increase in the number of personnel/professionals that are being employed in India and China, both sides held negotiations on the Social Security Agreement in 2019

- Cooperation in Railway Sector: A MoU on cooperation in the railway sector was signed in 2014.Accordingly, cooperation commenced in areas such as feasibility studies for high-speed rail, station redevelopment etc.

WAY FORWARD:

- Cooperation:

- India and China should work upon the areas of cooperation in the oil and gas sector to leverage upon the sheer size of the market of two countries

- India should negotiate with China on ‘Regional Comprehensive Economic Partnership (RCEP)’ Agreement, to make it more balanced and equitable.

- India and China could cooperate in areas of health, education and sanitation, by sharing best practices and technology, to improve standard of living of its population.

- Competition:

- Recommendations of Parliamentary Standing Committee on Commerce:

- Directorate General of Anti-Dumping (DGAD) should address the problem of lax implementation of anti-dumping duties, and rationalise the duties and make them more in line with current domestic production costs.

- It recommended that the workforce of the Directorate of Revenue Intelligence (DRI) be adequately augmented to check smuggling.

- It suggested that import of finished goods be taxed at the highest rate, and raw materials at the lowest, to boost domestic production.

- Creation of an integrated single umbrella National Authority, namely, Directorate General of Trade Remedies (DGTR) shall prove to be effective in providing comprehensive and swift trade defence mechanism in India

- A strong quality control framework and supporting infrastructure is the need of the hour to avert cheap and poor quality products from China which negatively impact Indian industry and consumers

- Single Window Interface for Facilitating Trade (SWIFT) need to optimally utilised for effective quality control of all the imports of products

- Re-routing of Chinese imports through countries with which India has FTAs and flagrant flouting of Rules of Origin norms should be immediately addressed to avoid distress to Indian industry

- Surveillance of Land Ports especially in the Indo-Nepal Border and North East border needs to be stepped up

- All the ports of entry should have an independent agency to ensure that import rules, duties and other government notifications are being enforced

- Public procurement order giving preference to domestically manufactured goods must be put to good use and made an effective tool to counter imports.

- Support Indian domestic manufacturing industries through improved infrastructure and logistics facilities to make it more cost efficient and quality effective

- Predictable and transparent trade policy:

- Resorting to unpredictable and opaque moves, like delaying port clearances for pharma consignments from China in the wake of tensions LAC, may prove counterproductive as investors may feel insecure in India’s trade policy.

- Data localisation policy:

- A data localisation policy for regulating access to data, mandating data storage requirements and controlling cross-border data flows, needs to be put in place.

- Companies should be required to set up data centres in India to minimise the need for storing sensitive data on foreign servers

- Accountability in trans-border data flows:

- There are legal best practices to be learned from other countries. For example; “The 13 Australian Privacy Principles” are designed to effectively protect the collection, holding use and disclosure of all personal information

- A centralised FDI screening mechanism for the IT-BPO industry:

- European Union recently introduced ‘EU Foreign Direct Investment Screening Regulation (FDIR)’, a nonbinding cooperation and oversight system which encourages sharing information across member states on the potential of certain investments to affect national security and interests

- Adopting a similar screening mechanism for the IT-BPO industry in India will protect citizens’ sensitive personal information from being shared through apps, browsers, search services and other critical technology and infrastructure in India

- Inter-agency committee to review foreign investments involving the collection of sensitive personal data:

- India can devise a body akin to the Committee on Foreign Investment in the United States (CFIUS).

- It can consist of members from the Ministry of Home Affairs, Department of Telecommunications, DIPP etc.

- This can help tackle security threats in India

CONCLUSION:

- At a time when there is an urgent need to stimulate our manufacturing sector, Chinese imports have thrown a spanner in the wheel of India’s economic progress, industrial manufacturing in particular

- Moreover, China quietly has created a significant place for itself in India in the last five years – in the technology domain.

- Unable to persuade India to sign on to its Belt and Road Initiative (BRI), China has entered the Indian market through venture investments in start-ups and penetrated the online ecosystem with its popular smartphones and their applications (apps).

- However Chinese imports are needed for many of our industries to sustain their production, as it offers a cheap source of raw materials.

- India has been able to reduce its import dependence in the mobile sector through a long-term focus on building self-reliance in manufacturing some of the crucial components required to make them. This approach can be replicated in other sectors too.

PRACTICE QUESTION:

Q. “India’s trade dependence on China plays a major role in shaping the geo-politics of Asia”. Critically Analyse?