Ban on Cryptocurrency?

2021 FEB 15

Mains >

Science and Technology > IT & Computers > Digital technology

IN NEWS:

- The government's draft bill on cryptocurrencies is likely to bar Indian companies and individuals from using digital currencies.

WHAT IS CRYPTOCURRENCY:

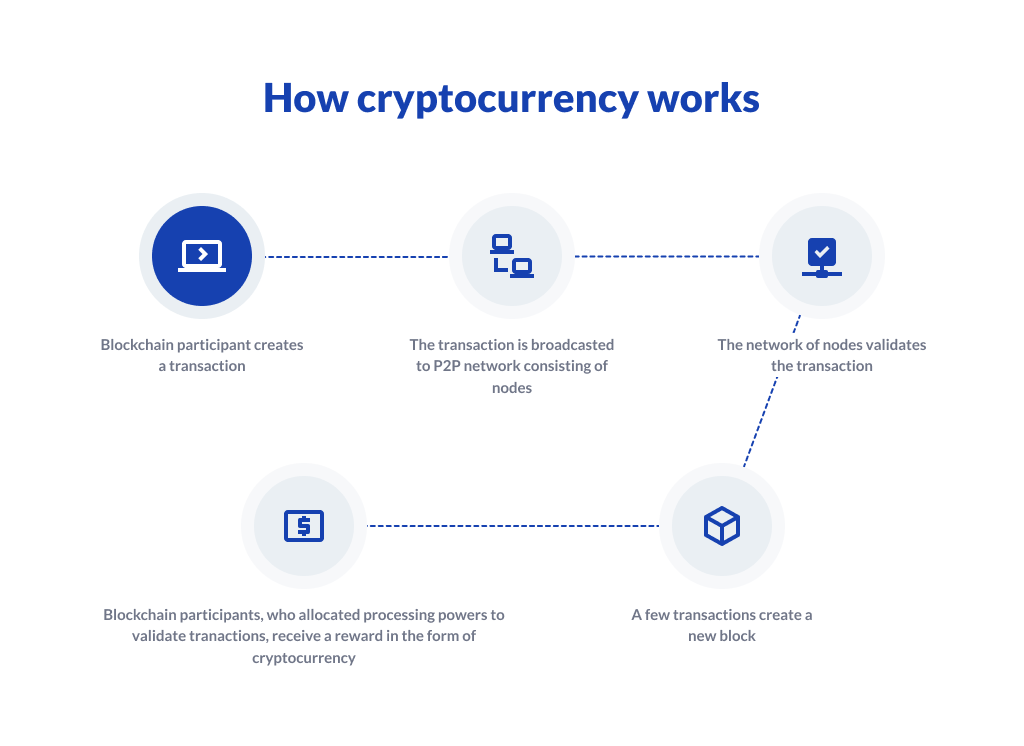

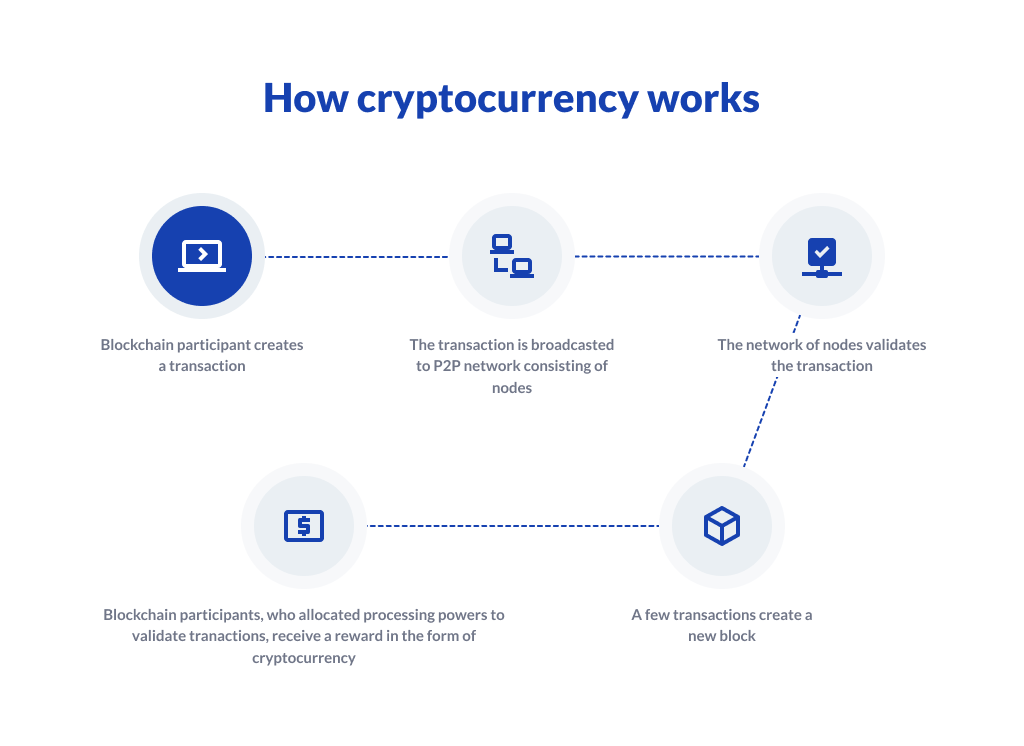

- Cryptocurrency is a decentralized digital currency transferred directly between peers and the transactions are confirmed in a public ledger – which is accessible to all the users.

- Bitcoin, Etherem, Litecoin, Tether and LIbra (proposed cryptocurrency by facebook) are some of the examples of virtual currencies.

BENEFITS OF CRYPTO CURRENCY:

- User Autonomy: Digital currencies allow users more autonomy over their own money than fiat currencies do, at least in theory. The payment system is also peer-to-peer, meaning that users do not require any approval from any external source or authority to make transactions.

- Decentralized: Users are able to control how they spend their money without dealing with an intermediary authority like a bank or government.

- Cost effective: cryptocurrency users are not subject to the litany of traditional banking fees associated with fiat currencies like minimum balance fees, overdraft charges etc. The saving is more pronounced in international transactions.

- Privacy: Each cryptocurrency transaction is a unique exchange between two parties, which protects users from issues like identity theft.

- Accessibility: On a global scale, more people have access to the internet than they have to banks or other currency exchange systems. This opens the opportunity for underprivileged people to establish credit.

- Time saving: Transactions are instantaneous because the entire process is simple and requires very little time to process.

WHY BAN CRYPTOCURRENCY?

- Undermines financial stability of the country:

- Cryptocurrencies are subjected to market fluctuations and the lack of a centralised authority makes it difficult to regulate them.

- As they lack a clear paper trail, tax evaders could use it as their tax havens in form of cryptocurrencies.

- Hence, they can easily undermine a country’s financial stability.

- Fuels illicit activities: Unlike a sovereign currency whose value is based on the relative value of a tradeable basket of goods and services, cryptocurrencies have been used as a mode of exchanging money for illegal activities, especially those on the dark web.

- Channel for money laundering: Given their decentralized nature and anonymity, cryptocurrencies are being used by some to launder their returns from illicit activities.

- Vulnerable to cyber threats: Although cryptocurrencies are very secure, exchanges are not that secure. Most exchanges store the wallet data of users to operate their user ID properly. This data can be stolen by hackers, giving them access to a lot of accounts.

- Impact on power consumption: Cryptocurrencies can have unfavorable consequences on India’s energy demand. Validating transactions in a distributed network involves high electricity consumption and requires high computation power. For eg: A study estimated that 19 households in USA can be powered for one day by the electricity consumed in a single transaction of bitcoin cryptocurrency.

CONCLUSION:

- Cryptocurrencies are hard or nearly impossible to regulate. But government should not shy away from entering into the sector which is dynamic and evolving. In this regard, government can look into some of the international best practices:

- In Russia, US and Japan, regulators have classified cryptocurrencies as either property or legal payment methods to co-opt them in a bid to stop money laundering.

- Owing to the concerns regarding the perceived potential of cryptocurrencies for tax evasion, US Government had issued a notice in 2014, labelling them as “intangible property” and deemed trading in cryptocurrencies to be taxable and subject to capital gains taxes.

- The People’s Bank of China has done trial runs of its prototype cryptocurrency, taking it a step closer to being the first major central bank to issue digital money.

- Also, government should make efforts to integrate them into formal channels by trying to improve the know-how and tech capabilities of government machineries.

- The detailed provisions of the bill have not yet been released to the public. However, the bill does mention that certain exceptions may be made to preserve the underlying technology of cryptocurrencies, which is blockchain.

(This article will be updated once the provisions of the bill are made public)

PRACTICE QUESTION:

Q. What are the risks and challenges associated with virtual currencies? Should the currency be banned in India. Substantiate your view?