Friendshoring and India’s Prospects

2023 JUN 26

Mains >

International relations > India and Global Regions > India-China

IN NEWS:

- From Tesla to Apple, leading U.S. corporations and several other multinational corporations are investing in manufacturing facilities in India as an alternative production hub to China.

- Earlier this year, US Treasury Secretary Janet L. Yellen pushed for India to be included in its "friendshoring" strategy, under which the U.S. is seeking to diversify away from countries that present geopolitical and security risks to the supply chain.

WHAT IS “FRIENDSHORING”?

- Friendshoring refers to the process of relocating supply chains to countries that are ‘friends’ or allies of each other.

- The objective seems to be to prevent countries (like China and Russia in the case of the US) from using their market advantages in key raw materials, foods and products.

- For instance, Covid pandemic exposed the limitations of global supply chain and the over-dependence of the West on China.

INDIA’S PROSPECTS AND ADVANTAGES:

I. LAND:

- Resource base:

- India is rich in conventional natural resources like iron and coal. India is also strengthening its energy basket by investing in renewable energy and developing strategic petroleum reserves.

- Industrial zones:

- Centre and States are actively promoting dedicated zones with plug and play infrastructure and tax incentives to attract industries. Eg: Textile parks under PM MITRA scheme, SEZs and IT parks in states.

- Connectivity with supply routes:

- India is strategically located at the centre of the trans- Indian Ocean routes which connect the European countries in the west and the countries of East Asia.

- The development of transport infrastructure like inland waterways, dedicated freight corridors and container trans-shipment ports (Eg: Vizhinjam port) will enable India to further integrate with the global supply chain.

II. LABOUR:

- Demographic dividend:

- Recent reports suggest that India has surpassed China as the world's most populous country. This offers both human resource as well as a market for global industries.

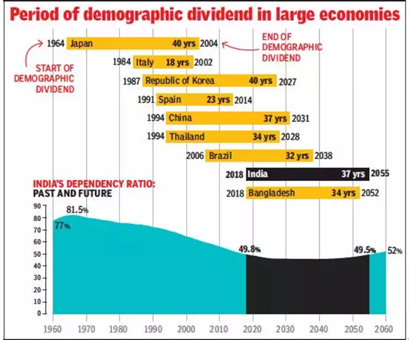

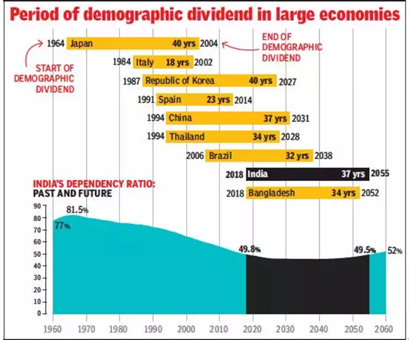

- Also, the window of demographic dividend opportunity in India is available for five decades from 2005-06 to 2055-56, longer than any other country in the world.

-

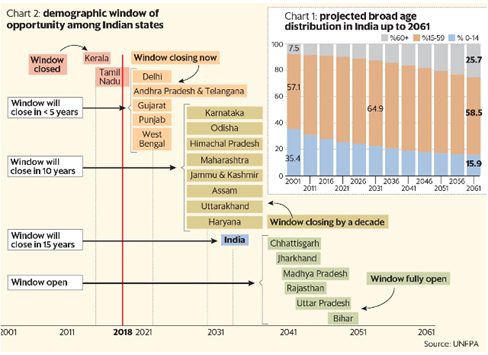

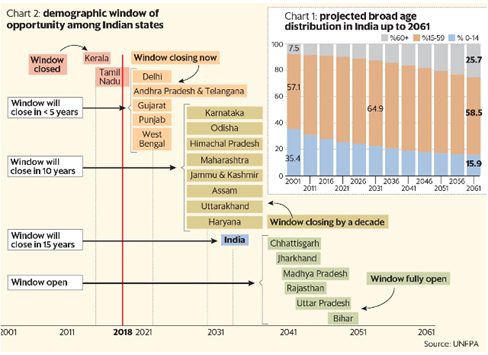

- This demographic dividend window is available at different times in different states because of differential behaviour of the population parameters.

-

- Lower labour cost:

- China's manufacturing labour costs have risen to quite high levels- USD 7.1 per hour, far higher than India.

III. CAPITAL:

- Rising capital expenditure:

- As per the 2023-24 budget announcement, government will raise its capital expenditure (capex) by 33% to 10 trillion rupees (USD122.29 billion) in the next fiscal year.

- The government’s investment orientation through public capex is creating an enabling environment to crowd-in private capex.

- Foreign direct investment:

- According to a report by the Confederation of Indian Industries (CII), FDI in India has seen a consistent rise in the last decade, with FY 2021-22 receiving FDI inflow of USD 84.8 billion. The report also states that India has the potential to attract FDI flows of USD 475 billion in the next five years.

- Incentives:

- Through various measures like Production Linked Incentives, subsidies and tax breaks, government is incentivising industries to set up units in India.

IV. ENTREPRENEURSHIP:

- Growing Start-up ecosystem:

- With 84000 recognised startups are spread across 56 sectors, India has the 3rd largest start-up ecosystem in the world after the US and China.

- Presence of MSMEs:

- Currently, many of India’s 64 million MSMEs provide ancillary goods to large multinational companies across the globe. Hence, for new industries, outsourcing of components would be easier.

V. OTHER FACTORS:

- Rising consumption:

- As the Indian economy continues to grow, incomes and purchasing power are increasing steadily. One in two households is expected to be upper-middle income and high-income by 2030. This can boost consumption, making India a strong market.

- Technological developments:

- Introduction of 5G and India’s advantage in the IT sector is expected to benefit the adoption of IR 4.0 technologies such as the Internet of Things (IoT), cloud computing and analytics and artificial intelligence (AI) for smart manufacturing.

- Favourable government policies:

- Union and state governments have taken various measures to improve the ease of doing business and attract investors and industries.

- Important efforts include the codification of labour laws, Make in India initiative, PLI Scheme, Gati Shakti, logistics policy Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS), Pravasi Bharatiya Divas convention and various investors summits.

- Emerging sectors:

- Electronic components manufacturing, Pharmaceuticals, green energy, space, defence manufacturing and AI-related service industries are among the most promising sectors in India.

- For instance, about 20% of the global exports in generic drugs are met by India. Pharmaceutical is one of the top ten attractive sectors for foreign investment In India.

- Good international credibility:

- India’s non-alignment in geopolitics, credible history of democracy and upholding human rights, vaccine diplomacy etc. has bolstered its image as a reliable nation. Hence, countries are considering India a key part of their friendshoring efforts.

- Eg: India is a key part of Supply Chain Resilience Initiative (SCRI)

|

CHINA PLUS ONE STRATEGY:

- Coined back in 2013, it is a global business strategy in which companies avoid investing only in China and diversify their businesses to alternative destinations.

- Although such model was in place by Japan and the US since 2008, it furthered much more during the pandemic.

|

CHALLENGES TO BE ADDRESSED:

- Low participation in the global value chains (GVC):

- Currently, India accounts for around 1.5% of the world's GVC exports. India's significant GVC participation is only in a handful of sectors like coal and petroleum, chemicals and business services.

- Low expenditure on research and development (R&D):

- India's gross expenditure on R&D is one of the lowest in the world, with just USD 43 per capita, according to NITI Aayog's India Innovation Index 2021.

- Protectionism:

- New Delhi’s decision to walk away from the RCEP, emphasis on Atmanirbhar Bharat and ban on wheat exports have generated widespread concerns about India returning to protectionist ways.

- Absence in trade blocs:

- India is not a member of major trade blocs like the Regional Comprehensive Economic Partnership (RCEP). But its competitors, like Vietnam and Malaysia, are members of RCEP as well as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. This could affect India’s competitiveness.

- Absence of data protection regime:

- India is yet to develop a Personal Data Protection legislation. In its absence, there are uncertainties over the processing of data, taxation, data localisation and cyber security.

- Disputes in digital trade:

- Delhi is not on the same page as its partners like the US, EU, Japan, and Australia on the emerging digital trade issues. This complicates the creation of strong trade relations.

- IP Regime:

- The enforcement of IP rights in India is weak. As a result, copying, plagiarism, piracy and other IPR violations are rampant, causing huge losses to IPR owners.

- As per the Annual Special 301 Report, India is on the ‘Priority Watch List’ of the United States Trade Representative (USTR) for lack of adequate IP rights protection and enforcement.

- Quality of human resource:

- India Skills Report 2023 suggests that only 50.3% of young people were found to be highly employable.

- Corruption:

- Transparency International ranked India at 85 among 180 countries in its Corruption Perception Index 2022. Also, some of the mechanisms that could help reign in corruption are weakening. Eg: The recent amendments to RTI Act and political interference in CBI.

- Fiscal sustainability:

- As of March 2022, India’s external debt stood at USD 620.7 billion and the external debt to GDP ratio stood at 19.9%. Increasing government expenditure through debt financing will be a challenge for emerging economies like India.

- Also, in Punjab, Rajasthan, Bihar, Kerala and West Bengal, the debt growth outpaced their gross state domestic product growth in the last five years. This raises concern over their debt sustainability.

- Issues in capital market:

- NPA crisis, underdeveloped corporate bond market and lack of diversity in financial instruments has resulted in shortage of long-term capital in India.

- Also, India has a partially convertible capital account policy. This limits the smooth inflows of capital into the country

- Delays in litigation:

- Prolonged litigation and weak contract enforcements are major hinderances to ease of doing business in India, as noted by the World Bank’s ease of doing business report.

- Environmental sustainability:

- Many parts of India are already suffering from poor air quality, water stress and land degradation. In this situation, attracting industries could be a challenge.

-

- For instance, Semiconductor manufacturing requires around 60 liters of water per layer of chip to avoid the contamination of electronic devices. Such levels of usage in a water stressed country like India is unsustainable.

-

Agrarian crisis:

- Despite contributing to 20% of GDP in 2020-21 and employing about 45% of the population, agriculture in India is becoming increasingly unremunerative. This threatens the overall stability of Indian economy.

- External factors:

- Inflation and recession are expected to be major disruptors in 2023. Potential escalation of the ongoing Russia-Ukraine crisis can also affect the global supply chain.

- Rising inequality:

- Income inequality:

- India's top 1% owned more than 40.5% of total wealth in 2021, according to the ‘Survival of The Richest’ report by Oxfam.

- Gender inequality:

- Despite socio-economic progress, the female labour force participation rate in India stood at 25.1% in 2020-21.

- Regional disparity:

- North-South:

- India's exports are spatially concentrated. As highlighted in the Economic Survey 2017-18, 75 per cent of India's exports emanate from only six states.

- Rural-Urban:

- The ‘State of Inequality in India’ Report finds that urban areas have a 44.4% wealth concentration in the highest quintile (20%) compared to 7.1% concentration in rural areas.

-

WAY FORWARD:

- Utilise G20 Presidency:

- As the President of the G20 for 2023, India needs to build multiple alliances and position itself as a bridge between the global economies.

- Capacity building:

- Social:

- India can reap the demographic dividend, provided timely measures are taken to improve education, healthcare and skilling.

- Physical:

- India needs to invest 6% of its GDP to close the infrastructure gap by 2030, from the current rate of 4.6%.

- Financial:

- Reforms in the financial markets are necessary to create sufficient long-term lending facilities.

- Rationalise tariffs:

- In order to engage more in the global supply chains, a rationalisation of tariff levels and non-tariff barriers is required. Also, the tax regimes in India needs to be made more predictable.

- Increase spending on R&D:

- Higher investment in R&D, by both the public and private sectors, is necessary. Government should raise public spending in R&D to at least 1% of the GDP.

- Encourage ease of doing business:

- Measures like minimising entry barriers, strengthening contract enforcement, protection of IP rights and stability in taxation are needed.

- Corporate governance should also be reformed. In this regard, the recommendations of Uday Kotak Committee on Corporate governance should be looked into.

- Strengthen dispute resolution:

- Alternate dispute resolution mechanisms like arbitration mechanisms must be encouraged in the country.

PRACTICE QUESTION:

Q. There is a strong desire among countries to diversify the global supply chains. In this regard, discuss India’s prospects and challenges in emerging as a major supply chain hub.