Cooperative Credit Institutions in India

2023 FEB 17

Mains >

Social justice > Development Processes & Industry > Cooperatives

IN NEWS:

- The Union Budget 2023-24 has announced Rs 2,516 crore for computerisation of 63,000 Primary Agricultural Credit Societies (PACS) over the next five years.

- With this, the government aims to bring greater transparency and accountability to their operations, enabling them to diversify their businesses and undertake more activities.

COOPERATIVE CREDIT MOVEMENT IN INDIA:

- The co-operative credit system, with two broad segments of urban and rural co-operatives, forms an integral part of the Indian financial system.

- Rural credit cooperatives in India were originally envisaged as a mechanism for pooling the resources of people with small means and providing them with access to different financial services.

- Democratic in features, the cooperative credit movement was also an effective instrument for development of degraded waste lands, increasing productivity, providing food security, generating employment opportunities in rural areas and ensuring social and economic justice to the poor and vulnerable.

- The history of the cooperative credit movement in India can be divided in four phases.

- In the First Phase (1900-30), the Cooperative Societies Act was passed (1904) and “cooperation” became a provincial subject by 1919.

- The major development during the Second Phase (1930-50) was the pioneering role played by RBI in guiding and supporting the cooperatives. However, even during this phase, signs of sickness in the Indian rural cooperative movement were becoming evident.

- In the Third Phase (1950-90), the All India Rural Credit Survey was set up which not only recommended state partnership in terms of equity but also partnership in terms of governance and management. NABARD was also created during this phase.

- The Fourth Phase from 1990s onwards saw an increasing realization of the disruptive effects of intrusive state patronage and politicisation of the cooperatives, especially financial cooperatives, which resulted in poor governance and management and the consequent impairment of their financial health.

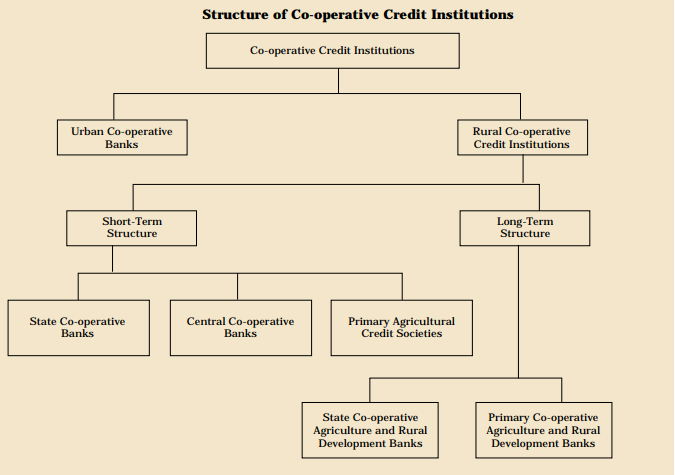

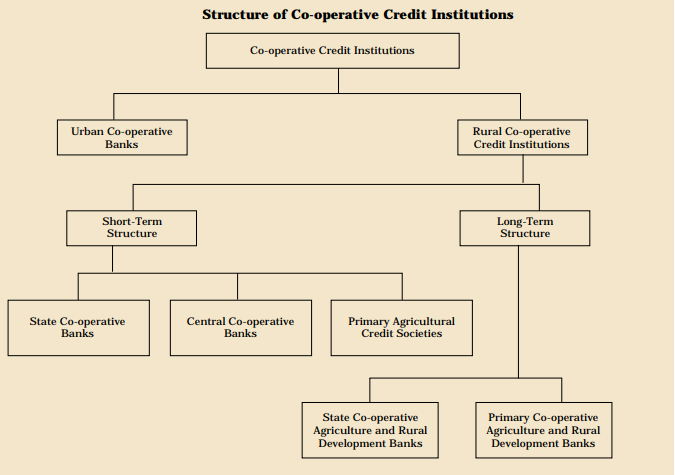

STRUCTURE OF CO-OPERATIVE CREDIT INSTITUTIONS IN INDIA:

- The co-operative credit structure in the country can be divided into two broad segments:

- the urban co-operative banks and

- the rural co-operative credit institutions.

- While the urban co-operative banking system has a single tier comprising the Primary Co-operative Banks (commonly known as urban co-operative banks – UCBs).

- The rural co-operative credit system is divided into long-term and short-term co-operative credit institutions which have a multi-tier structure.

- The short-term co-operative credit institutions have a three-tier structure comprising State Co-operative Banks (StCBs), Central Co-operative Banks (CCBs), and Primary Agricultural Credit Societies (PACSs) which are not banks but only societies.

- The long-term co-operative credit institutions have generally a two tier structure comprising the State Co-operative Agriculture and Rural Development Banks (SCARDBs) and the Primary Co-operative Agriculture and Rural Development Banks (PCARDBs). Long-term co-operative credit institutions have a unitary structure in some States, while in other States they have a mixed structure (unitary and two-tier).

- The States not having long-term co-operative credit entities are served by the State Co-operative Banks apart from being serviced by the branches of Regional Rural Banks (RRBs) and the rural/semi-urban branches of commercial banks.

---------------------------------------------

SIGNIFICANCE:

- Alternative to the traditional defective credit system:

- The main objective of the cooperative credit institutions is to provide an effective alternative to the traditional defective credit system of the village money lender.

- The cooperative banks tend to protect the rural population from the clutches of money lenders, who tend to provide credit at a higher rate of interest.

- Productive Borrowing:

- An important benefit of a cooperative credit system is that it changes the nature of loans.

- Previously, the cultivators used to borrow for consumption and other unproductive purposes. But, now, they mostly borrow for productive purposes.

- Cooperative societies discourage unproductive borrowing.

- Promotes savings and investment:

- Cooperative banking has enabled the rural population to save more and invest rather than hoard money.

- This will have a long-term benefit for the money management of the rural population.

- Improvement in farming methods:

- Due to the lower interest rates of the credits provided by the Cooperative credit institutions, the rural population can now utilise the same for better farming methods eg: purchasing seeds, chemical fertilizers etc.

- This has also enabled them to sell their products at good prices.

- Rural development and poverty eradication:

- Co-operative credit institutions support the construction of basic amenities and infrastructure in rural and backward regions. This encourages upward mobility and the improvement of living standards.

- Also, profits and benefits accrued by the cooperative credit institutions circulate within the same community.

CHALLENGES:

- Issues associated with regulation and supervision:

- The regulation and supervision of co-operative banks poses several challenges in view of the large number of such banks, as also the multiple controls by supervisors, including the Reserve Bank, the State Governments and NABARD.

- The co-operatives are at present under the control of State Governments in all matters relating to registration, membership, election, financial assistance, loaning powers, business operations, loan recovery and audit.

- Some aspects relating to banking activities are regulated and supervised by the Reserve Bank of India/NABARD.

- While urban co-operative banks come under the supervisory jurisdiction of the Reserve Bank, rural co-operatives are regulated by the NABARD.

- There is thus no clear demarcation of regulatory powers, which at times has resulted in cross directives from the controlling agencies, thereby undermining the working of co-operatives.

- Inadequate Coverage:

- Despite the fact that the cooperatives have now covered almost all the rural areas of the country, their rural household membership is only about 45 percent.

- In fact, the borrowing membership of the primary credit societies is significantly low and is restricted to a few states like Maharashtra, Gujarat, Punjab, Haryana, and Tamil Nadu, and to relatively rich landowners.

- Regional Disparities:

- There have been large regional disparities in the distribution of cooperative credit.

- According to the Seventh Plan, the eight states of Andhra Pradesh, Gujarat, Haryana, Kerala, Madhya Pradesh, Maharashtra, Punjab, and Rajasthan account for about 80 percent of the total credit disbursed.

- Problem of overdues:

- A serious problem of the cooperative credit is the overdue loans of the cooperative institutions which have been continuously increasing over the years.

- Large amounts of overdues restrict the recycling of the funds and adversely affect the lending and borrowing capacity of the cooperative societies.

- Lack modern banking practices:

- Most cooperative credit institutions lack modern banking practises like net banking, mobile banking, online banking, e-banking, ATM banking, and all other modern banking practices.

- Due to this, they remain on the back foot in the modern banking industry.

- Lack of Awareness:

- People are not well informed about the objectives of the cooperative movement, the contributions it can make in rebuilding society, and the rules and regulations of cooperative institutions.

- They look upon cooperative banks as a means of obtaining services and concessions from the government.

- Limited resources and coverage:

- The size of the cooperative banks is very small. Most of these societies only have a small number of members, and they only operate in one or two villages.

- As a result, their resources remain limited, which makes it impossible for them to expand their means and extend their area of operations.

- Audits:

- Audits in the co-operative banks are done entirely by department officials and are neither regular nor comprehensive.

- Delays in the conduct of audits and the submission of reports are widespread.

- Functional Weakness:

- The cooperative movement has suffered from an inadequacy of trained personnel right from the start.

CONCLUSION:

- Co-operative credit institutions play an integral part in the implementation of development plans and are important for the effective functioning of the banking system in India. The government should ensure the autonomous and democratic functioning of cooperatives while maintaining the accountability of management to the organization’s members and other stakeholders.

- The infusion of elements of good corporate governance, sound investment policy, appropriate internal control systems, better credit risk management, a commitment to better customer service, and a focus on newly emerging business areas like microfinance can strengthen the cooperative credit institutions in the country.

PRACTICE QUESTION:

Q. “Co-operative credit institutions play an integral part in the implementation of development plans and are important for the effective functioning of the banking system in India”. Discuss.