EASE OF DOING BUSINESS IN INDIA

2020 JUN 26

Mains >

Economic Development > Indian Economy and issues > Ease of doing business

CONTEXT

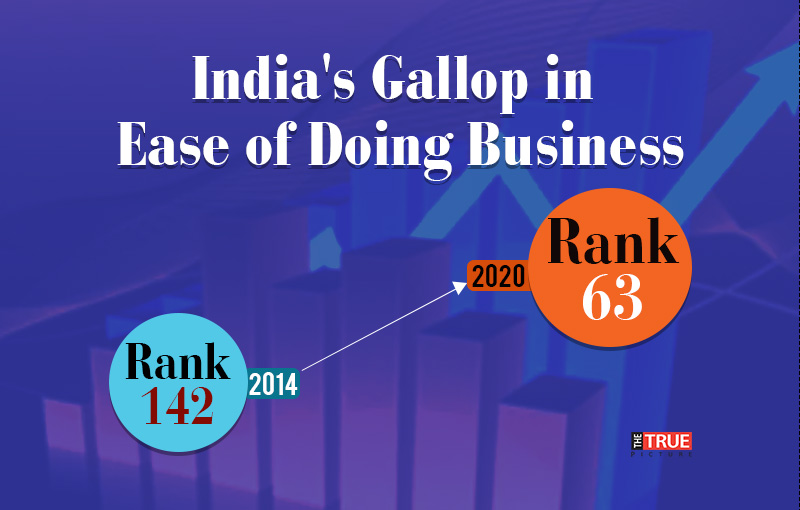

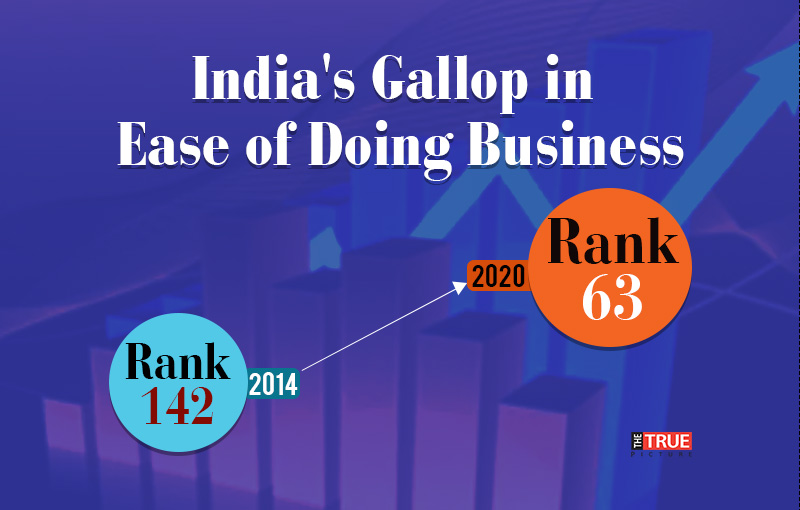

- India climbed 14 ranks in the World Bank’s Ease of Doing Business 2020 survey to stand at 63, among 190 countries

ABOUT EASE OF DOING BUSINESS INDEX

- ‘Ease of Doing Business Index’ is developed by World Bank, and it is released annually.

- In India, World Bank calculates the Index based on the data from Delhi and Mumbai.(from 2021 onwards data from Kolkata and Bengaluru will also be considered)

- The rankings are calculated based on ten parameters as listed below:

- Starting a business: Procedures, time, cost and minimum capital to open a new business

- Dealing with construction permits: Procedures, time and cost to build a warehouse

- Getting electricity: Procedures, time and cost required for a business to obtain a permanent electricity connection for a newly constructed warehouse along with reliability of supply.

- Registering property: Procedures, time and cost to register commercial real estate and quality of land administration (index calculated)

- Getting Credit: Strength of legal rights index, depth of credit information index

- Protecting Minority Investors: Indices on the extent of disclosure, extent of director liability and ease of shareholder suits

- Paying Taxes: Number of taxes paid, hours per year spent preparing tax returns and total tax payable as share of gross profit

- Trading across borders: Number of documents, cost and time necessary to export and import

- Enforcing contracts: Procedures, time and cost to enforce a debt contract

- Resolving insolvency: The time, cost and recovery rate (%) under bankruptcy proceeding

- Drawbacks:

- In large economies, only two cities are taken for consideration under the rankings. Thus, it does not give a true reflection of the economy

- It only measures the policy side i.e. government efforts and ignores market forces and other factors like human resource

WHERE DOES INDIA STAND IN EASE OF DOING BUSINESS?

- Continuous improvement in the rankings of Ease of Doing Business by the World Bank in which India has improved significantly once from 142nd in 2014 to the rank of 63 in 2020 is highly appreciable

- India saw the biggest jump in ranking in ‘resolving insolvency’ category, on the back of implementation of the Insolvency and Bankruptcy Code

- India’s ranking improved substantially in ‘Dealing with Construction Permits’ and ‘Trading across Borders’

- The improvement in ease of doing business would facilitate in achieving the goal of Make in India and to attract domestic and foreign investments.

- The Government should focus on the reforms in land acquisition, implementation of fixed term employment in all the states and de-criminalization of businesses as stringent labour laws are a major roadblock to enhance production possibility frontiers and employment generation in the economy.

INTERNATIONAL CAMPARISON

- New Zealand, Singapore and Hong Kong are ranked as top three in ease of doing business rankings 2020

- Economies that score highest on the ease of doing business share several common features, including the widespread use of electronic systems

GOVERNMENT INITIATIVES

- Starting a Business:

- SPICe (Simplified Proforma for Incorporating a Company electronically) :

- Permanent Account Number (PAN), Tax Deduction & Collection Account Number (TAN), Director Identification Number (DIN) have now been merged into a single form (SPICe) for company incorporation

- Real-time and online ESIC registration and EPFO registration for establishments without any requirement of inspections or physical touch points

- Reduction in application fee for incorporation of companies

- ‘Start-up India’ scheme is launched to reduce the regulatory burden on Startups, thereby allowing them to focus on their core business and keep compliance costs low. Benefits includes

- Self-certify compliance for Labour Laws and Environmental Laws

- No inspections will be conducted for a period of 5 years, under labour laws

- Tax holidays

- Easier public procurement norms

- ‘Make in India’ scheme: It is intended to boost the domestic manufacturing sector and also augment investment into the country

- Dealing with Construction Permits:

- India streamlined the process, reduced the time and cost of obtaining construction permits, and improved building quality control by strengthening professional certification requirements

- Cost of obtaining construction permits reduced from 23.2% to 5.4% of the economy’s per capita income

- Getting electricity:

- Electricity connection is provided within 7 days if no Right of Way (RoW) is required and within 15 days where RoW is required.

- Service line cum Development charges is now capped

- Number of documents required for getting electricity connection has been reduced

- Registering property:

- All sub-registrar offices have been digitized and its records have been integrated with the Land Records Department, in Delhi and Mumbai.

- Property tax records have been digitized in many urban local bodies

- Getting Credit:

- Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) was set up in 2011 under SARFAESI Act for registration of security interest created on all types of property. It was primarily created to check frauds in lending against equitable mortgages, in which people would take multiple loans on the same asset from different banks

- The government has strengthened access to credit by amending the rules on the priority of secured creditors outside reorganisation proceedings as well as the adoption of a new insolvency and bankruptcy code that introduced a reorganisation procedure for corporate debtors.

- Secured creditors, such as banks and financial institutions, are given powers to enforce securities without the intervention of courts.

- Protecting Minority Investors:

- Limits for certain related party transactions: Approval of shareholder would be required if the value of property is 10% or more of the net worth of the company or INR 100 crore, whichever is less.

- Paying Tax:

- Reduction in corporate tax:

- Reduction of corporate tax from 30% to 25% for mid-sized companies

- Domestic companies can opt for concessional tax regime at 22%. Such company cannot claim any income tax incentive or exemption.

- The tax rate for new domestic manufacturing companies is now 15%

- As a result, our corporate tax rates are now amongst the lowest in the world.

- Robust IT infrastructure of online return filing for Indian taxpayers

- The Employee State Insurance Corporation (ESIC) has developed a fully online module for electronic return filing with online payment. This has substantially reduced the time to prepare and file returns.

- Indirect tax reforms: Goods and Service Tax (GST) law replaces and subsumes all indirect taxes. GST has following impacts on ease of doing business:

- Common procedures for registration, return filing and payment of taxes

- Reduction in number of tax payments

- Total effective tax rate computed as a percentage of profits is reduced

- Under GST, all indirect tax compliances are centralised thereby reducing time taken to comply with GST return.

- Trading across borders:

- Central Board of Excise and Customs (CBEC) has implemented ‘Indian Customs Single Window Project’ to facilitate trade. Importers and exporters can electronically lodge their customs clearance documents at a single point.

- Upgrading port infrastructures

- ‘e-Sanchit’: An online application system, allows traders to file all documents electronically

- Number of mandatory documents required for customs purposes has been reduced

- Delegation of authority to Customs by other government agencies, wherever feasible

- Export and Import costs were also reduced through increasing use of electronic and mobile platforms

- Enforcing Contracts:

- Commercial Courts and Appellate Division of High Courts have been established in Mumbai and Delhi.

- India made enforcing contracts easier by introducing the National Judicial Data Grid

- Electronic case management tools for the use by judges and lawyers

- Provisions for adjournments of cases limited to unforeseen and exceptional circumstance

- Resolving Insolvency:

- Operationalization of the Insolvency and Bankruptcy Code. It provides for a 180-day time-bound process to resolve insolvency. Prior to the passage of the Code, it took 4.3 years in India to liquidate a business

CONCERNS

- Multiplicity of authorities:

- Businesses in India are regulated by different agencies across the three tiers of government (i.e. central, state and municipal).

- For example, for starting a business, registration and other clearances are granted by central ministries such as Finance and Corporate Affairs. Electricity and water connections for a business are granted by the state electricity and water boards. The municipal corporations grant building permits and various other no objection certificates to businesses.

- Delay in getting approval:

- Expert Committee constituted by the Department of Industrial Policy and Promotion observes that regulations and procedures for starting a business are time-consuming in India. As a consequence, a large number of start-ups are moving out of India and setting base in countries like Singapore where such procedures are easier.

- It takes approximately 17 days to start a business in India while the OECD average is 12 days.

- Procedures to secure permits are rather cumbersome and involve permissions to be sought from various departments.

- Poor enforcement of contracts:

- Though the government has brought into force an act for commercial courts, the report notes that the judicial system is very slow and it takes more than 4 years to enforce a contract

- Issues with IBC:

- Though the IBC mandates to complete the insolvency proceeding within a stipulated time period, it got delayed due to judicial interferences.

- Lack of land availability:

- Legislative roadblocks still exist for Land Acquisition.

- Lands in India are not scientifically mapped and land records are not digitized, which makes allocation and utilization of land resources, a time consuming process.

- The registration fee for the property documents is higher, and it acts as a hurdle in the easy transfer of real estates.

- Lack of coordination among different government ministries and departments, Central and State governments.

- Lack of logistics infrastructure:

- India’s rail, road and air infrastructure are poorly connected and the storage facilities are underdeveloped.

- Poor logistics makes it difficult to fill the supply-demand mismatch and it also increases the cost of running business.

- Taxation issues:

- Tax authorities in India are often engaged in unpredictable and discretionary enforcement practices, which disrupt the normal working of the business firm.

- The GST implemented is one of the most complex with the second highest tax rate in the world among a sample of 115 countries which have a similar indirect tax system.

- GST infrastructure faces technical issues

- International trade:

- Non-transparent and often unpredictable regulatory and tariff regimes.

- Intellectual Property Rights:

- India performs poor in ‘global intellectual property index’ compiled by US Chamber of Commerce.

- India’s IPR regime is weaker, and many of the times our IPR policy disincentives innovation for the sake of welfare objectives.

- Copyright infringement is still rampant in India due to lax administration and enforcement practices

- Risk of corruption and bribery:

- Companies operating or planning to invest in India face high corruption risks. India slipped from 79th to 81st position in the most recent Transparency International’s Global Corruption Perception Index.

WAY FORWARD

- Access to Information and Transparency Enablers:

- Develop an online information wizard to provide a comprehensive list of licenses, registrations required for undertaking a specific business

- Establish a formal investors’ facilitation centre in each State for investment promotion, regulatory reforms and obtaining user feedback

- Ensure timelines for property registration process, land allotment process etc.

- Online Single Window System:

- Implement an online single window system to eliminate the need to submit physical copies of the application.

- Approvals for electricity connection, water connection etc. should be provided as a service through the online single window system

- Land administration

- Digitising land records, improving titling and streamlining procedures for transfer of property should be taken up.

- Land availability

- Provide data of all land banks in State/UT-owned industrial estates on one portal in public domain

- Develop a GIS system for displaying availability of land and infrastructure

- Environment laws

- Notify a list of white category industries, which are exempted from taking clearances from State/UT Pollution Control Board

- Allow for auto-renewal of Consent to Operate under Water Act and Air Act based on self-certification

- Construction Permit Enablers:

- Enact a comprehensive uniform building code with provisions for risk-based classification of buildings and accreditation programs for professionals engaged in the construction process

- Develop land use plans/zonal plans with legal sanction for all urban areas and make it available online in public domain

- Design and develop an online single window system for granting construction permits

- Mandate that a single, joint site inspection will be carried out by all concerned authorities such as fire, sewerage, labour responsible for granting construction permits

- Labour Regulation:

- Implement the recommendations of the 2nd National Commission on Labour by codifying existing 44 central labour laws into four codes by simplifying, amalgamating and rationalising the relevant provisions of the legislations

- Paying Taxes:

- Set up service centres to assist taxpayers for e-filing of returns under GST

- Constitute an Authority for Advance Ruling (AAR) under GST Act. AAR is an effective mechanism to provide certainty in the tax liability and help reduce the risk of litigation in future

- Inspection enabler:

- Institutionalize a Central Inspection System (CIS) responsible for undertaking compliance inspections of the Departments concerned. CIS will increase transparency in the inspection

- Design and implement a system which is capable of computerized allocation of inspectors

- Contract Enforcement:

- Strengthen the functioning of Commercial Courts. Ensure that there are sufficient number of Judges and support staff are in place to deal with disputes

- Access to credit

- Credit should be assured for small businesses and rural entrepreneurs through penetration of formal banking channels into rural areas.

- Reforms in Bureaucracy

- Bureaucracy needs to be well trained and should try to come out of its popular mindset of being lax and indifferent.

CONCLUSION:

- It is clear that, not only the regulatory, governance and economic reforms to investors but also political and macroeconomic stability, law and order maintenance and quality physical infrastructure are also a major determinant factor in attracting business.

- Therefore, for further improvement in ease of doing business, we need to explore cooperative federalism and cooperative sub-federalism by bringing local bodies and State Governments in cooperation with Central Government.

PRACTICE QUESTION:

Q. It is argued that improving ‘ease of doing business’ in India is intended to meet the objectives of trade promotion and reducing poverty together. Comment on this statement.