GST Impact

2020 JAN 16

Mains >

Economic Development > Indian Economy and issues > Goods and Servies tax

WHY IN NEWS?

The government has asked GST authorities to block input tax credit of about 1,000 taxpayers who have allegedly claimed more credit than they were eligible for.

GOODS AND SERVICE TAX – SALIENT FEATURES:

- The Goods & Services Tax (GST) in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

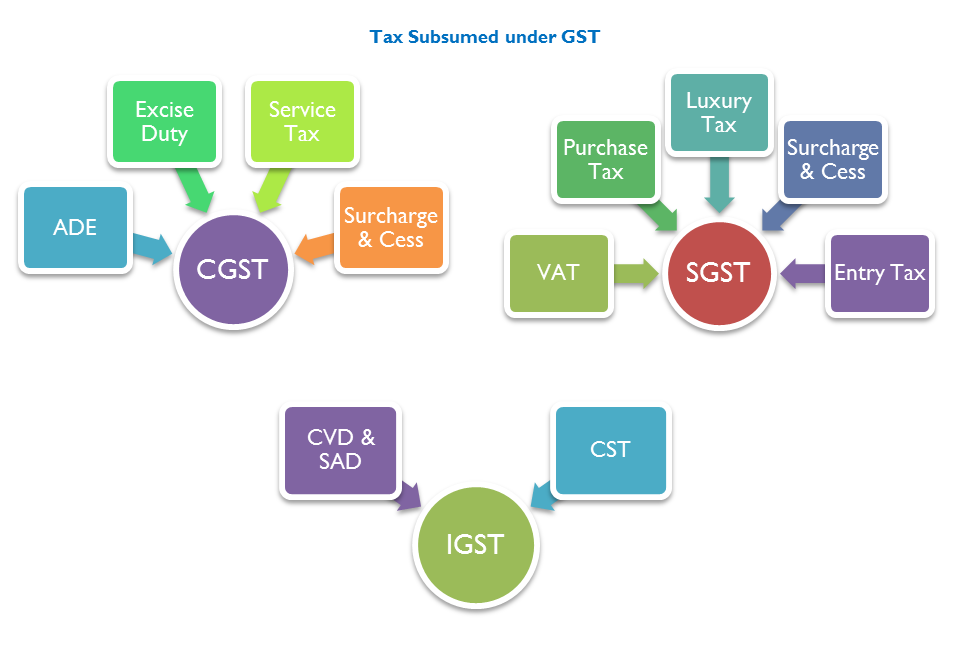

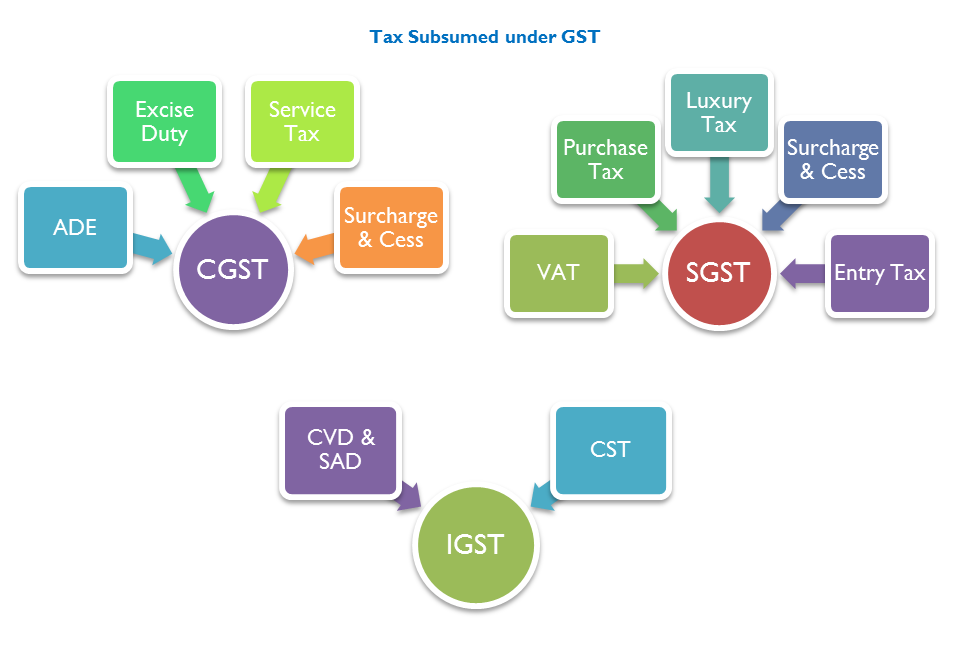

- It is an Indirect Tax which has replaced many Indirect Taxes in India.

- GST is a dual levy where the Central Government will levy and collect Central GST (CGST) and the State will levy and collect State GST (SGST) on intra-state supply of goods or services.

- The Centre will also levy and collect Integrated GST (IGST) on inter-state supply of goods or services.

- CGST collected is appropriated by the Centre, SGST is shared to the states while IGST is shared between the Centre and the states.

- Another very significant feature of GST will be that input tax credit will be available at every stage of supply for the tax paid at the earlier stage of supply. This feature would mitigate cascading or double taxation in a major way.

- Taxes subsumed under GST:

- The tax came into effect from 1 July, 2017 through the implementation of the One Hundred and First Amendment of the Constitution of India by the Indian government.

101st CONSTITUTIONAL AMENDMENT ACT:

- The important articles inserted are:

(1) Notwithstanding anything contained in articles 246 and 254, Parliament, and, subject to clause (2), the Legislature of every State, have power to make laws with respect to goods and services tax imposed by the Union or by such State.

(2) Parliament has exclusive power to make laws with respect to goods and services tax where the supply of goods, or of services, or both takes place in the course of inter-State trade or commerce.

-

- Article 269A - Goods and services tax on supplies in the course of inter-State trade or commerce shall be levied and collected by the Government of India and such tax shall be apportioned between the Union and the States in the manner as may be provided by Parliament by law on the recommendations of the Goods and Services Tax Council.

- Article 279A - The President shall, within sixty days from the date of commencement of the Constitution (One Hundred and First Amendment) Act, 2016, by order, constitute a Council to be called the Goods and Services Tax Council.

- Parliament shall, by law, on the recommendation of the Goods and Services Tax Council, provide for compensation to the States for loss of revenue arising on account of implementation of the goods and services tax for a period of five years.

- Entry 84 of Union List amended to include goods exempted from GST regime, which are as follows:

- petroleum crude

- high speed diesel

- motor spirit (commonly known as petrol)

- natural gas

- aviation turbine fuel

- tobacco and tobacco products

INSTITUTIONAL MECHANISM:

Goods & Services Tax Council

- Goods & Services Tax Council is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

.png)

- The Goods and Services Tax Council shall make recommendations to the Union and the States on the taxes which may be subsumed in the goods and services tax; exemptions from GST; model Goods and Services Tax Laws, principles of levy, apportionment of GST levied on supplies in the course of inter-State trade or commerce under article 269A and the principles that govern the place of supply; the threshold limit of turnover below which goods and services may be exempted from goods and services tax; the rates including floor rates with bands of goods and services tax etc.

GST Network

- Goods and Services Tax Network (GSTN) is a Section 8 (under new companies Act, not for profit companies are governed under section 8), non-Government, private limited company.

- The Government of India holds 24.5% equity in GSTN and all States of the Indian Union, including NCT of Delhi and Puducherry, and the Empowered Committee of State Finance Ministers (EC), together hold another 24.5%.

- Balance 51% equity is with non-Government financial institutions.

- The Company has been set up primarily to provide IT infrastructure and services to the Central and State Governments, tax payers and other stakeholders for implementation of the Goods and Services Tax (GST).

- It will manage the entire IT system of the GST portal, which is the mother database for everything GST.

- This portal will be used by the government to track every financial transaction, and will provide taxpayers with all services – from registration to filing taxes and maintaining all tax details.

GST RATE STRUCTURE:

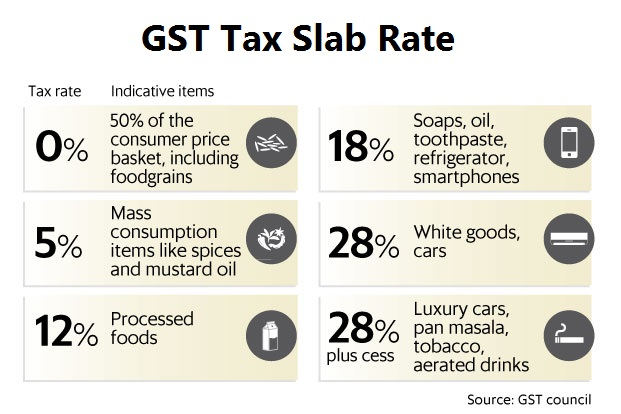

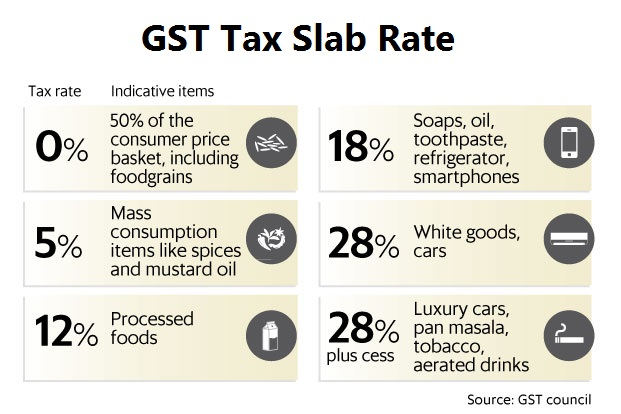

- There are 5 slabs under the current GST regime

- More than half of the consumer price basket including food grains fall under zero tax slab.

GST – MECHANISM:

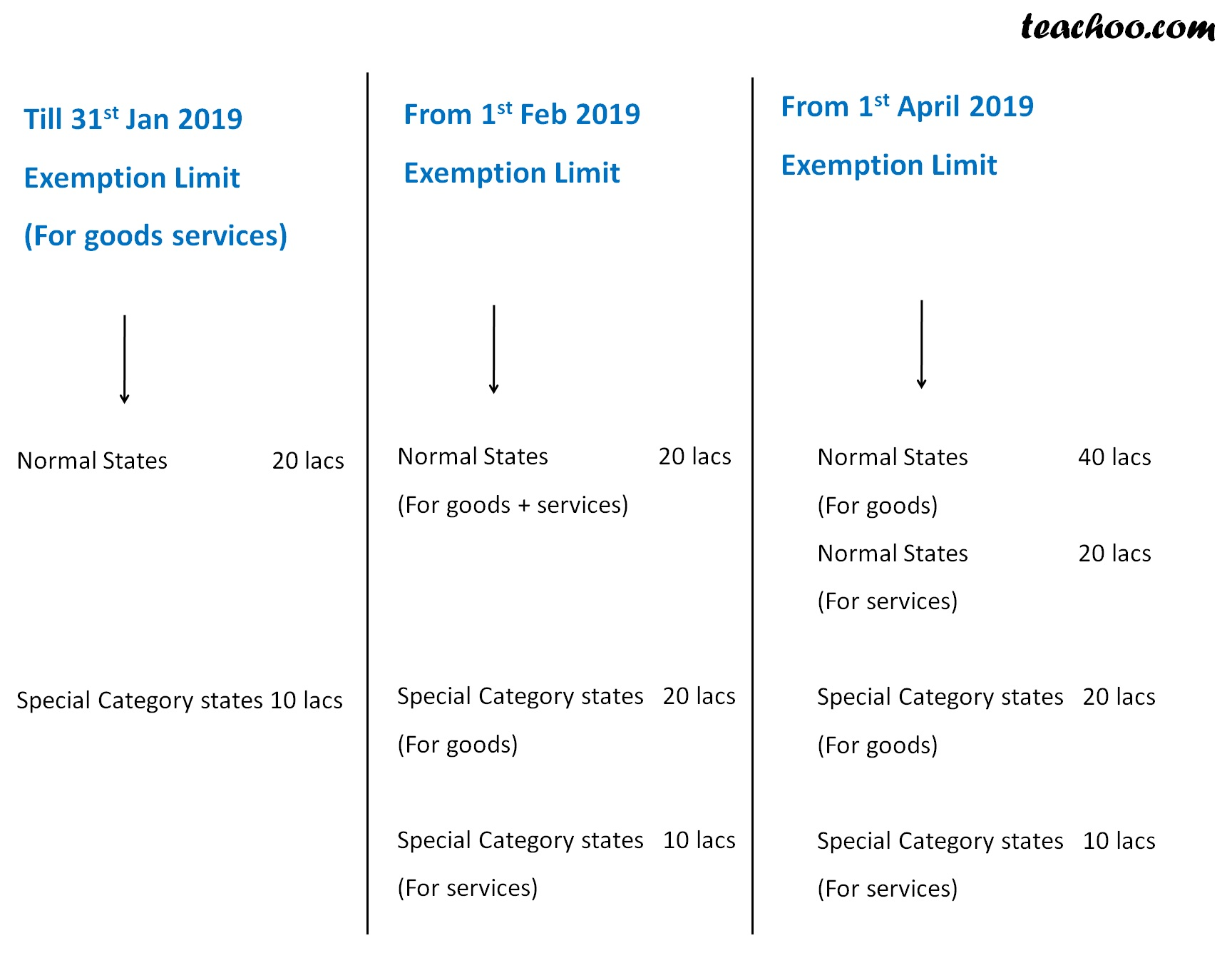

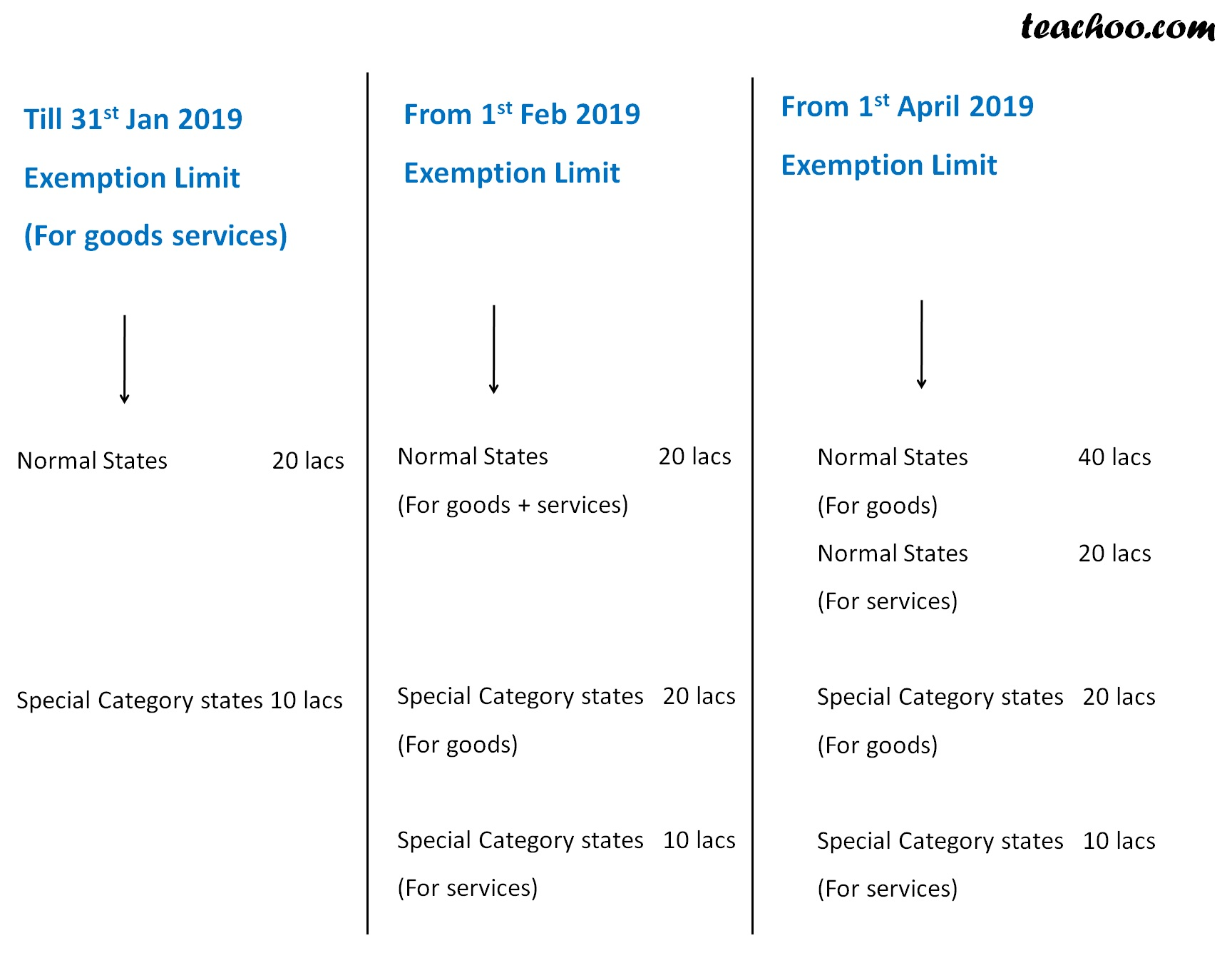

- Mandatory registration depending on turnover beyond a threshold – there are different thresholds for Special Category states and the rest of India.

- E-WAY BILL

- E-way bill or Electronic-way bill is a document introduced under the GST regime that needs to be generated before transporting or shipping goods worth more than INR 50,000 within state or inter-state.

- The physical copy of e-way bill must be present with the transporter or the person in charge of the conveyance and should include information such as goods, recipient, consignor and transporter.

- Even in case of inward supply of goods from unregistered person, E-Way Bill is applicable.

- GST Returns

- All individuals registered under the GST Act has to furnish the details of the sales and purchases of goods and services along with the tax collected and paid. This can be done by filing online returns.

- Individual taxpayers will be using 4 forms for filing their returns such as the return for supplies, return for purchases, monthly returns, and annual return.

- Small taxpayers who have opted for composition scheme will have to file quarterly returns.

GST – ISSUES:

- The GST regime in India has undergone numerous modifications and adjustments since it was introduced.

- The following are some of the issues with the implementation of GST in India:

- ONE NATION, MANY TAXES

- GST has as many as seven rates though the bulk of goods fall in the 12% and 18% slab.

- Gold has a GST rate of 3% and rough diamonds 0.25%, which is beyond the 5 slabs of GST.

- Petroleum products, power, and real estate are still outside the GST ambit.

- Additional cess and surcharge are currently levied on certain goods.

- Different thresholds for States with respect to the supply of goods is likely to distort the uniform tax regime and increase complexity.

- FREQUENT AND MULTIPLE CHANGES

- There has been numerous revisions of goods and services falling under different tax slabs.

- Multiple revisions in rules regarding GST

- Changes in thresholds for mandatory registration and interstate variation

- CUMBERSOME COMPLIANCE PROCESSES

- Filing returns remains challenging

- Multiple registration for service providers

- Jurisdiction divided between states and Centre

For instance, any company operating throughout India needs to register and be assessed in all the states where it operates. In case of services, where the payment and delivery of service do not happen simultaneously (e.g. advance booking for travel), the GST credit has to be held back by the party providing the service.

- INPUT TAX CREDIT RELATED ISSUES

- Delay in refunds relating to input tax credit, especially for exporters.

- There are also business items that do not qualify for input credit, such as automobiles, food and beverages et al.

- Fraud of overvaluing and faking invoices to claim refund of input tax credit.

The recent unearthing of fake invoices and fraudulent practices to corner input tax credit may only lead to more scrutiny, and more delays.

- LACK OF CLARITY REGARDING ANTI-PROFITEERING

- it is mandatory to pass on the benefit due to the reduction in the rate of tax or from input tax credit to the consumer by way of commensurate reduction in prices.

- The National Anti-profiteering Authority (NAA) established for this purpose has been endowed with some powers, however performance so far has been lackluster.

- COMPENSATION TO STATES

- According to Goods and Services (Compensation to States) Act, 2017, if a state’s revenue growth falls below 14% in a year, the Centre would bridge the shortfall for the first five years.

- The compensation is paid to the states once every two months out of a cess collected on taxes on sin and luxury goods.

- However, due to below par GST collection, compensation to states has been delayed on multiple occasions.

- States have urged the 15th Finance Commission to extend the compensation period under GST beyond the mandated year of FY 2022.

- TECHNOLOGY-RELATED ISSUES

- Technology glitches in the initial months of implementation of GST

- Server crashes on the last dates of returns

- Poor penetration of internet and digital technology, especially in rural areas

- Digital illiteracy

- Increasing number of internet shutdowns – For instance, industries in Jammu and Kashmir, which has been under a prolonged internet shutdown, has suffered drastically.

GST-BENEFITS:

- Increase in tax base - The assessee base under GST has increased by about 85 per cent in the past two years. On the eve of the GST rollout, the assessee number stood at around 65 lakhs, which has gone up to 1.20 crore now.

- Revenues rising despite rate cuts – though not consistently and not up to the projected collections. The monthly average revenue collection increased further in 2018-19 by about 10 per cent from the previous year to Rs 97,100 crore.

- Reduce cascading of taxes – a unified tax structure with input tax credit provision has reduced the cascading effect of multiple taxes and rationalized prices of commodities to some extent.

- Successful template for centre-state cooperation:

- GST Council arrangement has worked well

- Most decisions have been unanimous

- Centre has taken the states along in ironing out issues

- Council has proactively addressed issues as they arose

- Gains beginning to show up

- GST collections in January 2020, is expected to touch 1,15,000 crores.

- Logistics costs down as cargo moving faster across state borders

- Indirect tax compliance costs have fallen

- Moving towards a common economic market - In the pre-GST era, India was not a common market; State VAT rates were different in different states. In the GST regime, for one particular commodity, the rate of GST is same across the country. And, with the abolition of entry tax and inter-state check posts India is moving towards a 'Common Economic Market'.

- Equitable growth of industry across the country - While some states like Karnataka, Gujarat, Maharashtra etc. were highly industrialized, there were the populous states of Bihar, U.P., Odisha, West Bengal etc. that lagged far behind. GST being a destination-based consumption tax, in a case of interstate trade the state's share of GST accrues to the destination state.

WAY FORWARD:

- Reduce the number of tax slabs and rationalize GST rates

- Bring the remaining sectors under the ambit of GST regime - Electricity and petroleum products should be brought under GST to avoid the cascading effect of taxes, as these are used as input by the majority of manufacturers and service providers.

- Simplify procedures

- Filing system should be made more user-friendly

- Online filing of receipts and aggregation by system should help

- Solve issues over administration of GST

- Measures to lift revenues

- Steps needed to curb evasion

- Invoice-to-invoice matching and reversing charge

- Reach out to non-filers

- More certainty regarding compensation to states. Evolve a sustainable mechanism wherein states have adequate revenues without the need for the compensation.

- Technological improvements

- Technological modifications to reduce disruptions and ensure smooth functioning

- Improve digital connectivity and digital literacy

Prelims Question

Q. Rolling out of Goods and Services Tax (GST) to simplify indirect taxes collection in the country has met with numerous challenges. Explain.

.png)