Goods and Services Tax (GST)

2022 MAY 25

Mains >

Economic Development > Indian Economy and issues > Goods and Servies tax

IN NEWS:

- Recently, the Supreme Court, in a unanimous verdict (in Union of India vs Mohit Minerals case), held that Goods and Services Tax (GST) Council’s recommendations only have persuasive value and would not be binding on the states and the centre.

HIGHLIGHTS OF THE SUPREME COURT JUDGMENT:

- Recommendations of GST council is recommendatory in nature:

- The court said the recommendations of the GST Council are the product of a collaborative dialogue involving the Union and States and they are recommendatory in nature.

- To regard recommendations of the GST Council as binding would disrupt fiscal federalism where both the Union and the States are conferred equal power to legislate on GST.

- Union and States have simultaneous power for enacting laws on GST:

- The court emphasised that Article 246A (which gives the States power to make laws with respect to GST) of the Constitution treat the Union and the States as “equal units”.

- If the GST Council was intended to be a decision-making authority those recommendations are binding, such a qualification would have been included in Articles 246A or 279A.

- Moreover, Article 279A in constituting the GST Council, envisions that neither the Centre nor the states are actually dependent on the other.

- It confers a simultaneous power (on Union and States) for enacting laws on GST.

- Court’s views on federalism in India:

- As per the court the cooperative federalism is treated like marble cake federalism due to the integrated approach of the federal units.

- The judgment said that though the Centre may have a larger share of power in certain instances to prevent chaos and provide security, the States still wielded power.

- Even if the States have been given lesser power [in certain situations], they can still resist the mandates of the Union by using different forms of political contestations permitted by the Constitution.

- The court said that Indian federalism is a dialogue between cooperative and un-cooperative federalism where the federal units are at liberty to use different means of persuasion, ranging from collaboration to contestation.

WHAT IS GST?

- The Goods & Services Tax (GST) in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

- Comprehensive:

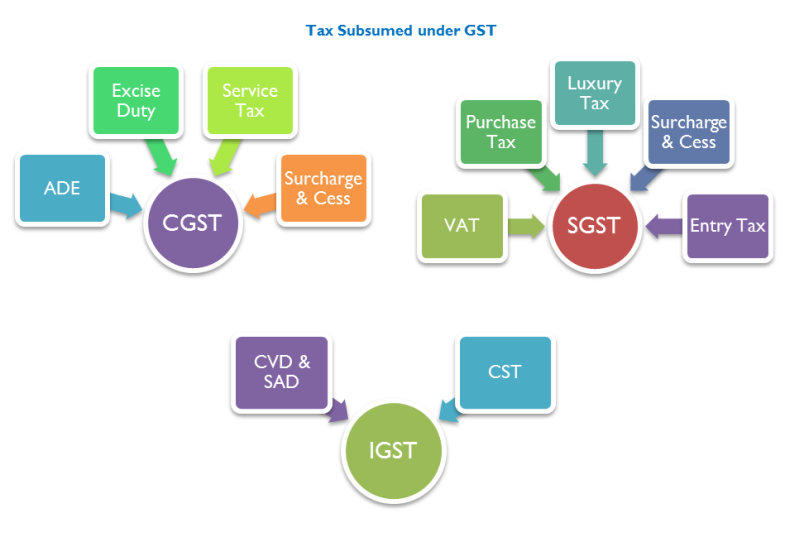

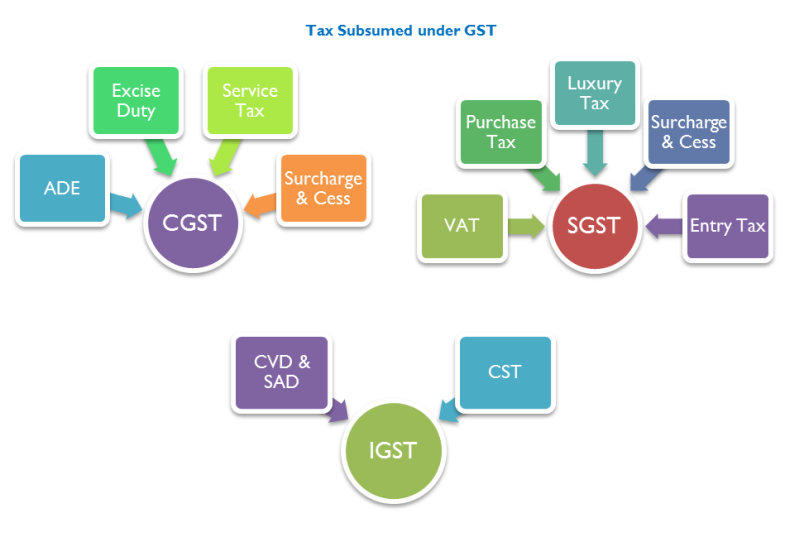

- GST is a comprehensive indirect tax on manufacture, sale, and consumption of goods and services throughout India. It has subsumed almost all the indirect taxes except a few.

- Multi-stage:

- An item goes through multiple stages along its supply chain, starting from manufacture until the final sale to the consumer. The Goods and Services Tax (GST) is levied on each of these stages making it a multi-stage tax.

- Destination-based:

- GST is a destination based tax, i.e., the goods/services will be taxed at the place where they are consumed and not at the origin. So, the state where they are consumed will have the right to collect GST.

- Levied on value addition:

- GST is levied on a commodity whenever it adds value at any point in the supply chain, from production to sale.

- For example, a manufacturer who makes biscuits buys flour, sugar and other material. The value of the inputs increases when the sugar and flour are mixed and baked into biscuits. The manufacturer then sells these biscuits to the warehousing agent who packs large quantities of biscuits in cartons and labels it. This is another addition of value to the biscuits.

- GST is levied on these value additions, i.e. the monetary value added at each stage to achieve the final sale to the end customer.

- The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

SALIENT FEATURES OF GST:

- Four-tier rate structure:

- The GST regime follows a for a four-tier rate structure of 5, 12, 18 and 28 per cent that exempts or imposes a low rate of tax 5 per cent on essential items and levies the highest tax rate of 28 per cent tax on luxury and sin goods.

- In the pre-GST era, the total of VAT, excise, Central Sales Tax and their cascading effect led to 31 per cent as tax payable, on an average, for a consumer.

- Dual GST:

- Dual GST means that GST will be levied simultaneously by Center and State Governments.

- Hence, every transaction of supply of goods or services shall suffer Central GST (CGST) and State GST (SGST), when the transaction is within the State.

- UTGST (Union Territory Goods and Services Tax): Similar to how SGST is levied by the state governments on the intra-state supply of goods and services, Union Territory Goods and Services Tax or UTGST is levied by the Union Territory governments.

- However, when the transaction is between states, there will be Integrated GST (CGST + SGST), which will be collected by the Central Government and then the SGST component paid to the State Government where the goods or services have been consumed.

- IGST will be also applicable on any supply of goods and/or services in both cases of import into India and export from India.

|

Summary Chart of Structure of Dual GST Model:

|

|

Types of GST

|

Levied By

|

When?

|

|

CGST

|

Central Government

|

On INTRA State supply of Goods and Services.

|

|

SGST/ UTGST

|

State/Union Territories

|

On INTRA State supply of Goods and Services.

|

|

IGST

|

Central Government

|

On INTER State supply of Goods and Services.

|

- GST rates to be mutually decided:

- CGST, SGST & IGST are levied at rates to be mutually agreed upon by the Centre and the States. The rates are notified on the recommendation of the GST Council.

- Applicable on supply side:

- GST is applicable on ‘supply’ of goods or services as against the old concept on the manufacture of goods or on sale of goods or on provision of services.

- Hence it is a destination-based consumption taxation

- Reverse charge mechanism:

- The GST is levied at every stage of the production process but is collected from the point of consumption (Reverse Charge Mechanism), refunding all parties eventually other than the end consumer.

- Goods and Service Tax Network (GSTN):

- It is a non-profit, non-government organization.

- It will manage the entire IT system of the GST portal, which is the mother database for everything GST.

- The government will use this portal to track every financial transaction and provide taxpayers with all services – from registration to filing taxes and maintaining all tax details.

- E-WAY BILL:

- E-way bill or Electronic-way bill is a document introduced under the GST regime that needs to be generated before transporting or shipping goods worth more than INR 50,000 within state or inter-state.

- The physical copy of e-way bill must be present with the transporter or the person in charge of the conveyance and should include information such as goods, recipient, consignor and transporter.

- Even in case of inward supply of goods from unregistered person, E-Way Bill is applicable.

- Exemptions:

- Businesses dealing in goods with an annual turnover of up to Rs.40 lakh are exempt from the tax.

- For the north-eastern states, the exemption limit is Rs 20 lakh

- Additionally, those with a turnover up to Rs.1.5 crore can opt for the Composition Scheme and pay only 1 per cent tax.

- In case of North-Eastern states and Himachal Pradesh, the limit is now Rs 75 lakh.

- Services providers with turnover up to Rs.20 lakh in a year are exempt from GST.

- Business in the service sector with turnover up to Rs.50 lakh in a year can opt for composition scheme for services and pay only 6 per cent tax.

- Moreover certain items like petroleum, alcoholic beverages and stamp duty are not included under GST regime.

LEGAL BASIS OF GST:

- In order to suitably implement the GST, 101st Constitutional Amendment Act inserted, deleted and amended of certain Articles of the Constitution.

- Article 246A: Special Provision for GST

- This Article was newly inserted to give power to the Parliament and the respective State/Union Legislatures to make laws on GST respectively imposed by each of them.

- However, the Parliament of India is given the exclusive power to make laws with respect to inter-state supplies.

- The IGST Act deals with inter-state supplies. Thus, the power to make laws under the IGST Act will rest exclusively with the Parliament

- Article 269A: Levy and Collection of GST for Inter-State Supply

- While Article 246A, newly inserted, gives the Parliament the exclusive power to make laws with respect to inter-state supplies, the manner of distribution of revenue from such supplies between the Centre and the State is covered in Article 269A.

- It allows the GST Council to frame rules in this regard.

- Import of goods or services will also be called as inter-state supplies.

- This gives the Central Government the power to levy IGST on import transactions.

- Article 279A: GST Council

- This newly inserted Article gives power to the President to constitute a joint forum of the Centre and States called the GST Council.

- GST Council is an apex member committee to modify, reconcile or to procure any law or regulation based on the context of Goods and Services Tax in India

- Its chairman is Union Finance Minister of India with ministers nominated by the state governments as its members.

- The council is devised in such a way that the Centre will have 1/3rd voting power and the states have 2/3rd.

- The decisions are taken by 3/4th majority.

- Supreme Court held that Goods and Services Tax (GST) Council’s recommendations only have persuasive value and would not be binding on the states and the centre.

|

- Article 286: Restrictions on Tax Imposition

- This was an existing article which restricted states from passing any law that allowed them to collect tax on sale or purchase of goods either outside the state or in the case of import transactions.

- It was further amended to restrict the passing of any laws in case of services too.

- Further, the term ‘supply’ replaces ‘sale or purchase’.

- Entry 84 of Union List amended to include goods exempted from GST regime, which are as follows:

- petroleum crude

- high speed diesel

- motor spirit (commonly known as petrol)

- natural gas

- aviation turbine fuel

- tobacco and tobacco products

- Compensation to States Under GST

- 101st Constitutional Amendment Act also contains a provision to provide for relief to states on account of the revenue loss to the states arising due to the implementation of GST. It has a validity period of five years.

- The 5-year period ends in June 2022.

- National Anti-Profiteering Authority (NAA):

- The National Anti-profiteering Authority (NAA) is the statutory mechanism under GST law to check the unfair profiteering activities by the registered suppliers under GST law.

- The Authority’s core function is to ensure that the commensurate benefits of the reduction in GST rates on goods and services done by the GST Council and of the Input tax credit are passed on to the recipients by way of commensurate reduction in the prices by the suppliers.

BENEFITS OF GST:

- For business and industry:

- Simple and easy online procedure

- The entire process of GST (from registration to filing returns) is made online, and it is simple.

- This has been beneficial for start-ups especially, as they do not have to run from pillar to post to get different registrations such as VAT, excise, and service tax.

- Improved efficiency of logistics:

- Earlier, the logistics industry in India had to maintain multiple warehouses across states to avoid the current CST and state entry taxes on inter-state movement.

- These warehouses were forced to operate below their capacity, giving room for increased operating costs.

- Under GST, however, these restrictions on inter-state movement of goods have been lessened.

- Reduction in unnecessary logistics costs is already increasing profits for businesses involved in the supply of goods through transportation.

- Benefits for small businesses

- Under GST, small businesses (turnover up to Rs.1.5 crore) can benefit as it gives an option to lower taxes by utilizing the Composition scheme.

- This move has brought down the tax and compliance burden on many small businesses.

- Higher threshold for registration:

- Earlier, in the VAT structure, any business with a turnover of more than Rs 5 lakh (in most states) was liable to pay VAT, also this limit differed state-wise. Also, service tax was exempted for service providers with a turnover of less than Rs 10 lakh.

- Under GST regime, the threshold for service providers has been increased to Rs 20 lakh ( and for business dealing with goods the limit is Rs.40 lakh), which exempts many small traders and service providers.

- For consumers:

- Removal of cascading effect of taxes:

- The cascading effect of taxes means paying taxes over a tax. Whenever a good is made, taxes are attached to it as it moves through different stages of production. Thus, the succeeding movement of goods causes it to be taxed inclusive of the tax levied in the preceding stage.

- When a commodity reaches the end consumer, the price to be paid increases tremendously, causing inflationary costs.

- Subsuming taxes under GST prevents this cascading effect.

- Essential Goods become Cheaper

- Since the GST rate for basic food grains and spices is 0-5 per cent, buyers may save significantly on their purchases. Products such as shampoos, tissues and toothpaste have also gotten more affordable.

- Uniform Prices across the Country

- With GST, consumers may get their goods at the same price regardless of where they live. This is a big benefit for consumers.

- Easy to understand & Boosts trustworthiness

- The former indirect tax structure was quite difficult for the average person to comprehend.

- Due to the computerization of the GST, consumers and businesses alike will have more confidence in tax administrators and businesses as a result of the increased mutual trust.

- Consumers will have more faith in a streamlined tax system as a result of this.

- For overall economy

- Bring about certainty:

- Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services will lend greater certainty to taxation system;

- Poverty eradication:

- By generating more employment and more financial resources.

- Reduce corruption:

- Greater use of IT will reduce human interface between the taxpayer and the tax administration, which will go a long way in reducing corruption;

- For the Government

- Create a unified common market:

- Will help to create a unified common national market for India. It will also give a boost to foreign investment and “Make in India” campaign.

- Streamline taxation:

- Through harmonization of laws, procedures and rates of tax between Centre and States and across States.

- Increase tax compliance:

- Improved environment for compliance as all returns are to be filed online, input credits to be verified online, encouraging more paper trail of transactions at each level of supply chain;

- Discourage tax evasion:

- Uniform SGST and IGST rates will reduce the incentive for evasion by eliminating rate arbitrage between neighbouring States and that between intra and inter-state sales.

CHALLENGES AND SHORTCOMINGS:

- Reduction in the fiscal autonomy of the States:

- With the introduction of GST, many indirect taxes levied by the states have been replaced.

- While these taxes were completely under the control of each state, GST rates are now decided by the GST Council.

- This implies that states have limited flexibility in making decisions regarding tax rates on goods and services.

|

Probable impacts of the Supreme Court’s GST Council ruling (Union of India vs. Mohit Minerals case):

- The court has also held that GST Council decisions are only recommendatory in nature and hold only persuasive value. This would have far reaching implications on various other matters where the States are not in agreement with the decisions of the GST Council, especially in light of the compensation period coming to an end in June 2022.

- The ruling clearly defines the role of the GST Council – to advise and recommend on GST issues. To accept such advice and pass appropriate amendments in law is purely the domain of the central and state legislatures.

- Finance Ministry sources said that ruling does not have any bearing on the way GST has been functioning in India, nor does it lay down anything fundamentally different to the existing framework of GST.

- The sources further clarified that the GST Council has been working with a collaborative institutional mechanism, where Centre and states follow the recommendations of the Council, which have been arrived at with consensus.

- Finance ministry sources said that there has been only a solitary instance where the Council took a decision by voting and even in this case the dissenting states implemented the decision of the GST Council. In all other instances, which run into more than a thousand, the decisions have been taken with consensus.

|

- GST’s collection shortfall and compensation:

- Though GST limits the flexibility of states, the Centre’s guarantee of 14 per cent annual growth in this tax revenue, for a period of five years

- This was offered to achieve consensus for the introduction of GST.

- In case of less than 14 per cent growth, states will receive compensation from the Centre.

- This issue became controversial when GST collections fell because of the Covid-19 pandemic

- The economic impact of the pandemic has led to higher compensation requirement due to lower GST collection and at the same time lower collection of GST compensation cess.

- Also many states have demanded that the GST compensation cess regime be extended for another five years and the share of the Union government in the centrally-sponsored schemes be raised as the COVID-19 pandemic has impacted their revenues.

- Overestimation of GST collection:

- In the initial year government has overestimated the GST collection, which was not fulfilled, and hence created a sense of failed taxation regime.

- Multiple Tax Rates:

- Unlike many other economies which have implemented this tax regime, India has multiple tax rates.

- This hampers the progress of a single indirect tax rate for all the goods and services in the country.

- Higher tax rates:

- Though rates are rationalised, there is still 50 percent of items are under the 18 percent bracket.

- Apart from that, there are certain essential items to tackle the pandemic that was also taxed higher.

- For example, the 12% tax on oxygen concentrators, 5% on vaccines etc.

- Failed to check tax evasion

- GST tax evasion and tax fraud, including use of fraudulent invoices, fake e-way bills, etc has led to massive losses in revenue collection.

- Failed to bring petroleum under GST:

- Petroleum products are used as inputs for production or supply of other goods and services. Excluding them from GST results in cascading of taxes

- The Centre and states have been increasingly dependent on excise duties on petroleum products to shore up their revenues.

- Hence, the GST council has been reluctant to discuss the matter, as around 30 per cent of the states’ revenue comes from excise duties on petrol and diesel.

- Transitional Issues:

- Even after four years, many assesses are still experiencing technical/legal issues as a result of the transition from the old to the new GST system.

- Complex tax slabs:

- The complex slab structure and continually switching between them has created an undesired confusion in the compliance system.

- Additionally, fluctuating tax rates often led to unethical profiteering practices.

- Cumbersome compliance processes

- Filing returns remains challenging also there are multiple registration for service providers.

- Jurisdiction divided between states and Centre

- For instance, any company operating throughout India needs to register and be assessed in all the states where it operates. In case of services, where the payment and delivery of service do not happen simultaneously (e.g. advance booking for travel), the GST credit has to be held back by the party providing the service.

WAY FORWARD:

- Simplifying tax structure and rationalize GST rates:

- A simpler tax slab structure limiting commodities to three tax slabs is the need of the hour. Experts have recommended a three-slab structure that will help rationalize this indirect tax system.

- Currently there are four main slabs—5%, 12%, 18% and 28%. One option, reportedly being proposed by the tax authorities, is to merge the 5% and 12% slabs into an 8% slab. Since the items in the 12% slab are relatively few in number, the loss of revenue would be minimal.

- Ensuring tax predictability:

- The GST Council should adjust the rates only once a year.

- Further, the Center shouldn’t bypass GST by introducing any Cess.

- The Center can also rationalise the present Cess ecosystem in India to a bare minimum. This will ensure tax predictability to states and enhance the ease of doing business.

- Bring important sectors under the GST regime:

- Electricity and petroleum products should be brought under GST to avoid the cascading effect of taxes, as these are used as input by the majority of manufacturers and service providers.

- Simplify procedures and optimising digital resources:

- Filing system should be made more user-friendly.

- A major issue for taxpayers under the GST framework is claiming input tax credit; the process is unnecessarily cumbersome and time-consuming.

- Moreover, the current GST portal is not capable of handling large amounts of processing tasks all at once.

- Optimising digital resources will help accelerate the process of claiming input tax credit and increasing the capacity of the portal to handle higher numbers of data processing.

- Improve digital connectivity and digital literacy.

- Solving the issues between Centre and States:

- The Centre needs to urgently figure out and put to rest the battle between the Central and State Governments on sharing of revenue collections.

- Center has to be more accommodative to State’s needs such as granting compensation amount without delays, extension of compensation period etc.

PRACTICE QUESTION:

Q. “The GST, which aimed to improve cooperative federalism among the states and the centre, has resulted in creating a gradually widening trust deficit among India’s federal framework.” Critically analyse.