Hybrid Annuity Model

2020 DEC 11

Mains >

Industry and infrastructure > Infrastructure & Investment models > infrastructure

IN NEWS:

- The government has introduced investor-friendly changes in the model concession agreement (MCA) for highway building under the hybrid annuity model (HAM) to make it attractive for developers once again.

HYBRID ANNUITY MODEL (HAM):

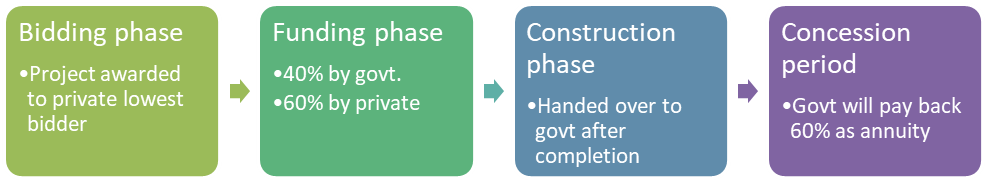

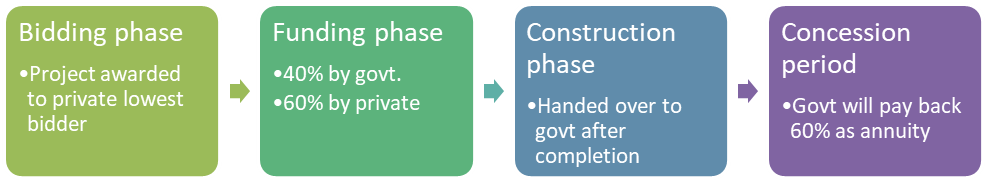

- HAM is a mix of the EPC (Engineering, Procurement and Construction) and BOT (Build, Operate, Transfer) models. HAM is a mix of the HAM combines EPC (40%) and BOT-Annuity (60%). It came into existence in 2015-16, when the government began to adopt it for contracting highway development projects.

- On behalf of the government, NHAI releases 40 per cent of the total project cost. It is given in five tranches linked to milestones.

- The balance 60 per cent is arranged by the developer in the form of equity or loans. It is paid back by the government as variable annuity amount after the completion of the project, depending upon the value of assets created.

- There is no toll right for the developer. Revenue collection would be the responsibility of the National Highways Authority of India (NHAI).

|

RECENT CHANGES:

- The first tranche of upfront payment will be released after 5% of progress in construction work and the second one after 10% progress. Similarly, the last instalment of the upfront payment will be disbursed after 90% of physical progress has been achieved.

- A shift to marginal cost of funds-based lending rate (MCLR) from bank rate earlier for computing interest on annuities. Earlier, the interest rate was linked to the Reserve Bank of India (RBI) bank rate plus 300 basis points.

|

ADVANTAGES OF HAM:

Government Perspective:

- Ease the cash flow pressure: In the case of EPC contracts, government has to fund all project cost as per the running bills thus there is a financial burden to the government. But by adopting HAM projects government is liable to pay a fixed annuity amount at intervals, thus easing the cash flow pressure.

- Source of Revenue: The authority is designated to collect toll during operational period which is expected to form good source of revenue against payment made to concessionaire in the form of annuities.

- Attract more private sector participation: HAM realigns the risk allocation based on ground level realities of the market thereby bringing about a revival in investor confidence. This will attract more private investment in the highway infrastructure.

- Speedy completion of projects: Payments are linked to various stages of project completion and there are sharp penalties for government as well as concessionaire if there is any delay in fulfilling their obligations. Hence, the model ensures that the project is completed on time.

- Operation and maintenance by private player: Better expertise and better quality of services can be expected, as the private sector is better equipped to ensure efficient construction, maintenance and operation of infrastructure projects.

Contractor/Lenders Perspective:

- Reduces sponsor’s risk for funding: HAM model entails lower sponsor contribution during construction period considering 40% construction support from authority and hence mitigate the funding risk to an extent.

- Assured cash flow: During operational stage, cash flow is assured in the form of annuity payments on semiannual basis covering 60% of the project cost along with the interest.

- Reduction in construction risk: Construction risk is partially reduced due to NHAI’s efforts for providing faster clearances as well as support in rehabilitation.

- No tolling risk: Private parties are relieved from the risk of tolling in this model as toll collection under this model would be done by government through NHAI.

- Insulation from price variations: Since the interest rates of funds are indexed to the prevalent inflation rates, private promoters are protected from price escalations. Also, lenders are partly secured in the event of termination of projects.

CHALLENGES:

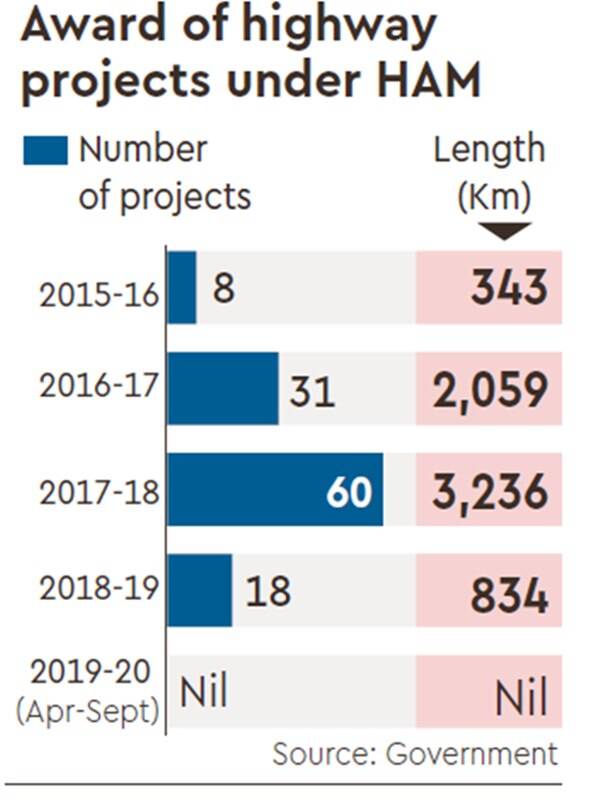

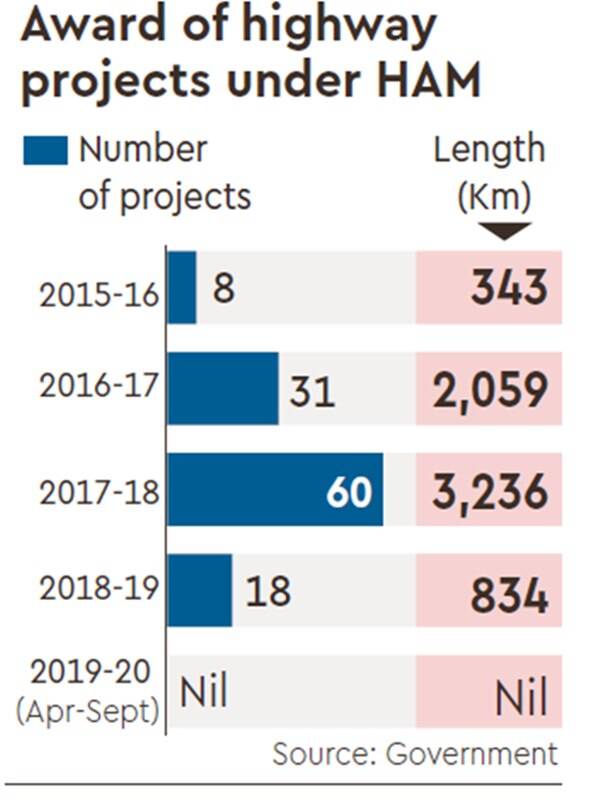

No projects were given under the HAM in 2019-2020. Also, as many as 210 national highway projects are delayed due to various reasons such as:

- Delays in land acquisition: Since land is a state subject, a number of steps have been taken to coordinate with the States to solve the land acquisition issues. As a result, project execution gets delayed.

- Financing projects: Due to their stressed balance sheets, banks are shying away from lending to long gestation projects like highway construction. Also, capital market is India is still underdeveloped. Hence, private is left with very few choices of acquiring funds.

- Slow Starting time: In the case of EPC contracts, work on the ground starts quickly after the projects are bid out. But in the case of works awarded under the HAM, it takes at least six months as the private players need to need to tie up funds from banks and other financial institutions.

- Regulatory hurdles: Approval for projects involves multiple regulatory agencies of both center and state governments, like transport, environment, pollution control and forest. This is a major hurdle for all models of read development in the country.

- Interest linked with Bank rate: The interest on annuities for HAM projects is sizeable, amounting to around 45% of overall inflows during the concession period. Till the recent changes, these rates were linked to bank rate. However, bank rate has steadily declined in recent times, without corresponding reduction in cost of borrowing. This trend has reduced the profit margins for private players.

- Delayed interest rate transmission: The transmission of reduced interest rates happened with a lag for the project loan. This inability of banks to pass on the interest rate benefit could affect the investor returns.

CONCLUSION:

- With the new changes, it is expected that the route is likely to become attractive for developers once again.

- However, government has to focus on other aspects like ensuring ease of doing business, solving the NPA crisis and streamlining the regulatory and approval mechanisms.

PRACTICE QUESTION:

Q. What is hybrid annuity model (HAM)? Examine its benefits over other investment models?