INDIA’S AGRI EXPORTS SECTOR

2021 JUN 15

Mains >

Agriculture > Allied areas > Agri productivity

IN NEWS:

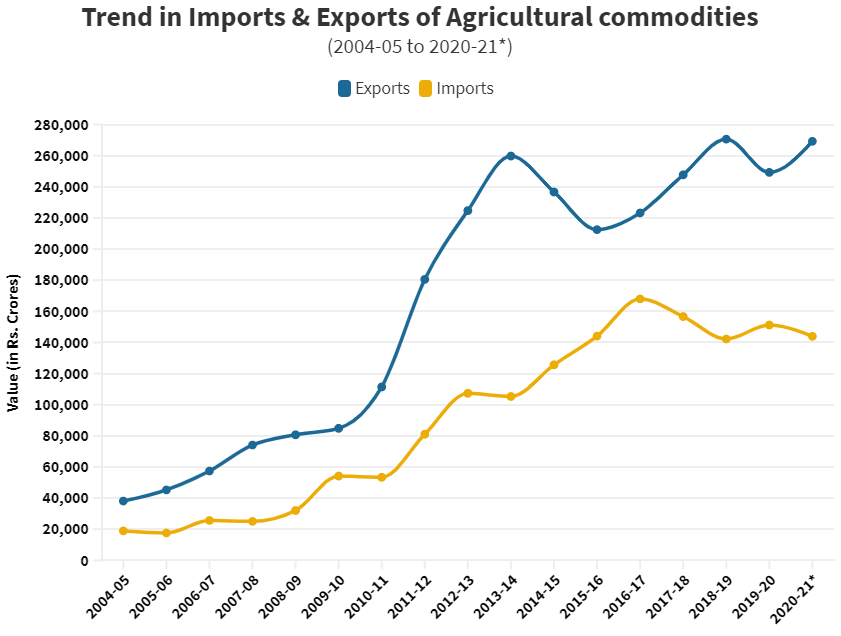

- After remaining stagnant for the last three years, the export of agriculture and allied products during 2020-21 grew 17.34 % to USD 41.25 billion.

STATUS OF INDIA’S AGRI EXPORTS:

- India occupies a leading position in global trade of agricultural products. India’s total agricultural export basket is estimated at USD 41.25 billion, which accounts for around 2.5% of world agricultural trade.

- India’s export basket is a diversified mix of Basmati rice, spices, fruits, marine products and meat.

- The major export destinations are USA, Saudi Arabia, Iran, Nepal, Bangladesh and UAE.

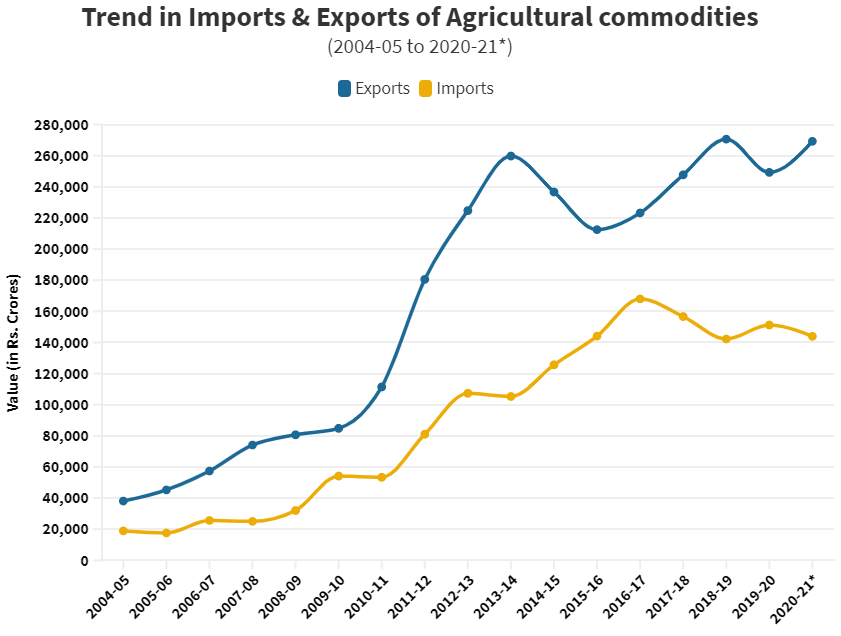

- India has maintained a trade surplus in agricultural commodities over the years. In financial year 2019-20, agri-exports touched Rs 2.52 lakh crores and imports at Rs 1.47 lakh crores.

INDIA’S OPPORTUNITIES IN AGRI EXPORTS:

- Diverse agroclimatic zones:

- India is blessed with large arable land with 15 agro-climatic zones, having almost all types of weather conditions and soil types. This enables the country to produce a variety of crops year-round to meet the global demand.

- Agri powerhouse:

- India’s produces enough to sustain a strong export industry. India is the top producer of milk, spices, pulses, tea, cashew and jute, and a leading producer of rice, wheat, oilseeds, fruits and vegetables, sugarcane and cotton.

- Proximity to food importers:

- India is located close to major food importers like the African and Gulf countries, who currently meet their needs through imports from USA, China and Brazil. India can potentially benefit by enhancing imports to these countries.

- Rise in demand for organic products:

- Changing demand due to increase in incomes, globalisation and health consciousness is gradually affecting the export sector. Demand for fruits and vegetables, dairy products, fish and meat is going to increase in future.

- Eg: Organic exports, that include products such as cereals and millets, spices and condiments, tea, medicinal plant products, dry fruits, and sugar, grew 51 % in 2020-21.

- Policy support:

- The government is actively pursuing policies for doubling farmers’ income, in which agri export plays a dominant role.

- Eg: To enhance agricultural export, India has been promoting GI tags for products and also created a dedicated agri export policy in 2018.

- Development of transport facilities:

- Government has been encouraging development of good storage and transport of agricultural produce. This will widen the market for produce from the heartlands of India.

- Eg: In 2020, Refrigerated coaches and containers for transportation of highly perishable parcel traffic was procured through Rail Coach Factory Kapurthala.

|

WHY THE SUDDEN INCREASE IN 2020-2021?

- Amidst the COVID-19 pandemic, the smooth functioning of agriculture sector was ensured by issuing relevant guidelines.

- Considerable improvement in the food grain production as a result of good monsoon and

- Special emphasis on collection and transportation of commodities during the pandemic. Eg: Kisan rails.

- Pandemic induced movement restrictions worldwide did not affect India’s agri-exports as they did with other commodities.

- Increase in demand for organic products.

- Diversification of export commodities and markets.

|

GOVERNMENT INITIATIVES:

I. POLICY SUPPORT:

1. Agriculture Export Policy, 2018:

- Its key features include:

- To double agriculture exports to USD 60 billion by 2022 and reach USD 100 Billion in the next few years thereafter, with a stable trade policy regime.

- To diversify our export basket, destinations and boost high value- and value-added agricultural exports including focus on perishables.

- Enable farmers to get benefit of export opportunities in overseas market.

- To provide an institutional mechanism for pursuing market access, tackling barriers and deal with sanitary and phytosanitary issues.

- To strive to double India’s share in world agri exports by integrating with global value chain at the earliest.

- To promote novel, indigenous, organic, ethnic, traditional and non-traditional Agri products’ exports.

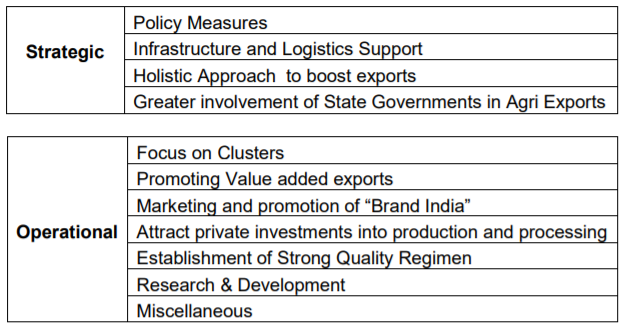

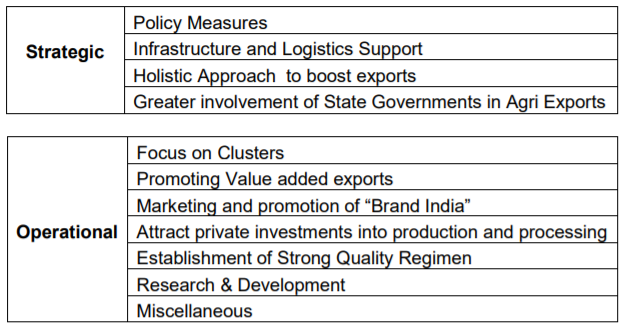

- The policy recommendations are organized in two broad categories: strategic and operational.

2. Trade Infrastructure for Export Scheme (TIES):

- TIES seeks to enhance export competitiveness by bridging gaps in export infrastructure. The scheme would provide assistance for setting up and up-gradation of infrastructure projects related with export, such as customs stations, quality testing and certification labs, cold chains.

II. SCHEMES:

1. Pradhan Mantri Kisan SAMPADA Yojana:

- It is an umbrella scheme implemented by Ministry of Food Processing Industries and aims at increasing value addition in agricultural sector.

- The schemes include:

- Mega Food Parks

- Integrated Cold Chain and Value Addition Infrastructure

- Creation / Expansion of Food Processing & Preservation Capacities

- Infrastructure for Agro-processing Clusters

- Creation of Backward and Forward Linkages

- Food Safety and Quality Assurance Infrastructure

- Human Resources and Institutions

- Operation greens

- Extra reading: Sampada scheme http://ilearncana.com/details/PRADHAN-MANTRI-MATSYA-SAMPADA-YOJANA-PMMSY/1190

2. GI Tags:

- GI tags for unique agricultural products are provided under the Geographical Indications of Goods Act, 1999.

- GI tag helps the producers to differentiate their products from competitors, offers protection from unauthorized use and develop a brand name, which helps in export earning.

- Extra reading: GI Tags http://ilearncana.com/details/GI-Tags/51

3. Paramparagat Krishi Vikas Yojana:

- The scheme promotes cluster based organic farming with PGS certification. Cluster formation, training, certification and marketing are supported under the scheme.

4. Participatory Guarantee Scheme (PGS):

- PGS is a process of certifying organic products, which ensures that their production takes place in accordance with laid-down quality standards.

- PGS is an internationally applicable organic quality assurance initiative that emphasize the participation of stakeholders, including producers and consumers, and operate outside the framework of third-party certification.

III. INSTITUTIONAL:

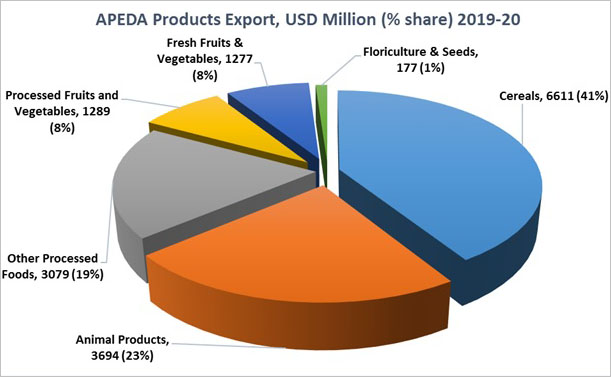

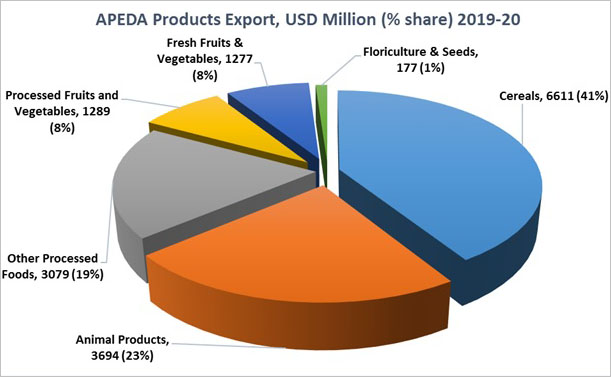

1. Agricultural and Processed Food Products Export Development Authority:

- APEDA was established by the Government under the APEDA Act of 1985. It works under the ministry of Commerce and Industry.

- It plays an important role in strengthening India’s export potential along with encouraging better price realization. It is responsible for the export promotion and development of listed products including meat and dairy products, floriculture products, horticulture, medicinal plants, etc.

2. The Marine Products Export Development Authority:

- MPEDA was set up by an act of Parliament in 1972. MPEDA is given the mandate to promote the marine products industry with special reference to exports from the country.

CHALLENGES:

While India occupies a leading position in global trade of aforementioned agri products, its total agri export basket accounts for little over 2% of world agri trade. Some of the challenges to improve the situation include:

- Low productivity:

- The average productivity of many crops in India remains low. This arises due to several factors such as low levels of farm mechanization, limited irrigation facilities and use of traditional farming practices. This will be a major challenge in the future, considering the country’s growing population.

- Value addition:

- Majority of India’s exports are low value, raw or semi-processed items. The share of India’s high value and value added agri produce in its agri export basket is less than 15% compared to 25% in US and 49% in China.

- Fragmented supply chain:

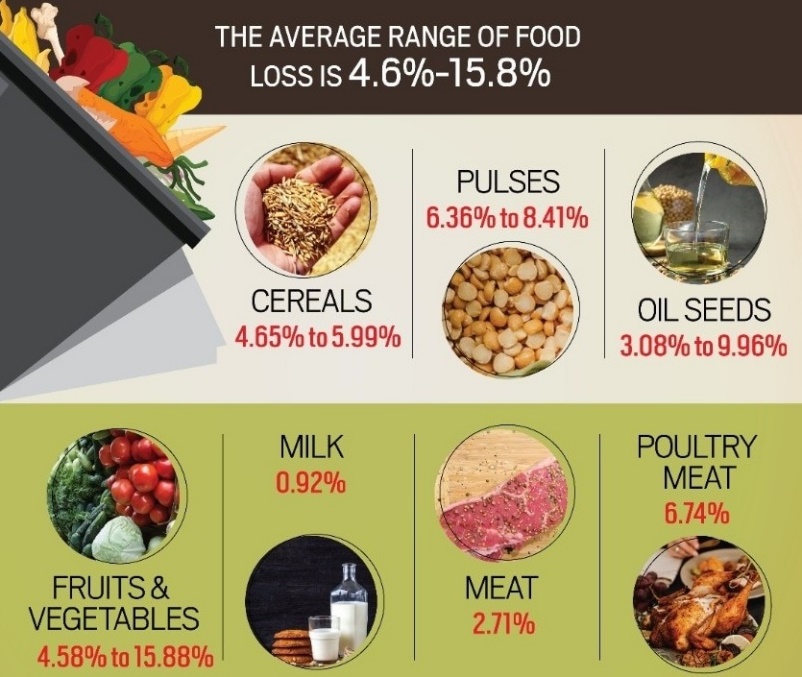

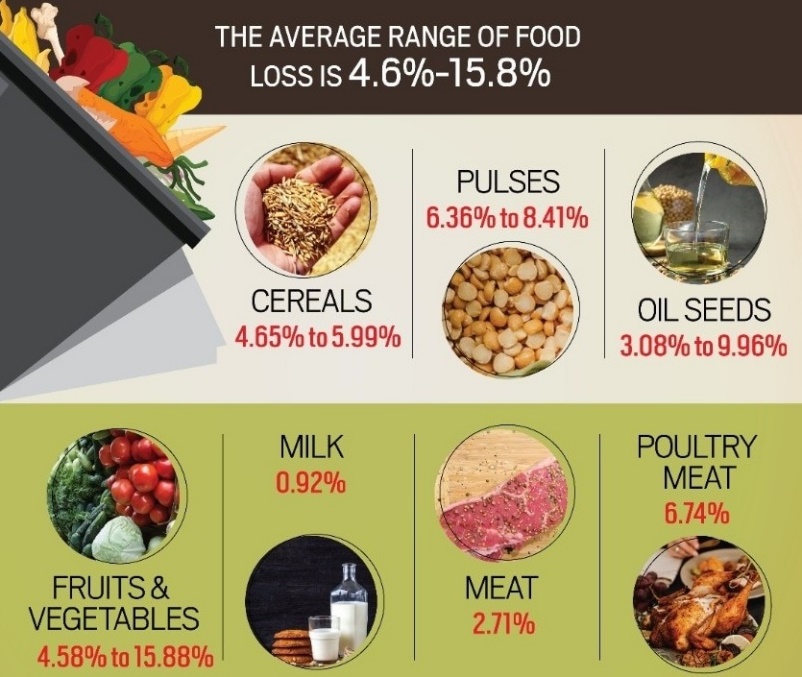

- Due to storage of storage facilities, cold storages and transportation system, the supply chain system in India remains highly fragmented. This has resulted in low price realization, poor quality and wastage of products.

- Import of products:

- Despite several efforts to enhance self-reliance, India continues to be an importer of several food commodities. About 54% of imports by India is of vegetable oils. Other major agri-imports are fresh fruits, pulses, spices, and cashew. Together, the five products accounts for 80% of India’s agri-imports.

- Phytosanitary regulations:

- Major destinations such as the US and European Union have established strict non-tariff trade barriers, like phytosanitary regulations. This has restricted India’s exports.

- Eg: Pesticide residue problems have affected exports of basmati rice to the EU due to stringent norms imposed for chemicals such as Tricyclazole and Buprofezin, extensively used in rice cultivation in India.

- Conflicts in WTO:

- India’s farm subsidy policies have come under the scanner at the World Trade Organization (WTO). This has restricted India from extending strong support to the farmers and traders.

- Eg: In March 2021, Canada, the US and Australia raised complaints regarding India’s agriculture export subsidies and urged India to reform its agricultural policies.

- Impact of COVID-19 second wave:

- Unlike last year, when cases were predominantly reported from urban centres, the second wave of the pandemics has spread to the rural hinterlands. This could impact shipments from India, at least temporarily.

WAY FORWARD:

- Address structural challenges:

- Addressing the underlying farm sector challenges, like reduction of post-harvest loss, availability of necessary infrastructure like cold storage, proper monitoring of fertilizer and pesticides usage, and adoption of the latest farm technology addressing would help boost India’s exports.

- Leverage on technology:

- India needs to utilize the opportunities from genetic modification and IT enabled solutions such as Artificial intelligence and Big data to leverage the full potentials of Indian agriculture.

- Reform marketing sector:

- Creating a strong and competitive market is essential for better price realization and promoting export. In this regard, the three new farm acts offer a potential solution.

- Promote cooperatives:

- Cooperatives strengthens collective bargaining power among the farmers. Hence, government efforts are needed to rejuvenate the cooperative movement and farmer producer organisations in the country.

- Encourage research:

- Agriculture research in India is slow to come by and is largely restricted to the public sector. Hence, focus must be given on enhancing agri-research and encouraging private investments in R and D.

- Encourage agripreneurs:

- A new breed of entrepreneurs, who rely on modern farming practices, are more technology-oriented focused in enhancing productivity and quality, is rising in India. They need to be supported through credit, research and infrastructure.

PRACTICE QUESTION:

Q. Agricultural exports are pivotal for helping Indian farmers increase their incomes. Discuss?