INDIA’S FOREX RESERVES

2021 JUL 21

Mains >

Economic Development > Indian Economy and issues > Foreign direct investment

IN NEWS:

- With forex reserves of USD 608.99 billion as on June 25, India has emerged as the fifth largest foreign exchange reserves holder in the world after China, Japan, Switzerland and Russia.

FOREIGN EXCHANGE RESERVES:

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies.

- These may include foreign currencies, bonds, treasury bills, and other government securities.

- They are used for direct financing of external payments imbalances and for indirect intervention in exchange markets to affect the currency exchange rate among other purposes.

INDIA’S FOREX:

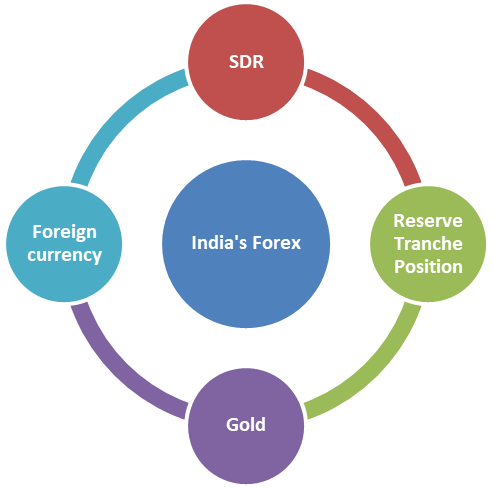

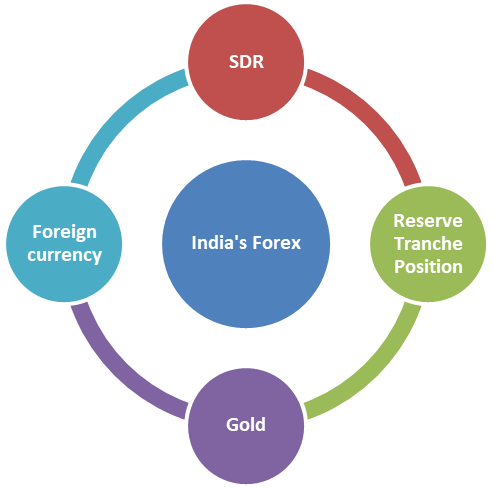

- The foreign exchange reserves include four items: Gold, Special Drawing Rights (SDRs), Reserve Tranche Position and foreign currency assets.

- Most of these reserves are held in the form of foreign currencies, particularly in U.S. dollar, since it is the most traded currency in the world and has high liquidity.

- The Reserve Bank functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with Government of India.

- Legal provisions governing management of forex reserves are set out in the RBI Act and Foreign Exchange Management Act, 1999.

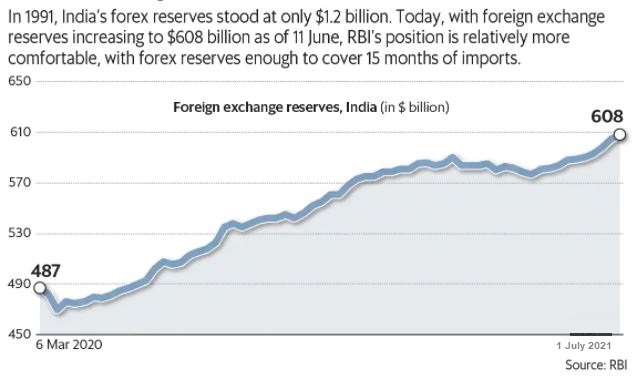

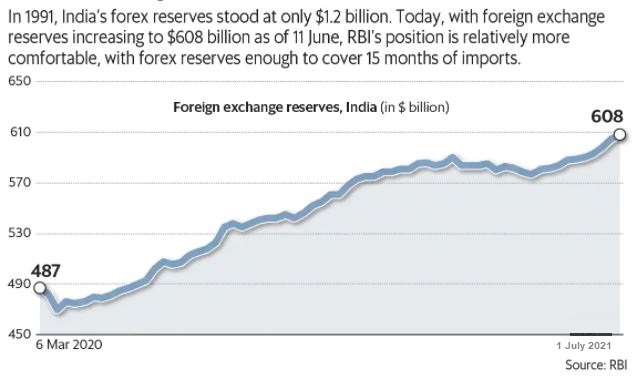

- In 1991, India’s forex reserves stood at only USD 1.2 billion, just about enough to meet about 3 weeks of imports. Today, RBI’s holds forex reserves account for USD 608 billion, enough to cover 15 months of imports.

- Variation in India’s forex reserves is primarily the outcome of RBI’s intervention in the foreign exchange market to smoothen exchange rate volatility, valuation changes in the reserve basket, movement in gold prices, interest earnings from deployment of foreign currency assets and inflow of aid receipts.

|

Special Drawing Rights:

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- The SDR serves as the unit of account of the IMF and some other international organizations.

- The SDR is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members.

- SDRs can be exchanged for these currencies.

- The value of the SDR is based on a basket of five currencies—the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.

|

WHY HOLD FOREX RESERVES?

- Acts as a safety net:

- Maintaining foreign currency liquidity helps to minimize external vulnerability to crisis situations and absorb shocks during times like disasters or emergencies.

- Also, bonds, treasury bills, gold, and other government securities can ensure that the RBI has backup funds to support Rupee if it devalues at some point.

- Facilitate macroeconomic stability:

- Forex reserves are reflective of the stability and strength of the fundamentals of an economy. When RBI maintains adequate forex reserves, other countries are confident about its monetary and exchange rate management policies.

- The reserves enhance RBI’s ability to intervene in the forex market and manage the exchange rate, while enabling orderly absorption of international money and capital flows.

- Eg: If Rupee starts depreciating against the dollar, then the RBI can sell its dollar reserves and buy Rupee in order to stop the depreciation.

- Encourage investments in the country:

- Strong reserves provide much confidence to foreign investors and credit rating agencies in the government’s ability to meet its debt obligations and the RBI’s capacity to insulate the economy from shocks.

- Eg: Good credit ratings will attract foreign direct investments and allow India to access cheaper funding for development projects from public debt markets.

- Support EXIM sector:

- Holding liquid forex indicates India’s capacity to pay for imports, especially crucial inputs such as crude oil and capital equipment.

- Also, providing confidence to the markets especially credit rating agencies helps to reduce the overall costs of doing business in the country.

WHY INDIA SHOULD HAVE MORE RESERVE:

- Well below other countries:

- While the reserve is enough to cover 15 months of imports, it is well behind other countries. Eg: Switzerland’s reserves can pay for 39 months of imports, Japan’s for 22 months and Russia’s for 20 months.

- Impending reforms in US:

- India is vulnerable to monetary policy by the US Federal Reserve. Once the Federal Reserve withdraws some of its extraordinary monetary stimulus, it will trigger an outflow of investments from India. A stronger reserve could counter this to some extent.

- Widening Current Account Deficit:

- With the pandemic receding, the demand for imports is likely to increase in coming months. This could increase India’s current account deficit. In this scenario, foreign equity and debt capital is essential for the country and a larger reserve would facilitate this.

- Support Atmanirbhar efforts:

- India has raised the call for self-reliance and is trying to attract industries that are shifting out of China. In this situation, a strong reserve will help attract more investments into the country.

CRITICISM OVER LARGE FOREX RESERVES:

- Conflict with inflation targeting:

- To strengthen the forex reserves, the central bank accumulates foreign currency by selling the rupee in the market. This excess liquidity could create inflationary pressure in the country.

- Promote inefficiency:

- High level of reserves could, under some circumstances, give comfort against weaknesses in the financial sector or high public debt or encourage laxity in financial and fiscal policies.

- Rarely used:

- In the past, instead of using the reserves, the RBI has tightened monetary policy and used capital controls in order to prevent the rupee from falling, Hence, critics argue that the large reserve does not serve its true purpose.

- Conflict with USA:

- Large stockpile of US dollar and sustained intervention by the RBI has resulted in India being added in the currency manipulation watch list of the USA. Though it does not immediately attract any penalties, it tends to dent the confidence about India in the global financial markets.

|

Currency manipulator:

- It is a label given by the US government to countries it feels are engaging in unfair currency practices by deliberately devaluing their currency against the dollar.

- The practice would mean that the country in question is artificially lowering the value of its currency to gain an unfair advantage over others. This is because the devaluation would reduce the cost of exports from that country and artificially show a reduction in trade deficits as a result.

- The US treasury department has set three parameters to determine whether an economy has manipulated its currency:

- Bilateral trade surplus with the US of more than USD 20 billion over a 12-month period.

- Current account surplus of at least 3 percent of GDP over a 12-month period.

- Net purchases of foreign currency of 2 % of GDP over a 12-month period.

- There are no countries at present in the list. However, several countries are places in the currency manipulator watch list.

- India was first added to the watch list in December 2018 but removed in 2019 and again got a mention in the list in December 2020.

|

CONCLUSION:

Despite a recession, substantial fall in exports in FY21 and the fall in exports, the rise in forex reserves indicates confidence in the?Indian economy among?foreign investors. However, further efforts such as stronger fiscal discipline, reduction of current account deficits and promotion of Ease of Doing business are needed for India to recover its developmental momentum.

PRACTICE QUESTION:

Q. ‘Forex reserves of the country has come a long way since 1991’. In this light, discuss the importance of having a strong foreign exchange reserve?