Insolvency and Bankruptcy Code (IBC)

2021 NOV 17

Mains >

Economic Development > Indian Economy and issues > Ease of doing business

WHY IN NEWS:

- In its recently released report, GN Bajpai committee has suggested Insolvency and Bankruptcy Board of India (IBBI) to come up with a standardised framework with a real-time data bank, with data on time, cost and recovery rates together with macroeconomic indicators to assess the success of the five-year-old law and improve its implementation

- The committee also said that resolution of the distressed asset remains the first objective of the Insolvency and Bankruptcy Code (IBC), followed by promotion of entrepreneurship, availability of credit and balancing the interests of stakeholders.

ABOUT INSOLVENCY AND BANKRUPTCY CODE, 2015:

- It was introduced in 2015, and came into force in 2016

- The Code seeks to create a unified framework for resolving insolvency and bankruptcy in India.

- Insolvency is a situation where individuals or organisations are unable to meet their financial obligations.

EFFECT ON OTHER STATUTES:

- The Code seeks to repeal the Presidency Towns Insolvency Act, 1909 and Provincial Insolvency Act, 1920.

- It seeks to amend 11 laws, including the Companies Act, 2013, Recovery of Debts Due to Banks and Financial Institutions Act, 1993 etc

APPLICABLE TO:

|

Types of creditors

With regard to corporate debtors, the Code defines two types of creditors: (i) financial creditors, who have extended a loan or financial credit to the debtor, and (ii) operational creditors, who have provided goods or services to the debtor, the payment for which is due.

Financial creditors could be secured or unsecured. Secured creditors are those whose loans are backed by collateral (security).

|

- The Code will apply to companies, partnerships, limited liability partnerships, individuals and any other body specified by the central government.

INSOLVENCY RESOLUTION:

- The insolvency resolution process (IRP) for individuals varies from that of companies. These processes may be initiated by either the debtor or the creditors.

- Resolution process for companies and limited liability partnerships:

- The resolution process will have to be completed within a maximum period of 180 days from the date of registration of the case. This period may be extended by 90 days if 75% of the financial creditors agree.

- The process will involve negotiations between the debtor and creditors to draft a resolution plan. The process will end under two circumstances, (i) when a resolution plan is agreed upon by a majority of the creditors and submitted to the adjudicating authority, or (ii) the time period for negotiation has come to an end. In case a plan cannot be negotiated upon, the company will go into liquidation.

- Resolution process for individuals and partnerships:

- Before going in for insolvency resolution, the debtor may apply for forgiveness of a specified amount of debt, provided that his assets are below a limit set by the central government. This process will have to be completed within six months.

- In case of insolvency resolution, negotiations between the debtor and creditors will be supervised by insolvency professional.

- If negotiations succeed, a repayment plan, agreed upon by a majority of the creditors will be submitted to the adjudicator. If they fail, the matter will proceed to bankruptcy resolution.

INSOLVENCY PROFESSIONALS AND AGENCIES:

- The insolvency resolution process (IRP) will be managed by a licensed professional. The professional will also control the assets of the debtor during the process. The Code also proposes to set up insolvency professional agencies. These agencies will admit insolvency professionals as members and develop a code of conduct and evolve performance standards for them.

INFORMATION UTILITIES:

- The Code proposes to establish information utilities which will maintain a range of financial information about firms. These utilities will collect, collate and disseminate this information to facilitate insolvency resolution proceedings.

INSOLVENCY REGULATOR:

- The Code seeks to establish the Insolvency and Bankruptcy Board of India, to oversee insolvency resolution in the country. The Board will have 10 members, including representatives from the central government and Reserve Bank of India. It will register information utilities, insolvency professionals and insolvency professional agencies under it, and regulate their functioning.

INSOLVENCY AND BANKRUPTCY FUND:

- The Code creates an Insolvency and Bankruptcy Fund. Deposits to the Fund will include: (i) grants made by the central government, (ii) amount deposited by persons, and (iii) interest earned on investments made from the Fund. Any person who has contributed to the Fund may apply for withdrawal, in case of proceedings against him.

BANKRUPTCY AND INSOLVENCY ADJUDICATORS:

- The Code proposes two separate tribunals to adjudicate grievances related to insolvency, bankruptcy and liquidation of different entities under the law:

- (i) National Company Law Tribunal will have jurisdiction over companies and limited liability partnerships, and

- (ii) Debt Recovery Tribunal will have jurisdiction over individuals and partnership firms.

- Appeals against orders of these tribunals may be challenged before their respective Appellate Tribunals, and further before the Supreme Court.

CROSS-BORDER INSOLVENCY:

- Cross border insolvency relates to an insolvent debtor who has assets abroad. The central government may enter into agreements with other countries to enforce provisions of the Code.

OFFENCES AND PENALTIES:

- The code specifies that for most offences committed by a debtor under corporate insolvency (like concealing property, defrauding creditors, etc.), the penalty will be imprisonment of up to five years, with a fine of up to one crore rupees.

- For offences committed by an individual (like providing false information), the imprisonment will vary based on the offence.

NEED FOR IBC IN INDIA:

- Delay in insolvency resolution:

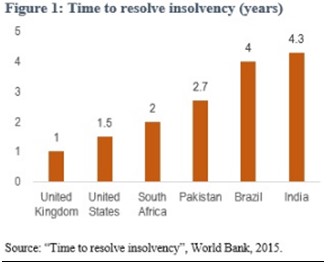

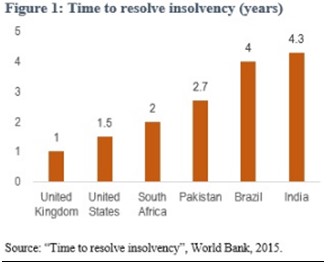

- As of 2015, insolvency resolution in India took 4.3 years on an average.

- This is higher when compared to other countries such as United Kingdom (1 year) and United States of America (1.5 years).

???????

???????

- Scattered laws relating to insolvency and bankruptcy:

- The era before IBC had various scattered laws relating to insolvency and bankruptcy which caused inadequate and ineffective results with undue delays. For example:

- SARFAESI Act for security enforcement

- Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (RDDBFI) for debt recovery by banks and financial institutions

- Companies Act for liquidation and winding up of the company etc.

AMENDMENTS IN 2017:

- This Amendment Act inserts a provision prohibiting certain persons from submitting a resolution plan. A person will be ineligible to submit a plan if:

- He is an undischarged insolvent

- He is a wilful defaulter

- He has been convicted of an offence punishable with two or more years of imprisonment

- He has been disqualified as a director under the Companies Act, 2013 etc.

- Further, it bars the sale of property of a defaulter to such persons during liquidation.

AMENDMENT IN 2018

- Representative of financial creditors:

- This Amendment provides that, during the insolvency resolution process, a Committee of Creditors (CoC) will be constituted for taking decisions (by voting) on the resolution process.

- These representatives will vote on behalf of the financial creditors

- Voting threshold of Committee of Creditors (CoC):

- The voting threshold for routine decisions taken by the committee of creditors has been reduced from 75% to 51%.

- Homebuyers as financial creditors

- This Amendment Act provides that homebuyers who paid advances to a developer are to be considered as financial creditors

- Withdrawal of submitted applications:

- The Amendment Act allows the withdrawal of a resolution application submitted to the NCLT under the Code. This decision can be taken with the approval of 90% of the committee of creditors (CoC)

- Applicability of the Code to MSMEs:

- The Amendment states that the ineligibility criteria for resolution applicants regarding NPAs and guarantors will not be applicable to persons applying for resolution of MSMEs.

AMENDMENT IN 2019

- Time-limit for resolution process:

- The Code states that the insolvency resolution process must be completed within 180 days, extendable by a period of up to 90 days.

- This Amendment adds that the resolution process must be completed within 330 days.

- This includes time for any extension granted and the time taken in legal proceedings in relation to the process

AMENDMENT IN 2020

- Threshold for certain creditors for initiating resolution process:

- It introduces an additional threshold for certain classes of financial creditors, including allottees of real estate projects, for initiating the resolution process. (homebuyers are recognised as financial creditors under the IBC in 2018)

- At least 10% of them or 100 such persons have to jointly initiate the process.

- Supply of critical goods and services not to be discontinued:

- It empowers the resolution professional to require suppliers to continue providing goods and services.

- This is because goods and service essential to keep a particular business running cannot be terminated when a company is undergoing insolvency resolution. But it also provides that suppliers have to continue supplying only if their current dues are paid

- Liabilities for prior offences:

- It provides that the company will not be liable for any offence committed prior to the insolvency resolution process, if there is a change in the management or control of the company.

- It aims to provide protection to new owners of a loan defaulter company against prosecution for misdeeds of previous owners.

- Licenses and permits not to be terminated due to insolvency:

- This Amendment states that any existing license, permit, registration, or clearance given by any government authority to the debtor will not be suspended or terminated due to insolvency.

SUSPENSION DURING PANDEMIC

- Provisions enabling filing of corporate insolvency cases are suspended for a period of six months (extendable to one year).

- This amendment was made to provide some relief to those corporate debtors who are directly affected due to the COVID-19 pandemic which has resulted in widespread disruption of business operations

- Government increased the minimum default amount to trigger corporate insolvency resolution from ?1 lakh to ?1 crore. This was purportedly done to protect MSMEs from insolvency petitions

HOW IBC BENEFITS:

- For debtor:

- It promotes entrepreneurship, as IBC framework facilitates easy exit for loss making companies

- Maximization of the value of assets of corporate persons.

- It helps in reviving the company in a time-bound manner.

- For creditors:

- It protects the interest of creditors, and consequently increases the credit supply in the economy

- Timely recovery procedure helps banks/financial institutions to reduce their NPAs

- For Government:

- Helps in reducing number of time-consuming litigations

- Simplifying procedure:

- It consolidates and amends all existing insolvency laws in India, hence simplify and speed-up the Insolvency and Bankruptcy proceedings.

SUCCESSES OF IBC:

- High recovery rate:

- Before enactment of the IBC, the recovery mechanisms available to lenders were through Lok Adalat, Debt Recovery Tribunal and SARFAESI Act.

- According to a World Bank statement, IBC has improved the recovery rate of stressed assets to 48% in two years from 26% in the pre-IBC era

- Shorter resolution process:

- Until 2015, it used to take 4.3 years on an average to resolve an insolvency case in India.

- That has fallen dramatically after IBC regime to an average 380 days.

- Higher credit realization:

- Till June 2020, 250 companies had been rescued and 955 others referred for liquidation.

- According to IBBI, the resolution plans yielded about 191% of the realizable value for financial creditors

- Improvement in ease of doing business ranking:

- IBC played an indisputable role in improving India’s Ease of Doing Business (EODB) ranking from 130 in 2016 to 63 in 2020.

ISSUES:

- Poor compliance to timelines:

- The earlier envisaged timeframe of 180 days (+90 days extension) was increased to 330 days for resolving issues.

- Despite the extension, resolution plans continue to cross the deadline.

- On average, it takes 380 days for resolution plans to reach a conclusion.

- Issues with NCLTs and NCLATs:

- In most cases, delay in resolution is due to lack of capacity in National Company Law Tribunal and National Company Appellate Tribunal (NCLAT)

- Due to delays in appointment and vacancies of judges in NCLTs >> NCLTs are overburdened - the number of benches is 16 and the total number of bench members is only 20.

- This forces one judicial member to sit for two or more benches.

- More over IBC cases are not the only mandate of the NCLT. They also consider various cases under the Companies Act such as mergers or oppression and mismanagement cases.

- Complex in its nature:

- IBC process also involves a number of stakeholders with competing interests, which further makes resolution complex and time-consuming.

- Issue in order of priority to distribute assets during liquidation:

- Unsecured creditors have priority over trade creditors, and government dues will be repaid after unsecured creditors

- Fragmented information in multiple IUs:

- Code provides for the creation of multiple IUs. However, it does not specify that full information about a company will be accessible through a single query from any IU. This may lead to financial information being scattered across these IUs

- Issues with Insolvency and Bankruptcy Fund:

- Code does not clearly specify the manner in which the Insolvency and Bankruptcy Fund will be used.

- Performance bond:

- The IPAs will be jointly and severally liable for the conduct of a member IP during the resolution process. For this purpose, they will have to furnish a performance bond with the Bankruptcy Board at the beginning of the process. Joint Committee of Parliament, which examined the Code, observed that requirement of furnishing a performance bond may deter IPs and IPAs from entering the sector

- Conflict of interest in IPAs:

- Code allows for multiple IPAs to operate simultaneously, which could enable competition in the sector. However, this may also lead to a conflict of interest between the regulatory and competitive goals of the IPAs

- Burden for small creditors:

- Mandating all operational creditors to submit financial information to IUs may create a burden for small creditors, who may not have the necessary resources to provide such information to IUs

- Missing the deadline:

- IBC mandates that an insolvent asset must be resolved in 270 days. But many cases are pending for more than 600 days due to continuous litigation by some party or the other.

SUGGESTIONS:

- Adopting recommendations of the GN Bajpai committee:

- Setting up specialised National Company Law Tribunal benches to hear only IBC matters

- Establishing professional code of conduct for committee of creditors

- Strengthening the role of resolution professionals

- Digitalising IBC platforms in order to make the resolution process faster and maximise the realisable value of assets.

- Enhance institutional capacity of the NCLT benches

- There is a need to increase the number of appointments of judicial members/experts.

- More NCLT benches of the adjudicating authority would enhance the process.

- Background checks in terms of conflict and integrity should be done for insolvency professionals, with timelines being set to complete proceedings

- Data integrity and more IU’s should support the process.

- Information Utilities (IU’s) play a crucial role in terms of providing transparent evidence of default. Now, IBBI has the only registered IU, National e-Governance Services Limited.

- IBC is not the only solution for resolving stress:

- Pre-IBC mechanisms such as one-time settlements, restructuring packages can also help in improving the resolution process in cases where there is some consensus between the debtor and the debtor and the creditors.

CONCLUSION:

- The IBC is a crucial structural reform, which if implemented effectively and in a timebound manner can produce major gains for the corporate sector and the economy as a whole.

- There has been a marked improvement in the recovery process after the IBC was in force, but still, a lot needs to be done.

- In the US, it took 10 years (from 1978) for the bankruptcy law to attain some stability. The progress in India has been remarkable by global standards

PRACTICE QUESTION:

Q. Examine the role of a robust insolvency and bankruptcy framework in attracting investment into the country?

???????

???????