International Trade in Rupee

2023 APR 21

Mains >

Economic Development > Indian Economy and issues > Internationl trade

IN NEWS:

- Banks from 18 countries have been permitted by the Reserve Bank of India (RBI) to open Special Vostro Rupee Accounts (SVRAs) for settling payments in Indian rupees, the government told the Rajya Sabha.

ABOUT THE MECHANISM:

- In the existing mechanism, if an Indian national exports or imports, transactions are carried out in a foreign currency, which is usually the US Dollar.

- The RBI stated that the new system will denominate all exports and imports and invoice them in rupee (INR).

- Authorised Dealer Banks in India had been permitted to open a special Rupee Vostro Accounts.

- Indians undertaking imports through this system shall make payment in rupee into the Vostro account of the partner country, against the invoices for the supply of goods or services from the overseas seller.

- Indian exporters shall be paid the export proceeds in rupee from the balances in the special Vostro account of the partner country.

- However, authorised banks will need prior permission from the Foreign Exchange Department of RBI before putting the mechanism to use.

- The exchange rate between the currencies of the two trading partner countries will be decided by the market.

- Balance in Special Vostro Accounts may be used for permissible capital and current account transactions like payments for projects and investment in treasury bills & government securities.

|

Vostro account:

A vostro account is an account a correspondent bank holds on behalf of another bank. These accounts are an essential aspect of correspondent banking in which the bank holding the funds acts as custodian for or manages the account of a foreign counterpart.

|

SIGNIFICANCE:

- Internationalization of the currency:

- With the new system, the INR will get used increasingly for trade transactions. This can gradually contribute to the global acceptance of rupee for international trade transactions.

- Promote exports from India:

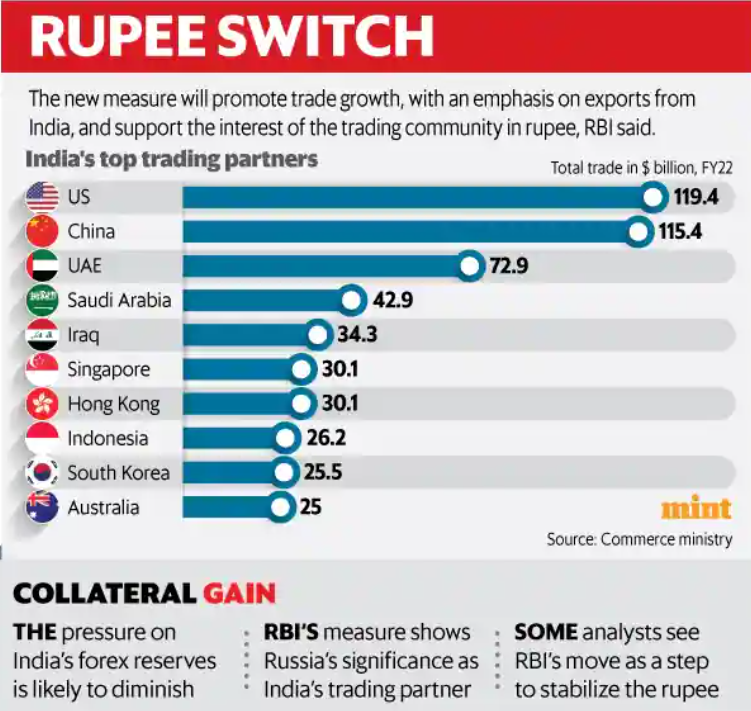

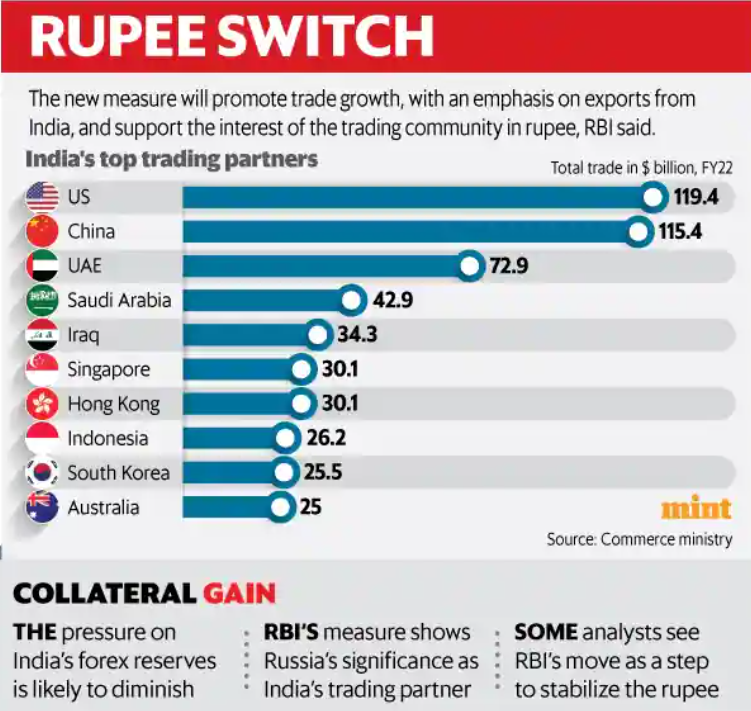

- The step is aimed at promoting growth of global trade with emphasis on exports from India and to support the increasing interest of the global trading community in the domestic currency.

- Ensure continued trade relations during crisis:

- The decision to allow INR in international trade settlements is considered as an important step to facilitate trade with Russia, Iran and Sri Lanka.

- Eg: Normally, India would have had to pay Russia in dollars for oil purchases. Now, the same payment can be done through the rupee-ruble route.

- Stabilise forex reserves:

- RBI’s move would reduce the outflow of US dollars and shore up demand for the rupee. This would allow the central bank leeway to conserve its forex reserves and deploy it to keep the rupee stable.

- Reduce trade deficit:

- The US dollar has been going through a phase of strength against most currencies in the world. By trading directly in Rupee, India can reduce its trade deficit.

- Also, The RBI move could help narrow the trade deficit as New Delhi can now increase the share of Russian oil purchases at a discounted price.

- Towards free convertibility:

- In India, there is full current account convertibility, but only a partial capital account convertibility. Financial experts see the new mechanism as a first step towards 100% convertibility of the rupee.

- Regain currency primacy:

- It may also be a small step in regaining the central role that the INR used to play in the Indian Ocean region prior to 1947.

CHALLENGES:

- Low share in global trade:

- India’s share in global trade is not significant enough and our dependence for import of fossil fuels, edible oils, gold and silver etc. is quite large. Hence, it is unlikely that exporting countries will consider Indian rupee as a currency of invoicing, unless it suits their interests.

- Bilateral trade disequilibrium:

- Countries whose exports to India are more than imports, will not be too enthusiastic to trade in rupees.

- Eg: China had a USD 73-billion trade surplus with India in 2021-22. If China were to trade with India in rupees, it would have Indian rupees worth USD 73 billion sitting idle in its Rupee Vostro accounts in an Indian bank. China would either have to invest this money in India, or let it lie idle in its accounts. China can simply trade with India in US dollars and avoid this problem.

- Challenge in monetary policy management:

- Unless markets are deep with large financial institutions other than the RBI, large trade flows could lead to volatility in the value of the rupee, which could make monetary policy setting difficult for the RBI.

- Competing national interests:

- In the prevailing global trade protectionism and geopolitical rivalries, each country wants to promote exports and reduce imports.

- Impact on India US relations:

- Russia has been vocal in using trade in local currency for the overall process of “de-dollarisation”. Invoicing in Indian Rupee and not depending on US Dollar may upset India’s relationship with the US.

- Impact on service sector:

- It may have an indirect impact on services sector for which India is dependent on developed markets like the US and Europe.

- Volatility of rupee:

- The rupee has depreciated by around 6 per cent in 2022. Depreciation in local currency and inflation put together add substantial burden, which may make imports unviable even if rupee is used as a currency of invoicing.

WAY FORWARD:

To promote rupee for international trade settlements, the first stage is that India should increase exports and imports so that rupee becomes a highly tradable currency. This should be supported by critical reforms in financial markets which include capital account convertibility, deepening financial markets coupled with large financial institutions other than the RBI to manage the large-scale inflow and outflow of capital.

PRACTICE QUESTION:

Q. Discuss the implications of the move to allow cross border trade in rupee?