PRIVATISING INSURANCE SECTOR IN INDIA

2021 AUG 12

Mains >

Economic Development > Indian Economy and issues > Privatisation

IN NEWS:

- Amid protests, the General Insurance Business (Nationalisation) Amendment Bill, 2021, which permits privatisation of state-run general insurance companies, received parliamentary assent.

INSURANCE:

- Insurance is a contract, by which a company or the state undertakes to provide a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium.

- There are mainly two types of insurances:

- Life insurance: It is a long-term insurance by which the insurance company pays an assured sum to a nominee in case of premature demise of the policy holder.

- General insurance: They are short-term insurances that cover non-life assets such as home, vehicle, health and travel.

HISTORY:

- 1818 saw the advent of life insurance business in India with the establishment of the Oriental Life Insurance Company in Calcutta.

- The colonial era was dominated by foreign insurance, like Albert Life Assurance and Royal Insurance.

- In 1956, the Government nationalized the Life Insurance sector and Life Insurance Corporation (LIC) came into existence. The LIC had monopoly till the late 1990s.

- Subsequently, the government nationalised the general insurance business in 1971.

- Following the LPG reforms in 1991, the insurance sector was open for private players.

- In 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry.

PRESENT STATUS:

- Today there are 34 general insurance companies and 24 life insurance companies operating in the country. Together with banking services, insurance services add about 7% to the country’s GDP.

- Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company. There are six public sector insurers in the non-life insurance segment.

RECENT GOVERNMENT EFFORTS:

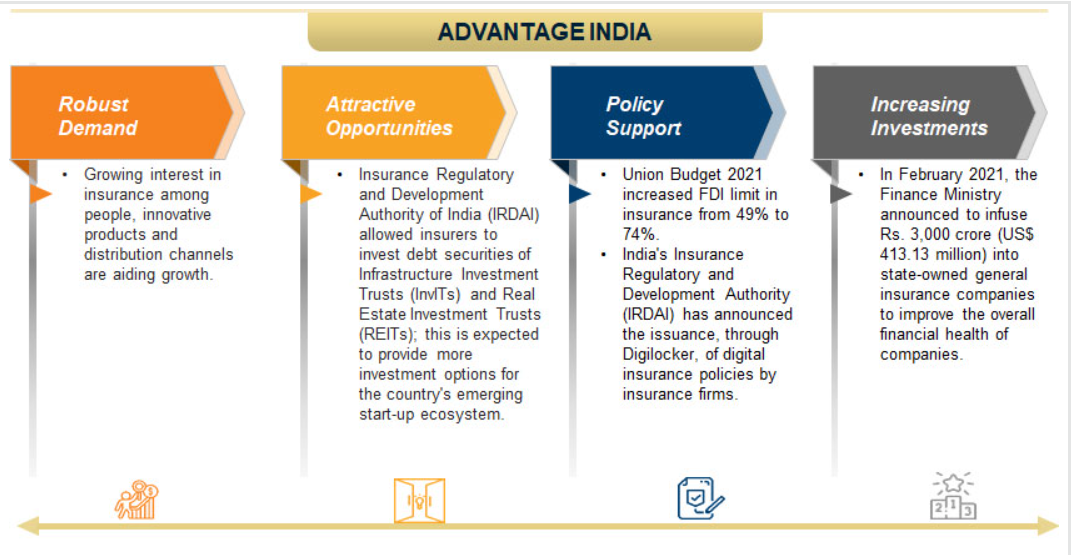

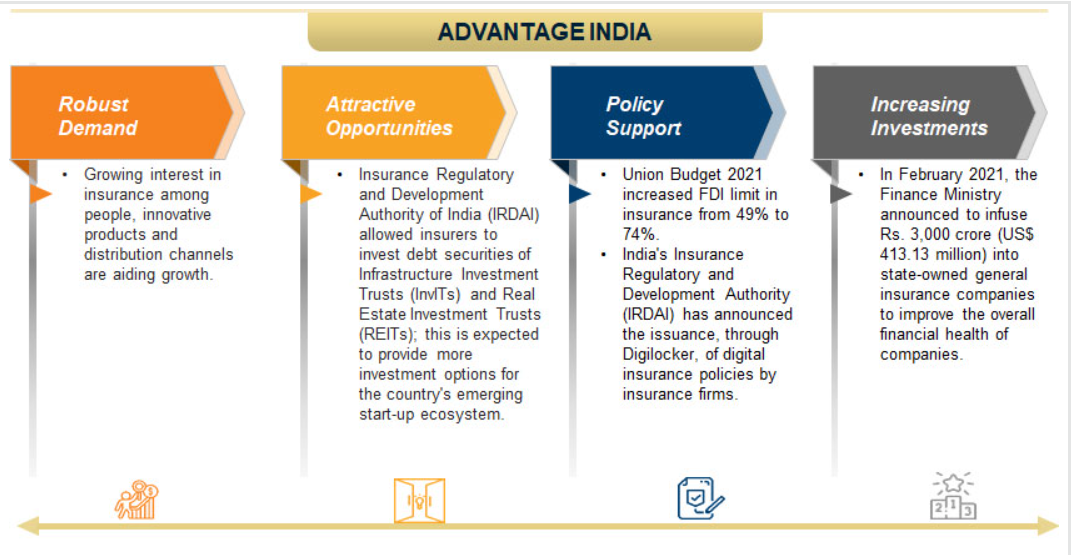

Under the Union Budget 2021, the Government of India has taken number of initiatives to boost the insurance industry:

- Increased FDI limit in insurance from 49% to 74%.

- Initial Public Offering (IPO) of LIC will be implemented in FY22, as part of the consolidation in the banking and insurance sector.

- Infusion of Rs. 3,000 crores into state-owned general insurance companies to improve the overall financial health of companies.

- In this year’s budget speech, Finance Minister announced that one general insurance company would be privatised.

- Accordingly, General Insurance Business (Nationalisation) Amendment Bill, 2021 is now passed by both houses. Its key feature is the removal of the requirement that the Central government should hold not less than 51 per cent of the equity capital in a specified insurer.

WHY PRIVATISE THE SECTOR?

- Bridge Insurance gap:

- India’s insurance penetration was 3.76%, while insurance density stood at USD 78 in FY20. This indicates that a large section of the population in India is uninsured.

- Reduce government’s financial burden:

- While the government has been repeatedly infusing capital, the financial position of public sector general insurers continues to remain weak. Privatisation will help augment the financial resources.

- Reduce risk:

- The solvency ratio of the public sector general insurance companies is lower than the regulatory minimum of 1.5, which affects the ability of insurance firms to settle claims. Privatising them will create more capital and thus improve the solvency ratio.

- Aligns with government’s policy:

- The effort is part of the government’s strategic disinvestment policy. According to the policy, in strategic sectors such as banking, insurance and financial services, there will be a bare minimum presence of public sector enterprises. The remaining public enterprises in strategic sectors will be privatised, merged or closed.

- Accelerate growth:

- The insurance sector in the country is growing at a speedy rate of 15-20%. Increasing private participation would help enhance accelerate this trend.

- Increase competition:

- The Covid pandemic has made people realise the importance of having adequate health coverage. More number of players could make the insurance market more competitive as they would vie to offer accessible and low-cost insurance products.

- Facilitate long term lending:

- By mobilizing domestic savings, insurance sector turns accumulated capital into productive investments. This in turn facilitates long-term funds for infrastructure development and the sustained growth of economy.

- Promote ease of doing business:

- General insurance levels are still very low in India, which indicates that industries bear a significant proportion of risks while doing business in India. By facilitating more insurers and insurance products, companies can reduce their risk of doing business.

CHALLENGES:

- Fear of premium hike and claim rejection:

- there is a likelihood that premiums will increase as a result of this consolidation and Private insurers will strenuously deny claims to increase their profit. Both these developments will have a chilling effect on the customers.

- Loss of economic backup for government:

- Government often relies on public insurance companies for stabilizing the economy, rescue ailing financial institutions or make investments in government undertakings. With privatisation, this possibility is lost.

- Eg: In August 2018, LIC was brought in by the government to rescue IDBI Bank Ltd.

- Fails to address existing issues:

- Privatisation does not address issues that have led to the inefficiencies in public general insurance companies.

- Eg: In 3 of the 4 public insurers, senior positions have remained vacant, which has hampered business and decision-making in them.

- Exposure to global financial variations:

- With more foreign private entities in the market, the sector will be more exposed to the global markets. This means that in case of a global economic crisis like the one in 2008, the insurance sector could be severely affected.

WAY FORWARD:

- Promote awareness:

- There is a need to promote awareness on financial literacy and importance of insurance among the common man.

- Revitalise existing insurers:

- While pushing ahead with privatisation, there should also be efforts to address issues such as vacancies within the present system.

- Develop capital market:

- To facilitate the entry of new players, the capital market, particularly the secondary market needs to be enlarged.

- Strengthen regulator:

- The IRDAI needs to be equipped to exercise its vigilance on matters concerning premium rates, claim settlement, regulation of unfair practices etc.

PRACTICE QUESTION:

Q. Discuss the significance of insurance sector in Indian economy. What measures have the government taken for its development?