Revamping SEZs in India

2022 FEB 15

Mains >

Economic Development > Indian Economy and issues > External sector

WHY IN NEWS:

- Finance minister Nirmala Sitharaman in her Budget speech 2021-23 said the Special Economic Zones (SEZ) Act will be replaced with a new legislation that would enable states to become partners in becoming development hubs.

SPECIAL ECONOMIC ZONES:

- “A SEZ is a designated duty-free enclave to be treated as foreign territory for the purpose of trade operations and duties and tariffs.”

- It is a geographical region that has economic laws that are more liberal than a country’s usual economic laws.

HISTORY:

- India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia's first EPZ set up in Kandla in 1965.

- With a view to overcome the shortcomings and to make SEZs an engine for economic growth, the Special Economic Zones (SEZs) Policy was announced in 2000.

- To instill confidence in investors and to impart stability to the SEZ regime, the Special Economic Zones Act, 2005 was enacted.

- As of 2021, there are 378 notified SEZs, out of which 270 are operational. They accounted for Rs. 5456 crores in export in 2020-21.

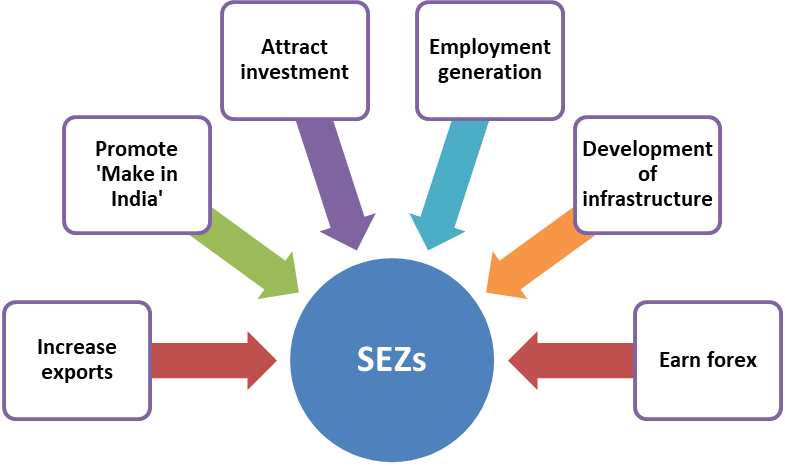

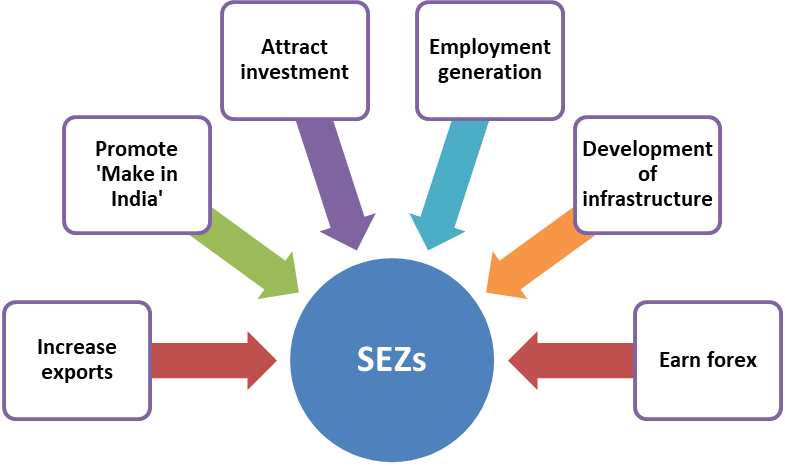

NEED OF SEZs:

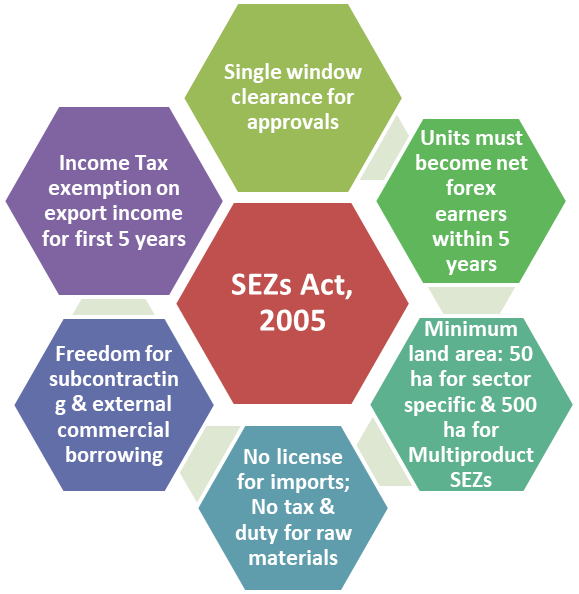

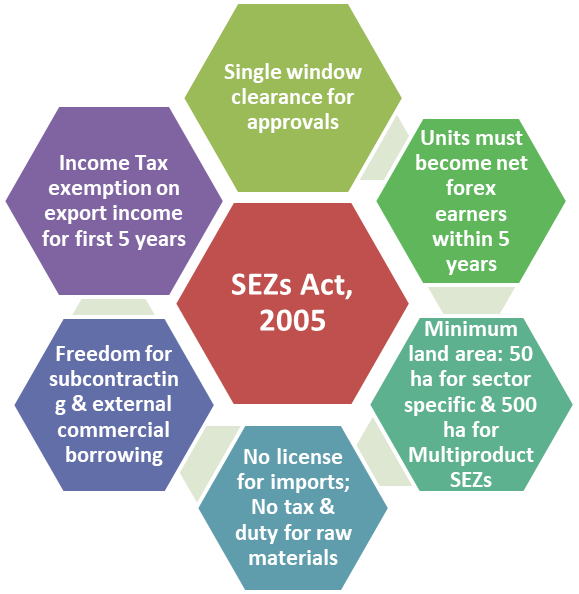

SPECIAL ECONOMIC ZONES ACT, 2005:

- The SEZ Rules provide for:

- Simplified procedures for development, operation and maintenance of SEZs and units within them.

- Single window clearance for setting up of an SEZ and a unit in a SEZ

- Simplified compliance procedures and documentation with an emphasis on self-certification

- The Act was amended in 2019 to pave way for trusts to set up units in SEZs.

ISSUES SURROUNDING INDIAN SEZs:

- Land related:

- Unutilized land:

- There is lack of flexibility to utilise land for different sectors within SEZs.

- Presently, 10 crore square feet of built-up space is idle in over 250 SEZs. In money terms, at Rs. 3,000 per square foot, that is Rs.30,000 crore of built-up area idle.

- Misuse of benefits:

- Developers have been misusing the SEZ policy by buying land in such zones and later de-notifying these for gaining from the price appreciation.

- Also, there have been several instances of companies operating in these zones misusing import tariff exemptions for tax evasion.

- Institutional:

- Multiple models:

- In India, there exist multiple models of economic zones, resulting in multiplicity of legislations and regulators.

- Eg: SEZ, coastal economic zone, Delhi-Mumbai Industrial Corridor, National Investment and Manufacturing Zone, food park and textile park.

- Constrains in ensuring credit:

- The lack of infrastructure status for SEZs, NPA crisis and the weakness of long-term lending institutions in India have been major hindrances to securing credit for SEZs.

- Legal hurdles:

- Judicial process in India is complex and long.

- Also, dispute resolution through arbitration is still in the nascent stage in India. This affects the ease of doing business in the country.

- Political:

- Influence of vested interests:

- Site selection for SEZs has been guided by self-serving agendas rather than development.

- Local politicians often influence bureaucrats to secure land for personal or political gains.

- As such, sites for SEZs are selected based on real estate speculation rather than the economic potential of a region.

- Lack of support from state government:

- Several state governments are lagging in promoting ease of doing business, through faster land acquisition, developing effective single-window system for clearances and resolving contracts.

- Financial:

- Restrictions on domestic trade:

- SEZ products in local markets are treated as imports. Also, SEZ units are not allowed to do “job work” for Domestic Tariff Area (DTA) units.

- Unpredictable tax regime:

- There has been uncertainty regarding the tax regime in India. Taxes are changed without prior consultation with the industry.

- Ex: While SEZs were first described as duty free enclaves, they were later brought under the purview of Minimum Alternative Tax (MAT).

- Others:

- Dominance of service sector industries:

- About 70% of the country’s SEZs cater to IT/ITES sector and only 9.6% cater to the multi-product manufacturing sector.

- Hence, SEZs contribution to manufacturing sector remains low.

- International competition:

- In the past few years, many countries like Vietnam and Thailand have tweaked their policies to attract investment into their SEZs.

- Ex: SEZs in Indonesia enjoy Income Tax exemption for 12 years. Consequently, Indian SEZs have lost some of their competitive advantages.

WHY NEW LEGISLATION?

- Enable optimum utilisation of all the vacant land and buildings in SEZs and industrial parks:

- As the infrastructure needs to be used to the maximum, the government is looking to convert SEZs into a plug-and-play industrial park ecosystem.

- To equip domestic industries to embrace competition:

- Since India was going to sign a host of ‘very deep’ FTAs with advanced economies like Australia, the UK and the EU >> exporters in India must shape up.

- Formulate separate rules and procedures for service SEZs:

- Services companies appear to have been able to use SEZs more effectively than manufacturing companies.

- To revive business from pandemic shock:

- The pandemic has hit the performance of several businesses in SEZs.

- Enabling SEZs firms to sell in domestic market:

- New legislations can incorporate provisions that allow SEZ firms to sell goods in the domestic market by paying just an ‘equalisation levy’.

- This levy would be smaller than the regular customs duty that SEZ units are currently mandated to pay while supplying to the domestic tariff area.

- A lower duty would, no doubt, help boost sales. But it will neutralise the advantages that SEZs enjoy, being specifically delineated duty-free enclaves, vis-à-vis domestic manufacturers to ensure a level-playing field.

- To focus on labour-intensive exports:

- With a focus on tier-2 and tier-3 cities in the hinterland to establish business units>> we are able to cash in on labour costs and the relatively lower cost of living.

- If the new legislation is framed with these considerations in mind, labour-intensive exports in apparel, footwear, furniture can be encouraged in a big way.

BABA KALYANI COMMITTEE:

- Ministry of Commerce and Industry constituted a committee headed by Mr. Baba Kalyani in 2018 to study the existing SEZ policy of India and prepare strategic policy measures for their development.

- Some of its key recommendations were:

- Rename SEZs as 3Es- Employment and Economic Enclave, with the objective of moving from island of exports to catalyst of economic and employment growth.

- Formulate separate rules and procedures for manufacturing and service SEZs.

- Infrastructure status for SEZs to improve access to finance and enable long term borrowing.

- Promote MSME participation in 3Es and enable manufacturing enabling service players to locate in 3E.

- Dispute resolution through arbitration and commercial courts.

- Align the policy framework to avoid competition among similar schemes of industrial parks, export-oriented units, SEZ, national investment and manufacturing zones etc.

- Extend Sunset Clause and retain tax or duty benefits.

- Ease of doing business by simpler entry and exit processes

WAY FORWARD:

- Impact assessment:

- Government should undertake comprehensive social, environmental and economic impact studies before granting approval for SEZs.

- Optimal utilisation of land:

- Allowing flexibility of land use and removing sector-specific constraints can help revive the SEZs.

- There should be adequate compensation on land acquisitions and provisions for return the unutilized land back to farmers.

- Rationalize SEZ models:

- A uniform model for economic enclaves should be established and overlapping laws must be removed.

- In this regard, the NITI Aayog has been developing a master plan for industrial clusters.

- Predictable policy support:

- Taxation regime and incentives given to SEZs in India should be more predictable and in line with what is offered by competing countries in Asia.

- Performance-measuring mechanisms:

- Performance review mechanisms should be put in place so that the promoters can be held accountable and prevent tax evasions.

- Reforms in labour laws and reduced protectionism:

- Changes to SEZs need to be accompanied by better labour laws and lower levels of protectionism.

CASE STUDY:

- Shenzhen SEZ, China

- Once a small, ancient village, the modern city of Shenzhen has evolved into a state-of-the-art tech and financial global epicenter.

- In 1980, the Chinese govt designated the town as one of four SEZs. It received special tax benefits and preferential treatment for foreign investment. Shenzhen grew exponentially and its GDP per capita grew 24,569% from 1978 to 2014.

- Its success is attributed to factors such as the geographical proximity to ports, strong domestic market, large size, decentralized management and investor friendly policies.

PRACTICE QUESTION:

Q. “Changes to SEZ Act need to be accompanied by better labour laws and lower levels of protectionism”. Discuss