Securities and Exchange Board of India (SEBI)

2023 FEB 27

Mains >

Polity > Institutions/Bodies > Statutory Bodies

IN NEWS:

- In the recent Adani-Hindenburg episode, failure on part of SEBI to check alleged stock price manipulation has been criticised.

SECURITIES AND EXCHANGE BOARD OF INDIA (SEBI):

- SEBI is a statutory body and a market regulator, which controls the securities market in India.

- Initially, SEBI was a non-statutory body. Following the passage of the SEBI Act by Parliament in 1992, it was given autonomous and statutory powers.

- The basic function of SEBI is to protect the interests of investors in securities and to promote and regulate the securities market.

- SEBI is run by its board of members. The board consists of a chairman and several other whole time and part time members:

- The chairman is nominated by the union government.

- The others include two members from the finance ministry, one member from Reserve Bank of India and five other members are also nominated by the Centre.

- The headquarters of SEBI is situated in Mumbai and the regional offices are located in Ahmedabad, Kolkata, Chennai and Delhi.

POWERS AND FUNCTIONS:

- SEBI caters to the needs of three parties operating in the Indian Capital Market. These three participants are mentioned below:

- Issuers of the Securities:

- SEBI ensures that the issuance of Initial Public Offerings (IPOs) and Follow-up Public Offers (FPOs) can take place in a healthy and transparent way.

- Protects the Interests of Traders & Investors:

- SEBI is responsible for safeguarding traders’ interests and ensuring that the investors do not become victims of any stock market fraud or manipulation.

- Financial Intermediaries:

- SEBI acts as a mediator in the stock market to ensure that all the market transactions take place in a secure and smooth manner. It registers and monitors financial intermediaries, such as broker, sub-broker, NBFCs etc.

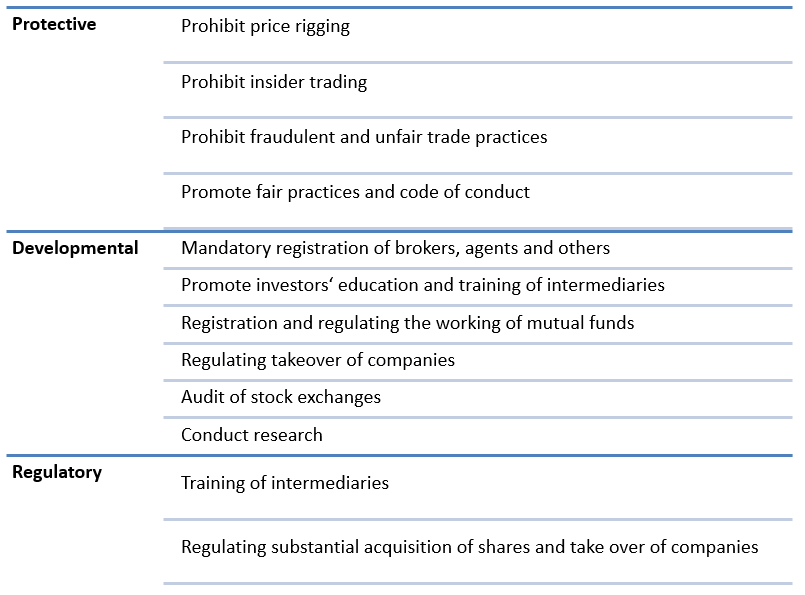

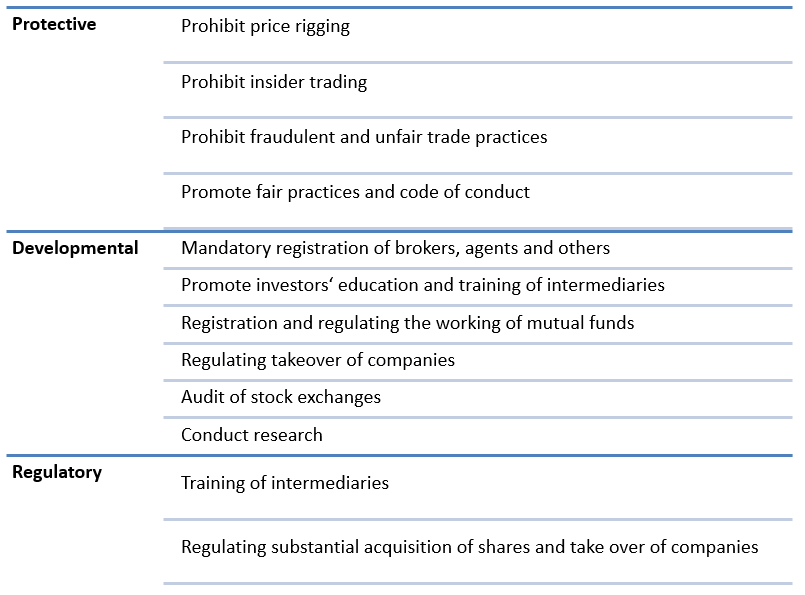

- SEBI has the following three powers:

- Quasi-Judicial:

- SEBI can conduct hearings and pass ruling judgements in cases of unethical and fraudulent trade practices.

- Quasi-Legislative:

- Powers under this segment allow SEBI to draft rules and regulations for the protection of the interests of the investor.

- It also approves by-laws of stock exchanges and can ask stock exchanges to amend their by-laws.

- Quasi-Executive:

- SEBI is authorized to file a case against anyone who violates its rules and regulation.

- It is empowered to inspect account books and other documents if it finds traces of any suspicious activity.

- The orders and directions issued by the Sebi in exercise of its power could be first challenged in the Securities Appellate Tribunal (SAT) and then in the Supreme Court of India.

CRITICISM OF SEBI:

- Regulatory failures:

- In recent times, there have been instances where the actions, or absence thereof, of the regulator have come under scrutiny for failure to identify frauds and unethical practices.

-

- Eg: In the NSE co-location scam, the tardiness of the SEBI in passing an order has been questioned.

- Ineffective enforcement:

- SEBI has made various rules and regulations. But it has been blamed for excessive focus on regulation of market conduct and lesser emphasis on prudential regulation.

- Questionable independence:

- According to the SEBI Act, the market regulator is bound by the Centre on questions of policy. So, while SEBI may not be consulting the Centre on all policy decisions in practice, the provision does undermine the regulator’s independence.

- Top positions in SEBI are political appointments. But there is absence of clear rules on the processes to be followed in candidate selection.

- Insulated from direct public accountability:

- The SEBI has been blamed for creating an atmosphere of low transparency since it was not accountable to a governing authority in matters concerning operational, supervisory or other functions.

- Hindering ease of doing business:

- Supreme court recently observed that initiating frivolous criminal actions against large corporations would give rise to adverse economic consequences for the country in the long run.

- Underdeveloped market:

- Despite numerous attempts, SEBI has not been successful in developing a strong capital debt market or to attract sufficient liquidity.

- Emerging technologies:

- Technology is changing fast and has changed the way the market operates. However, many of the existing regulations are not up-to-date and SEBI is not sufficiently equipped to regulate them.

WAY FORWARD:

- Consultative approach:

- Prior consultation with the market and a system of review of regulations needs to be established.

- Clear rules on recruitment:

- Central government should clarify the criteria to be followed during selection and the role of Centre’s nominees to the SEBI Board.

- Promote transparency:

- Opaqueness is antithetical to transparency and institutions like SEBI ought to adopt procedures that further the democratic principles of transparency and accountability.

- Establish self-regulatory organisations:

- Like its peers (regulators of US and UK), SEBI needs to established self-regulatory organisations. SRO can focus on routine decisions and SEBI can work on more important issues.

PRACTICE QUESTION:

Q. The Securities and Exchange Board of India (SEBI) plays an important role in protecting investors and establishing an equitable, efficient and transparent securities market. Elaborate.