Direct Benefit Transfer (DBT)

2022 DEC 8

Mains >

Economic Development > Indian Economy and issues > Direct benefit transfer

IN NEWS:

- Recently, several economists have advocated the conversion of all agricultural subsidies into direct income support for farmers.

- Also, the International Monetary Fund (IMF) has recently lauded India's Direct Benefit Transfer scheme as a "logistical marvel," considering the sheer size of the country.

ABOUT DIRECT BENEFIT TRANSFER (DBT):

- Direct Benefit Transfer (DBT) is Government’s major reform initiative to reengineer the existing delivery processes, ensuring better and timely delivery of benefits using Information & Communication Technology (ICT) by transferring benefits into the bank/postal accounts, preferably Aadhaar seeded, of accurately targeted beneficiaries, as well as in-kind transfers from Government to individual beneficiaries.

- Types of Schemes Covered in DBT:

- Cash Transfer:

- Government directly transfers the cash benefits to the individual beneficiaries.

- The cash transfer is undertaken through:

- Direct transfer to beneficiary account by Union Government;

- Transfer through State Treasury Account;

- Cash transfer by implementing agencies of the Government.

- For example, PAHAL for LPG subsidy (Ministry of Petroleum & Natural Gas), MGNREGA payments (Ministry of Rural Development).

- In-Kind benefit transfer:

- Government offers benefits in kind to the beneficiaries either directly or through their implementing agencies.

- Government or its agent incurs expenditure to procure goods & distribute it to the targeted beneficiaries for free or at subsidized rates.

- Eg: Public Distribution System , Mid-Day Meals Scheme

- Other transfers:

- DBT scheme also transfers funds & subsidies to several non-governmental functionaries that help implement the government policies/schemes till the last mile.

- They are not beneficiaries but are given training, wages & incentives to serve the beneficiaries.

- Eg: ASHA workers under NHM, Anganwadi workers under ICDS, Teachers in aided schools, Sanitation staff in ULBs are not beneficiaries themselves but they are given wages, training & incentives for their service to the beneficiaries/community.

- Rollout of DBT:

- 1st January, 2013 : DBT Mission was created in the Planning Commission to act as the nodal point for the implementation of the DBT programmes.

- July,2013- Sep,2015: The Mission was transferred to the Department of Expenditure

- Sep, 2015 - 2022(Present) : To give more impetus, DBT Mission has been placed in Cabinet Secretariat.

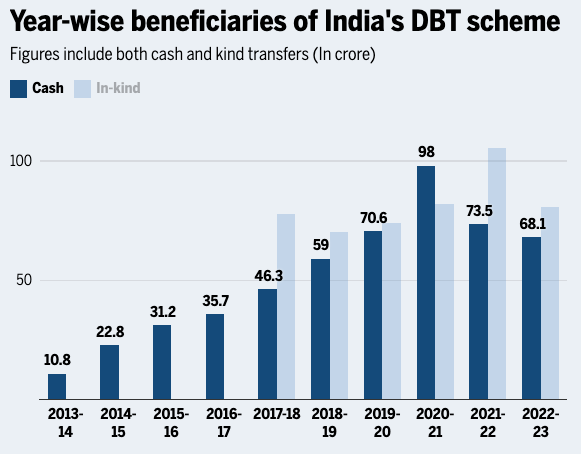

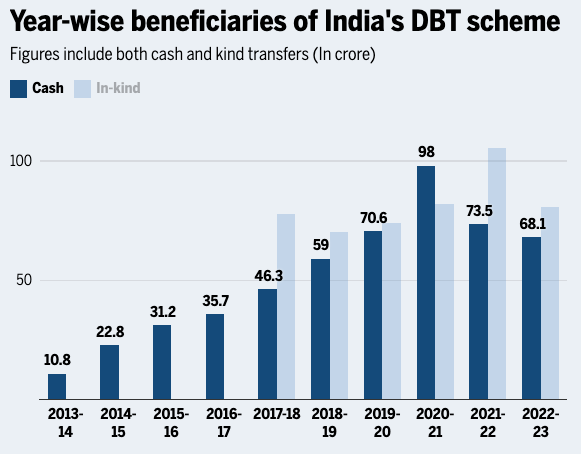

- Present status of DBT:

- DBT has been implemented in 310 schemes spanning 53 ministries and departments.

- Total Direct Benefit Transfer of 3.34 Lakh crore done in FY 2022-23

-------------------

BENEFITS:

- Accurate targeting:

- Accurate targeting of genuine and deserving beneficiaries by removal of duplicate/ fake beneficiaries.

- For example, 35,000 families drawing kerosene subsidies in spite of having LPG connections were weeded out in Chandigarh.

- Timely delivery of benefits to people:

- For instance, time required to transfer benefits of Pradhan Mantri Matru Vandana Yojana brought down to 30 days.

- Enhance financial inclusion:

- For example, 7,00,000 Janani Suraksha Yojana mother beneficiaries have opened bank accounts in Bihar.

- Cumulative savings:

- Estimated cumulative savings/ benefits of around 2.2 Lakh crore (up to March 2021) through plugging of leakages & reduction in structural expenditures;

- Efficiency and effectiveness in governance:

- Bring efficiency, effectiveness in governance and infuse confidence of citizens in the Government.

- Eg- Disbursement of social security pension amount at the doorsteps of the beneficiaries in Krishna District (AP) with the help of Business correspondents

- Enhance transparency & accountability:

- Enhance transparency and accountability in the government system as Public Distribution System (PDS) services are provided to beneficiaries based on biometric authentication.

- Data led governance:

- Data led governance by making use of the data generated from the DBT system.

- Eg: Nutrition and Health Tracking System in Andhra Pradesh

- Digitalisation:

- DBT is assisting India in accelerating its transition toward a cashless economy.

CHALLENGES:

- Lack of awareness :

- Several beneficiaries were not aware of their entitlements and missed out on benefits.

- Deficits in infrastructure:

- Especially rural & tribal areas don’t have adequate banking facilities and road connectivity

- For instance, one ATM available on an average for ten villages of rural India.

- Lack of financial literacy:

- Only 27% of Indian adults and 24% of women meet the minimum level of financial literacy as defined by the RBI.

- Coverage of Beneficiaries:

- Various DBT schemes, including the PM-Kisan, Telangana government’s Rythu Bandhu and Andhra Pradesh’s YSR Rythu Bharosa do not reach tenant farmers, i.e., those who undertake cultivation on leased land.

- Lack of Accessibility:

- Lack of accessibility to enrolment points and unavailability or erratic availability of officials/operators responsible for enrolment.

- Low level of digital literacy:

- Low level of digital literacy among people living in rural areas

- Eg: Recipients make several journeys to banks to check on & withdraw funds. This resulted in significant opportunity costs for the rural poor.

- Internet connectivity issues:

- Internet connectivity issues & other technical difficulties like biometric failure plague bank correspondents.

- Disruption in the process:

- Disruption in the process in terms of receiving money in their bank accounts through DBT.

- Reasons for disruptions could be spelling errors in Aadhaar details, pending KYC, frozen or inactive bank accounts, mismatch in Aadhaar and bank account details.

- Delay in payment:

- Money not being deposited in accounts on time.

- For instance, MGNREGA wage payments were delayed for 71 per cent of the transactions beyond the mandated 7 days.

- Cash transfers are not inflation indexed:

- Cash transfers are not inflation-indexed, as a result of which the transferred monetary value is less than the market value of the goods to be purchased.

- Time-consuming:

- Going to the bank to withdraw money and then purchasing goods takes a longer time than going to the ration shop to obtain their fortnightly rations.

- Exploitation by banks:

- Banks were discovered to be adjusting the money beneficiaries received with any outstanding loans they had, rendering them unable to buy the goods & services.

- Inadequate grievance redressal mechanisms:

- Inadequate grievance redressal mechanisms to resolve grievances like non-receipt of funds or transaction failure.

- Between April-June 2020 ~1.47% of 830 million (i.e. ~12 million) transactions failed

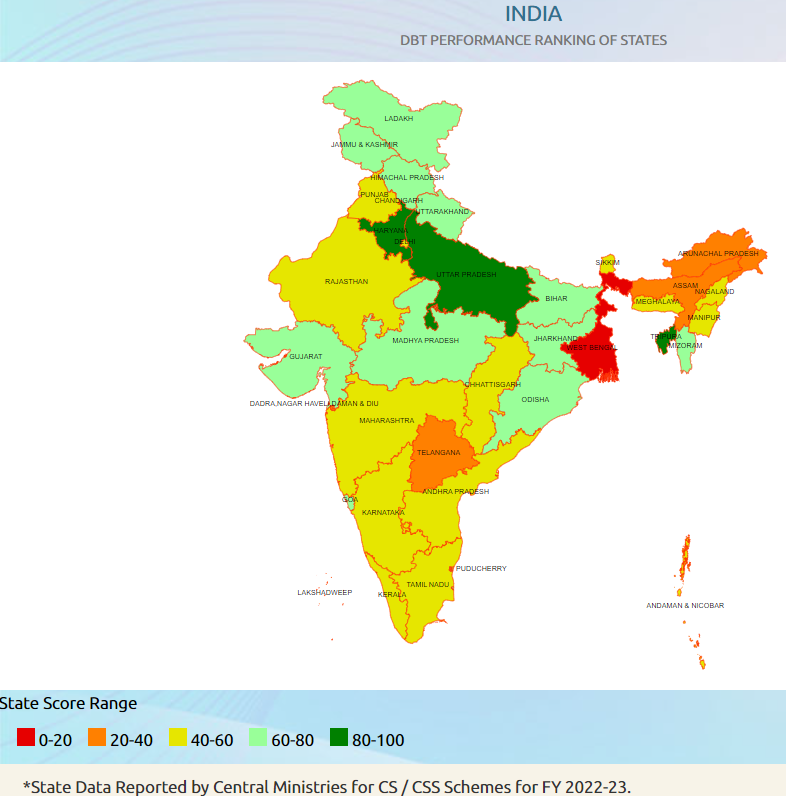

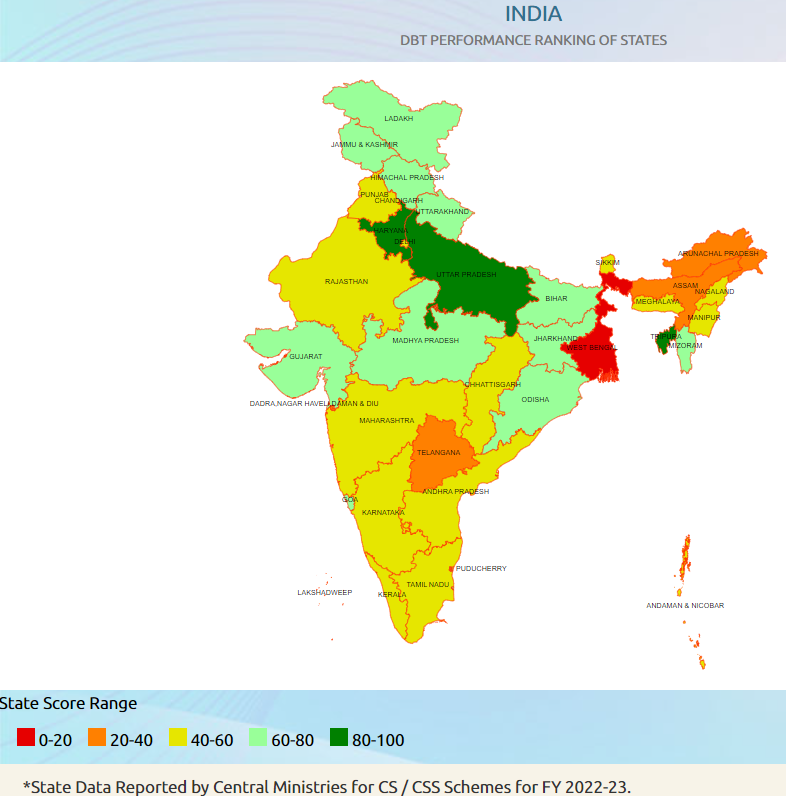

- Regional disparities in DBT implementation:

- West Bengal , Arunachal Pradesh and Assam lagging behind in DBT performance ranking of States

-------------------

WAY FORWARD:

- Augment the availability of enrolment points for citizens across schemes specifically in rural and peri-urban areas.

- Increase Accessibility in rural areas : Increased number Bank branches in rural regions along with improved physical connectivity to banking centers.

- Ensure adequate compensation for BCs & Allow BC agents to ‘white-label’ their services to multiple banks, which means BCs can sell products from multiple banks to a customer. This will help in enhancing reach and last-mile delivery.

- Adopt a strategic approach to Awareness, Communication, and Outreach (ACO) for G2P (Government to Person) programs. Dedicated campaigns keeping in mind low level of literacy among beneficiaries.

- Choice-based DBT system until resolving bottlenecks: People could be given the option of switching to cash transfers or remaining with subsidized kind transfers(eg:food) to protect the most vulnerable against suboptimal implementation.

- Timely transfer of money to beneficiaries: to ensure basic minimum needs of the poor.

- More pilot initiatives with a focus on beneficiary convenience rather than government cost savings. The system should address common consumer risks such as unreliable network or service, complex user interfaces & inadequate payment processes that force recipients to ask others for assistance and share personal information.

- A dynamic database (updated on real-time basis) of social safety programmes that are categorized according to families and segments, such as occupation, gender, condition, and income level should be maintained.

- Doorstep delivery of cash benefits for providing a safety net to those who cannot travel to access points (like the elderly, differently-abled & women customers constrained by safety concerns or regressive social norms)

- Promote the use of digital payments:This will allow beneficiaries to use the benefit amount without visiting a withdrawal point, which would save them time and cost.

- A common grievance redress cell with a simple procedure for all DBT schemes across tiers — State, district, and block to help the beneficiaries resolve their issues immediately

- Beneficiaries should be given the opportunity to provide feedback on the manner in which benefits are distributed. This would enable the Government to take corrective steps in case of any gaps.

- Technology solutions should be developed to identify, monitor and rectify issues like transaction failure or delays.

PRACTICE QUESTION:

Q. In what way could replacement of price subsidy with Direct Benefit Transfer (DBT) change the scenario of subsidies in India? Discuss (PYQ GS-3 (2015))