Mains > Polity > Election > Electoral reforms

SYLLABUS

GS 2 > Polity > Election > Electoral reforms

REFERENCE NEWS

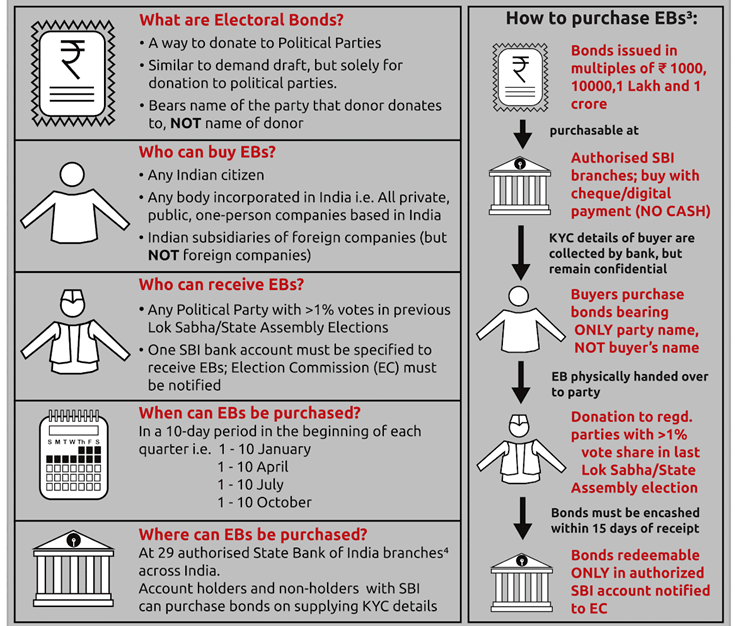

ELECTORAL BONDS

FEATURES OF ELECTORAL BONDS:

BENEFITS OF ELECTORAL BOND SCHEME:

CONCERNS OVER ELECTORAL BOND:

SC Verdict Issue 1: Does the electoral bond scheme violate the Right to Information under Art 19(1)(a)? SC Verdict- The electoral bonds scheme violates the right to information under Article 19(1)(a), which guarantees the freedom of speech and expression. SC Rationale- The restrictions on the right to information in the electoral Bonds scheme fails the court’s proportionality test, laid down in the KS Puttaswamy case verdict over the right to privacy. An infringement of the right to information is not proportionally justified to curb black money in electoral financing. Issue 2: Is curbing circulation of black money in electoral financing a legitimate reason to restrict the right to information (RTI)? SC Verdict- RTI can only be restricted based on Article 19(2), which mentions the reasonable restrictions to freedom of speech and expression. The reasonable restrictions do not include curbing black money as a restriction under Art 19 (2) SC Rationale- There is deep association between money and politics. Money enhances access to legislators and raises the legitimate possibility of quid pro quo or mutually beneficial arrangements such as favourable policy changes. Economic inequality contributes to political inequality. Hence, Information on the funding of political parties is essential for voting. Issue 3: Whether the right to privacy of donor is a valid ground for the infringement of RTI SC Verdict- The court held that the right to privacy of political affiliation does not extend to those corporate contributions, which may be made to influence policies. It only extends to contributions made as a genuine form of political support. SC Rationale- Huge contributions made by corporations should not be allowed to conceal the reason for financial contributions made by other sections of the population. Issue 4: Whether unlimited political contributions by companies are unconstitutional SC Verdict- The court held that the amended section 182 (3) of the companies act 2013 as unconstitutional, as it is violative of Art 14. This amended section permitted unlimited political contributions by companies. SC Rationale- Contributions made by companies are purely business transactions made with the intent of securing benefits in return. The ability of companies to influence the political process through contributions is much higher compared to individuals. |

WAY FORWARD:

PRACTICE QUESTION:

Q. “The electoral bond has its merits, but the present structure of the scheme is not conducive to clean up the political funding process in India”. Discuss.(15M,250W)