Foreign Contribution (Regulation) Amendment Act, 2020

2021 NOV 16

Mains >

Social justice > Development Processes & Industry > NGOs

IN NEWS:

- The Supreme Court has reserved its judgment on petitions challenging the validity of amendments introduced in 2020 to the Foreign Contribution (Regulation) Act, 2010, aimed at tightening the curbs on NGOs allowed to receive foreign funds.

- This comes a month after the Government has told the Supreme Court that NGOs have no fundamental right to receive “unbridled foreign contributions” without regulations.

FOREIGN CONTRIBUTION REGULATION ACT, 2010:

- Objective:

- It was enacted to ensure that foreign contribution is utilized for genuine activities without compromising on concerns for National Security. It replaced the Foreign Contribution (Regulation) Act 1976.

- “Foreign Contribution” is defined by FCRA as a donation, delivery or transfer made by a foreign source of:

- any article, the value of which ought not to exceed Rs. 25,000.

- Currency, foreign or Indian.

- Foreign securities including all foreign debentures, bonds, shares, stocks and similar instruments of credit. Any income or interest generated from such contributions is also treated as a foreign contribution under the FCRA.

- Prohibition:

- The act provides a list of individuals prohibited from accepting any type of foreign contribution, such as:

- Judges, government servants or employees of any public sector corporation

- Candidates for election, members of any Legislature, political parties or their office-bearers

- Organisations of political nature

- Cartoonists, editors, or publishers of a registered newspaper

- Association/group engaged in the production or broadcast of audio or audio-visual news or current affairs programmes through any electronic mode.

- Permissions:

- Permits only NGOs having a definite cultural, economic, educational, religious or social programme to accept foreign contribution, that too with the approval of the Government of India, through the Ministry of Home Affairs.

- Registration:

- In order to be eligible to receive the foreign contributions, an organization may seek prior approval either each time the entity is to receive contributions or by obtaining a one-time long-term registration, which is valid for a period of 5 years.

- Managing contributions:

- Upon obtaining registration/prior permission, the organization is required to open and maintain a bank account exclusively for the receipt and utilization of foreign contributions under FCRA. It is also required to submit the annual returns to the Central Government.

- Restrictions on end use:

- The contributions must be used only for the purpose for which it is received. Further, they must not use more than 50% of the contribution for meeting administrative expenses.

- Authority:

- The central government has the power to prohibit any persons or organisations from accepting foreign contribution or hospitality. It can conduct separate audits for FCRA certified organisations and has the power of search and seizure.

- Punishment:

- The MHA can cancel the registration of an organisation, making them ineligible for registration or grant of ‘prior permission’ for three years from the date of cancellation.

- Exemptions:

- Funding from the United Nations, the World Bank and the International Monetary Fund is exempt from the requirements of the act.

THE FOREIGN CONTRIBUTION (REGULATION) AMENDMENT ACT, 2020:

- Prohibition for public servants:

- The 2020 amendment bars public servants from receiving FCRA funds.

- Aadhaar for registration:

- Any person seeking prior permission, registration or renewal of registration must provide the Aadhaar number.

- In case of a foreigner, they must provide a copy of the passport or the Overseas Citizen of India card for identification.

- FCRA account:

- Foreign contribution must be received only in an FCRA account in such branch of the State Bank of India, New Delhi, as notified by the central government.

- Transfer of foreign contribution:

- Before the amendment, foreign contribution could be transferred to a person who is also registered to accept foreign contribution.

- The 2020 amendment amends this to prohibit the transfer of foreign contribution to any other person.

- Reduction in use of foreign contribution for administrative purposes:

- The 2020 amendment reduces the limit to 20% from the existing 50%.

- Restriction in utilisation of foreign contribution:

- The government may restrict usage of unutilised foreign contribution based on a summary inquiry, and pending any further inquiry.

- Renewal of license:

- Government may conduct an inquiry before renewing the certificate to ensure that the person making the application is not fictitious, not been prosecuted for creating communal tension or misutilisation of funds, among others conditions.

- Surrender of certificate:

- Central government can permit a person to surrender their registration certificate. The management of its foreign contribution has been vested in an authority prescribed by the government.

- Suspension of registration:

- Under the 2010 Act, the government may suspend the registration of a person for a period not exceeding 180 days. The 2020 amendment adds that such suspension may be extended up to an additional 180 days.

WHY REGULATE FOREIGN DONATIONS FOR NGOs?

- Concerns over national security:

- As pointed out by an Intelligence Bureau Report published in 2014, many NGOs, with support from international donors, were disrupting the developmental activities and even funding anti-national activities, thus endangering Indian interests.

- Prevent money laundering:

- Because of the positive public perception and Income tax benefits available to them, Indian NGOs are targeted for money laundering activities. As a result, there is a growing tribe of NGOs called briefcase NGOs which exists only on paper and handle vast funds for laundering.

- Prevent opaque operations:

- In 2017, the CBI has informed that less than 10 per cent of registered NGOs filed their audited accounts. Also, NGOs, except those substantially financed by the government, are outside the purview of the RTI Act. Hence, there should be measures to ensure transparency in the operation of NGOs.

- Reduce corruption:

- The operations or sources of funding of most NGOs are not available in the public domain. This lack of transparency has resulted in abject corruption and misappropriation of funds among many Indian NGOs.

CRITICISM OVER REGULATIONS:

- Multiplicity of laws:

- Many of the objectives of the Act are met by other laws in force such as the Unlawful Activities Prevention Act, 1967, the Prevention of Money Laundering Act, 2002, the Foreign Exchange Management Act, 1999, and the Income Tax Act, 1961.

- Wide discretionary powers for government:

- The Act prohibits all organisations of a “political nature” from receiving any foreign contribution. It gives the central government powers to classify any organisation in this category but does not provide any guidelines to define organisations of a “political nature.” Hence, it can be used as a weapon to suppress criticism.

- Limits functioning of NGOs:

- Many NGOs have sector specific expertise and undertake collaborative research scientific research, involving academic institutions, think-tanks and grassroots organisations. The amendment limits the use of foreign funds for administrative purposes, which could severely impact these functions.

- Operational burden:

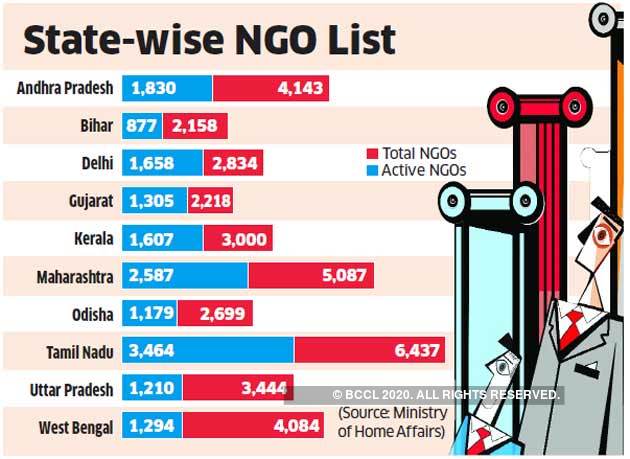

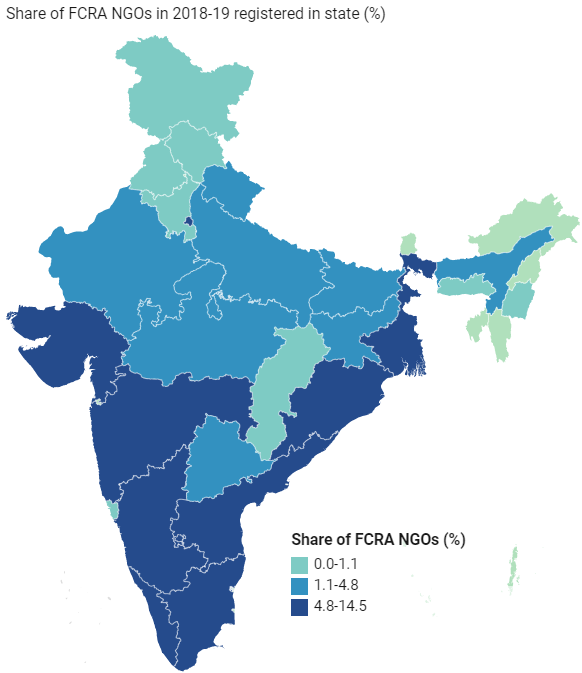

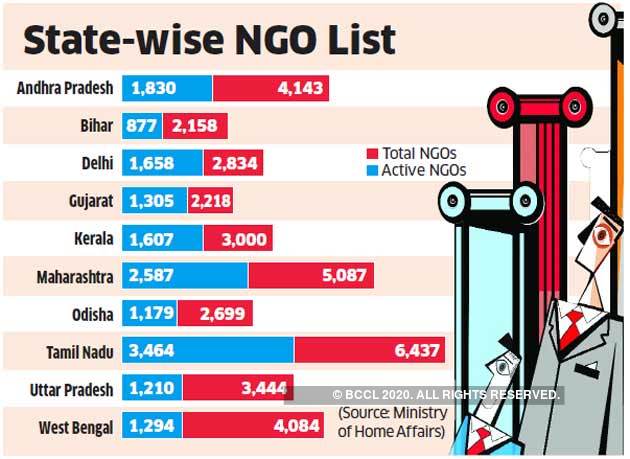

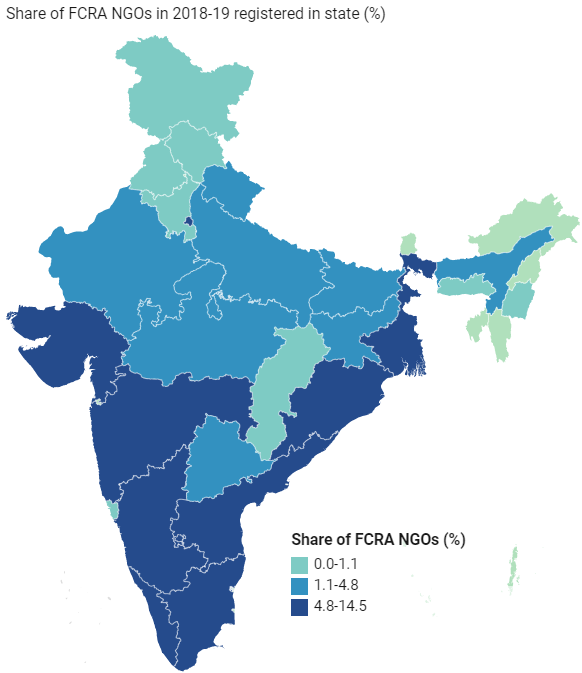

- 93% of FCRA NGOs are registered outside Delhi, and will now have to open a bank account in the capital. This creates added difficulty in the functioning of NGOs.

- Affects grassroot organisations:

- Large NGOs collaborate with smaller NGOs at the grassroots level to do the real work. These grassroot organisations and its workers rely on the resources transferred from larger organisations. But the amendment restrict this, which could mean the end for small NGOs.

- Violates international standards:

- In 2016, UN special rapporteurs on human rights had called to repeal the FCRA, citing that it is increasingly being used to obstruct civil society’s access to foreign funding, and fails to comply with international human rights norms and standards. The new amendments make no efforts to rectify this issue.

- Arbitrary exemption for political parties:

- Through Finance Act 2016 and 2018, the government had amended the FCRA to make it easier for parties to accept foreign funds. This benefitted political parties that were held guilty by the Delhi High Court for receiving foreign funds from a U.K.-based company.

- Vague terms:

- There are a number of terms in the 2020 amendment including, “foreign source,” “foreign hospitality,” and “speculative business” that either lack clarity or are not defined.

- Existing financial constrains:

- A large share of CSR funding for 2020 has already gone towards the PM CARES Fund or other COVID-19 relief efforts. While this is understandable, an unintended consequence has been a squeeze in funding available for NGOs, thereby stifling the sector.

WAY FORWARD:

- The pressing issue in question is of transparency. NGOs should develop mechanisms to ensure transparency and accountability and regain their lost credibility in terms of their sources of funding.

- The government should alleviate the fear of shutting down of grassroot NGO operations, particularly at a pandemic time. The faster establishment of social stock exchange can help in this regard.

- The degeneration of NGOs is a recent phenomenon and it should not deflect us from the worthwhile contribution it has made, particularly in humanitarian work. They play the vital role of an effective interface between the government and the community.

PRACTICE QUESTION:

Q. Effective regulation of voluntary organisations is essential in tackling the issue of money laundering in India. Discuss in the light of recent amendments to the Foreign Contribution Regulation Act?