PETROLEUM UNDER GST?

2021 MAY 24

Mains >

Economic Development > Indian Economy and issues > Miscellaneous

IN NEWS:

- The issue of bringing petrol and diesel under the GST regime is repeatedly being raked up.

GOODS AND SERVICES TAX:

- The Goods & Services Tax (GST) in India is a comprehensive, multi-stage, destination-based indirect tax that is levied on every value addition.

- The tax system came into effect from 1 July, 2017 through the implementation of the One Hundred and First Amendment of the Constitution.

- Under GST, the Central Government will levy and collect Central GST (CGST) and the State will levy and collect State GST (SGST) on intra-state supply of goods or services.

- The Centre will also levy and collect Integrated GST (IGST) on inter-state supply of goods or services.

- A significant feature of GST is the input tax credit, which mitigates double taxation. Input tax credit means that when a manufacturer pays the tax on their output, they can deduct the tax previously paid on the input they purchased.

- When the GST was introduced, five commodities - crude oil, natural gas, petrol, diesel, and aviation turbine were kept out of its purview given the revenue dependence of the central and state governments on this sector.

HOW PETROLEUM IS CURRENTLY PRICED:

- India imports nearly 80% of its crude oil requirements from abroad. The Indian basket of the crude price is a weighted average price of Brent Crude, Oman Crude, Dubai Crude.

- India follows the dynamic fuel pricing system. Fuel prices are revised daily, and the government has no control over pricing.

- However, the price of petroleum products is not determined by the actual costs incurred by PSU refiners on crude oil sourcing, refining and marketing. Rather, a formula called Trade Parity Price (TPP) is used.

- The TPP is determined based on prices for petroleum products (Viz. Petrol and Diesel) prevailing in the international market, assuming that 80 per cent of the petrol and diesel is imported and 20 per cent is exported.

- The government then imposes taxes on the base price.

- The central government has the power to tax the production of petroleum products, while states have the power to tax their sale.

- Central government imposes excise duty and value added tax.

- States choose to levy a combination of ad valorem tax, cess, extra VAT/surcharge based on their needs.

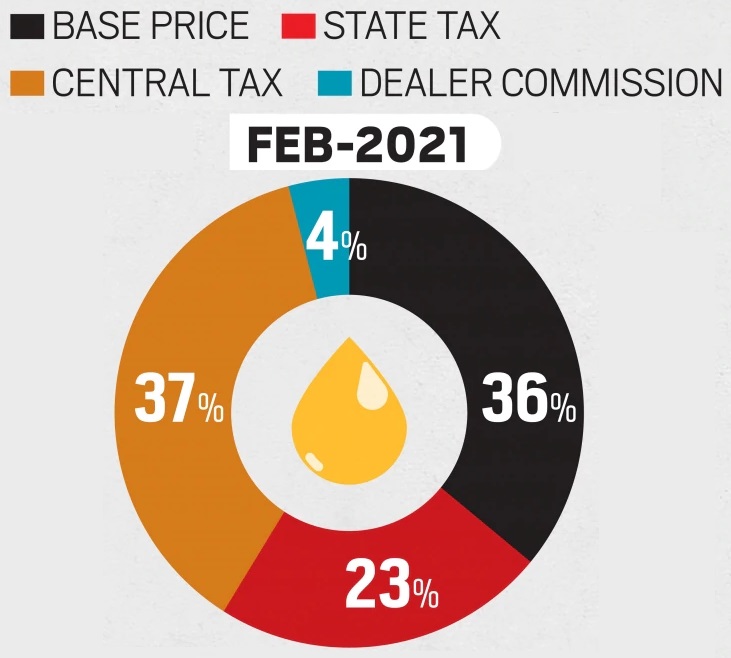

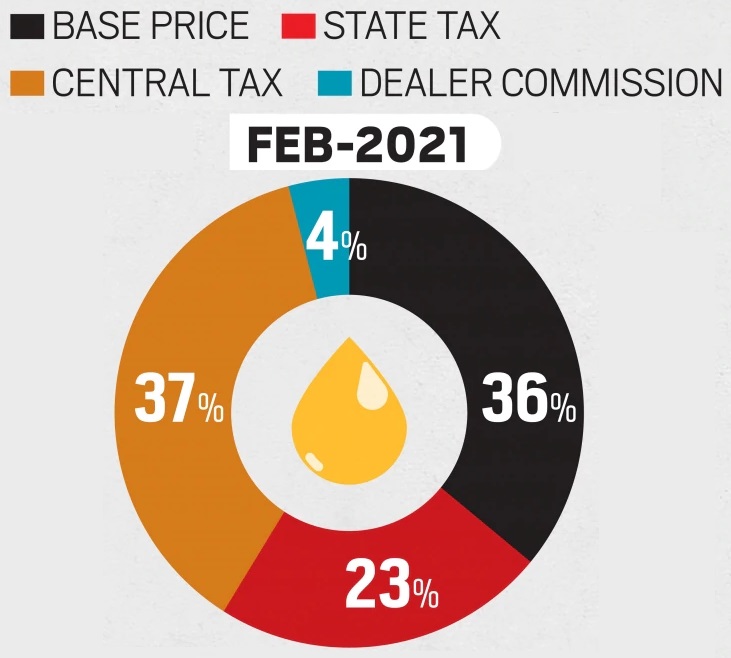

- The final price includes the base price, freight charges, government taxes and dealer’s commission.

BENEFITS OF PETROLEUM UNDER GST:

- Reduces final cost:

- According to a report of SBI economist, petrol prices can fall to as much as Rs 75 per litre and diesel to Rs 68 per litre if they are brought under the current GST regime.

- Benefits Petroleum Industry:

- With GST, the industry can avail the benefits of input tax credit. This, in turn, results in lower product prices and encourages the industry to invest.

- Reduce inflation:

- Oil is a major input in the economy. Hence, a fall in the price of petroleum products can reduce inflationary trends.

- Promote cleaner fuels:

- Lower prices can promote the sale of premium petrol and diesel, which are relatively clean fossil fuels. This, in turn, reduces the net emission from automobiles.

- Uniformity of tax would lead to a reduction of cost of natural gas and increase its usage across industries.

- Improve transparency:

- While current taxes on petrol and diesel are more than 100%, the system of taxation is not so transparent. Hence, most people do not realize the high taxes they are paying. Here, GST can put in place a more transparent taxation system.

- Enhance energy use intensity:

- Adoption of cleaner fuels will result in better energy use density. This can result in the reduction of import of petroleum by India and reduce the government deficit.

- Uniform rate across India:

- GST will ensure that fuel has a uniform rate across the country. This will benefit the transport and logistics sector, especially aviation sector.

WHY PETROLEUM IS OUTSIDE GST:

- Loss of revenue:

- Central and state taxes on petroleum products contributed over ?5.55 lakh crore in 2019-20. Bringing it under 28% GST could result in a shortfall of ?2 lakh crore to 2.5 lakh crore to both the Centre and states.

- This forms a substantial amount in the income source of government and they may not want to reduce it by bringing it under GST.

- Loss of fiscal freedom for states:

- Many states derive large revenue from levy of VAT on petrol/diesel. They charge taxes according to their fiscal policy.

- But if brought under GST regime, the power to decide upon the taxes goes to the GST Council.

- Fixing the rate of GST:

- If brought under the current GST regime, 28% tax would be collected on petroleum as that is the highest slab in the tax regime. But at present, around 60% tax is being collected on petroleum products.

- Hence, for petrol and diesel to be brought under GST yet limit the shortfall, the rates will have to be very high and hence new rates may be needed.

- Issue of compensation:

- Under the GST mechanism, shortfalls in revenue collection of states are compensated by the Centre. But since the potential shortfall in case of petroleum will be high, it will be a challenge to decide on the compensation mechanism between centre and states.

- Affects public spending:

- Revenue from fuel is a major source for government to bridge the fiscal deficits. Any loss in this income could increase the fiscal deficit, which will in turn affect the government’s public spending.

- A large deficit could also affect India’s credit rating, which will hinder foreign investments into the country.

- COVID-19 crisis:

- The covid contingencies has weakened the national finances. This is the reason why governments are reluctant to ease taxes on petroleum products. Hence, bringing petroleum under GST in the current situation will be detrimental.

WAY FORWARD:

Due to massive revenue implications, it is unlikely that petrol and diesel be brought under GST in the near future. Only when the dependence of governments on taxes earned from fuel comes down will it be possible to bring petrol and diesel under GST. And for that to happen, economic growth has to get back on track.

Until then, the government can adopt two measures:

- Adopt for Aviation fuel and natural gas:

- But a start could be made with natural gas and ATF, where revenue implications are not that significant.

- Refine pricing mechanism:

- India imports most of its oil but is self-sufficient in petrol and diesel production. So, rather than the trade parity pricing mechanism, other transparent pricing mechanisms based on market principles, will likely help consumers more.

PRACTICE QUESTION:

Q. Discuss the implications of bringing petroleum products under the Goods and Services Tax (GST) regime?