Payment Banks

2024 FEB 7

Mains >

Economic Development > Indian Economy and issues > Banking sector

SYLLABUS

GS 3 >> Financial Sector >> Banking

REFERENCE NEWS

The recent actions taken by the Reserve Bank of India (RBI) against Paytm Payments Bank Ltd (PPBL) have drawn attention to the functioning of Payment Banks in India. The RBI has directed PPBL to stop a broad range of its operations, which includes ceasing to accept new deposits and stopping top-ups on customer accounts effective after February 29, 2024.

MORE ON NEWS

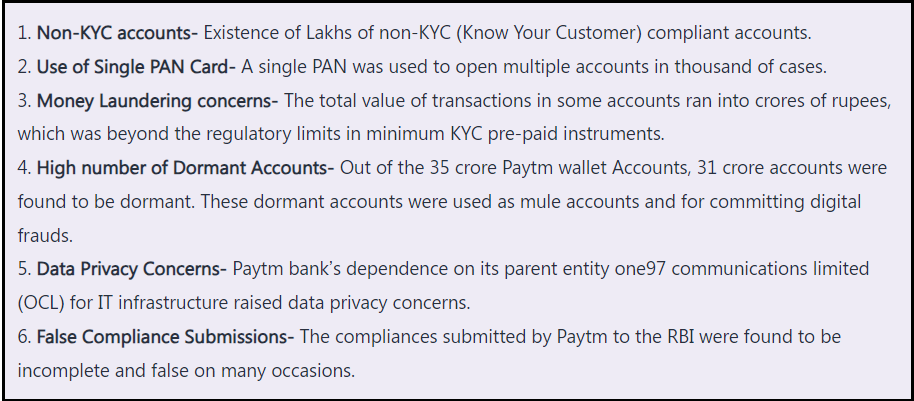

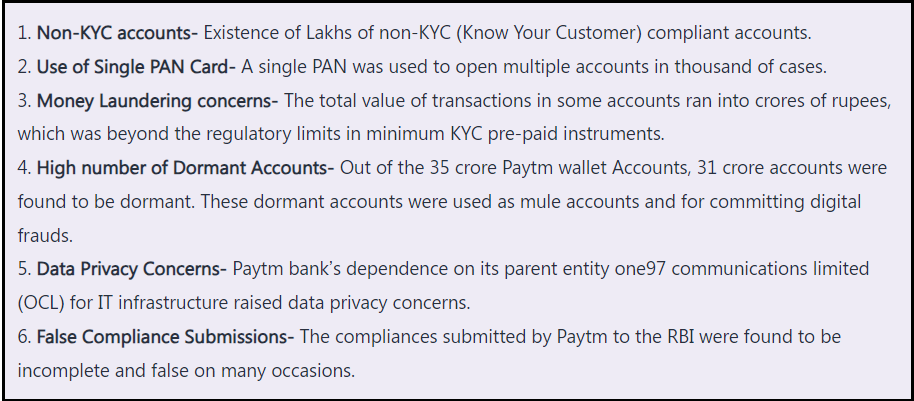

Reasons for the restrictions on payment banks:

ABOUT PAYMENT BANKS

- Payment Banks in India were established in 2014, based on the suggestions of the Nachiket Mor Committee. Their establishment aimed at operating within a limited scope to minimize credit risks.

- The primary goal of Payment Banks is to enhance financial inclusion by delivering banking and financial services to regions and groups previously unserved or underserved by traditional banking channels.

Regarding the legal framework that governs Payment Banks in India:

- They must incorporate as a Public Limited Company under the Companies Act of 2013 and secure a banking license as dictated by the Banking Regulation Act of 1949. Oversight is provided by several acts, including the RBI Act of 1934, the Foreign Exchange Management Act of 1999, and the Payment and Settlement Systems Act of 2007.

- A minimum capital of ?100 crores is required. Promoters must hold at least a 40% stake for the initial five years. Foreign investment is permissible under the existing FDI guidelines applicable to private banks in India.

- Shareholder voting rights are limited to 10%, with a possibility of increase to 26% upon receiving RBI's approval. Payment Banks are expected to be fully networked from their inception.

Key characteristics of Payment Banks:

- They are authorized to open Savings and Current Accounts with a cap on deposits at ?2,00,000 per account, an increase from the previous limit of ?1,00,000, but they cannot accept deposits from non-resident Indians.

- They lack the ability to offer loans or credit services, though they can issue ATM or Debit cards but not credit cards.

- Like other commercial banks, they must meet the Cash Reserve Ratio (CRR) requirements set by the RBI.

- A minimum of 75% of their demand deposit balances must be invested in SLR-eligible government securities or treasury bills with a maturity of up to one year. Up to 25% of demand deposit balances can be held in current or fixed deposits with other commercial banks for operational purposes.

- Payment Banks cannot establish subsidiaries for non-banking financial services activities, though they can collaborate with commercial banks to offer products like mutual funds, pension schemes, and insurance with RBI approval.

- They offer internet and mobile banking, utility bill payment services, and can handle remittances through RBI-approved payment systems such as RTGS, NEFT, and IMPS.

As of now, six Payment Banks are operational in India: Airtel Payments Bank Limited, India Post Payments Bank Limited, Fino Payments Bank Limited, Paytm Payments Bank Limited, NSDL Payments Bank Limited, and Jio Payments Bank Limited.

SIGNIFICANCE OF PAYMENT BANKS

- Enhancing Financial Accessibility: Payment Banks have played a crucial role in making financial services accessible to sections of society traditionally excluded from the banking system, such as migrant laborers, low-income families, and small business owners. This initiative is a step forward in promoting financial inclusion across the country.

- Offering Accounts with No Minimum Balance: Unlike traditional banks, which may charge fees for not maintaining a minimum balance, Payment Banks provide the option of zero balance or no minimum balance accounts, making banking more accessible without any hidden charges.

- Higher Interest Rates on Deposits: Payment Banks offer more attractive interest rates on deposits compared to conventional banks. For example, Payment Banks may offer an interest rate of approximately 7%, whereas traditional banks typically offer rates between 3.5% to 6%.

- Facilitating Small-Scale Transactions: These banks have developed efficient infrastructures to support high-volume, low-value transactions. An example of this is the widespread use of QR codes by small vendors, from vegetable sellers to grocery stores, facilitated by platforms like Paytm.

- Supplementing Traditional Banking Services: By collaborating with traditional banks to offer products like mutual funds, pension plans, and insurance, Payment Banks enhance the overall financial ecosystem. An example is the offering of SBI Life Insurance products through Paytm, illustrating how these banks complement the broader financial efforts.

- Leveraging Technology for Wider Reach: With a focus on technology-driven services, Payment Banks have managed to extend their reach across geographical boundaries more effectively than traditional banks, which often rely on physical infrastructure, thus broadening access to banking services in remote and underserved areas.

CHALLENGES FACED BY PAYMENT BANKS

- Intense Market Competition: Payment banks are navigating a highly competitive landscape, contending with digital payment platforms such as PhonePe and BharatPe, as well as the digital banking services offered by traditional banks, including SBI YONO and ICICI iMobile Pay.

- Challenges in Generating Profit: The profitability of payment banks is constrained by regulations that prohibit lending and the requirement to invest a significant portion of their funds in government securities. This scenario was exemplified when operational payment banks reported a collective net loss of Rs 516.5 crore in the financial year 2018.

- Constraints on Return on Equity: With a cap on demand deposits at Rs 2,00,000 and a high capital to Risk-Weighted Assets ratio, payment banks in India experience a reduced return on equity, often below 5%.

- Impact of Digital Divide: The reliance on internet connectivity for banking operations, combined with the digital divide between rural and urban areas, hampers the expansion and penetration of payment banks.

- Prevalence of Inactive Accounts: A large number of dormant accounts, including those with zero balances, have not only impacted the efficiency of payment banks but also posed risks of being exploited for fraudulent activities, as seen with the misuse of accounts in Paytm payment bank.

- Rising Closure of Payment Banks: The sector has seen an uptick in the number of payment banks surrendering their licenses and shutting down operations due to the over-regulated environment and significant operational losses, with notable companies like Cholamandalam Distribution Services and Aditya Birla Payment Bank among those that have exited the market.

WAY FORWARD

- Revenue Diversification: Payment banks should be granted the ability to introduce their own insurance and mutual fund products. This expansion of services would not only diversify their revenue streams but also bolster their financial stability and profitability.

- Infrastructure Collaboration: Measures should be implemented by the RBI to promote shared infrastructure between traditional and payment banks, such as establishing payment bank counters within traditional bank branches. This strategy would leverage existing banking networks to enhance service delivery and operational efficiency.

- Boosting Internet Access in Underserved Areas: To encourage the entry of new payment bank players and reduce the dominance of telecom giants, there is a critical need to improve internet connectivity in rural areas. Enhanced digital infrastructure would facilitate broader market participation and competition.

- Expanding Profit Generation Mechanisms: The RBI could play a pivotal role by increasing the deposit limit for payment banks and creating a framework that allows the transfer of surplus funds from demand deposit accounts to universal banks, thereby opening up additional avenues for profit generation.

- Strengthening Regulatory Oversight: In light of challenges such as those highlighted by the Paytm situation, there is a need for increased regulatory vigilance, including regular compliance checks for e-KYC and no-frills accounts. Implementing the recommendations of the Anand Sinha committee could further secure the operations of payment banks by clearly delineating the banking and ownership aspects.

Thus, to thrive and fulfill their potential in promoting financial inclusion, payment banks in India must navigate a future path marked by expanded operational scopes, enhanced digital infrastructure, collaborative efforts, and robust regulatory frameworks.

PRACTICE QUESTION

Q: Examine the role of payment banks in advancing financial inclusion in India. Suggest measures for their effective functioning and integration into the broader financial ecosystem. (15M, 250W)