State of State Finances

2023 JAN 25

Mains >

Economic Development > Budgeting > Centre-State Finance

IN NEWS:

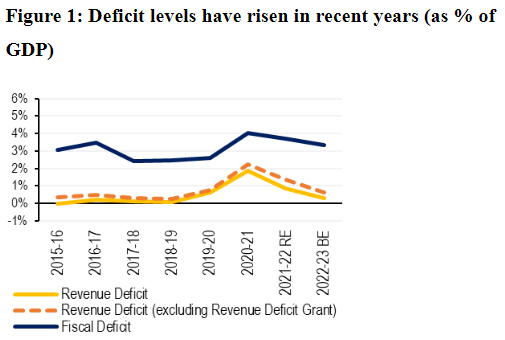

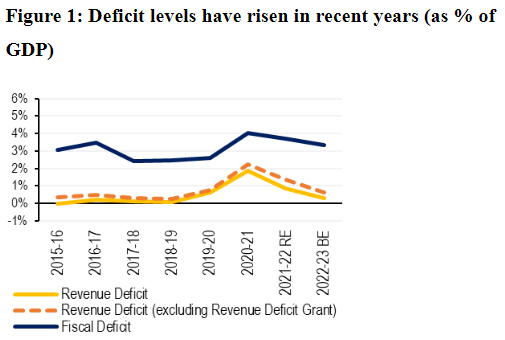

- The Gross fiscal deficit (GFD) of states is budgeted to narrow to 3.4% of gross domestic product (GDP) in 2022-23 from 4.1% in 2020-21, as per Reserve Bank of India’s report titled ‘State Finances: A Study of Budgets’.

CURRENT STATUS OF STATE FINANCES:

- The report said that states have budgeted for higher revenue receipts in 2022-23, driven primarily by State Goods and Services Tax (SGST), excise duties, and sales tax collections.

- While states’ debt is budgeted to ease to 29.5% of GDP in 2022-23 as against 31.1% in 2020-21, it is still higher than the 20% recommended by the FRBM Review Committee, 2018.

- Provision for capital outlay by states saw a growth of 32% in 2021-22, aided in part by the Centre’s allocation for states through Scheme for Financial Assistance to the States for Capital Investment.

- In 2022-23, states on an aggregate have budgeted to spend 54% of their revenue receipts towards three items: 29% on salaries and wages, 13% on pension and 12% on interest payments.

- During 2022-23 (up to Dec, 2022), the states’ net market borrowing was Rs 3.02 lakh crore. They are expected to raise Rs 3.41 lakh crore (gross) during January – March 2023.

IMPORTANCE OF STRONG STATE FINANCES:

- Strengthen capital spending:

- In 2021-22, capital outlay by state governments stood at 2.7% of GDP, as against 2.3% by the Centre. For 2022-23, states total outlay is actually budgeted to rise to 2.9% of GDP.

- Promote economic growth:

- As per the RBI report, states’ share in general government capital spending averages around 70%. Higher capital expenditure not only creates additional demand immediately but also paves the way for growth and recovery.

- Sustainable development:

- A sustained improvement in the quality of public expenditure, with a focus on infrastructure, research and development, health, education and other social services can play a conducive role in promoting inclusive and sustainable economic growth.

- Attain climate goals:

- India’s goal of net zero emissions by 2070 requires the State governments to prioritise investments in low-carbon technology, supporting infrastructure, research to shield the most vulnerable households from the impact of the transition.

- Spillover effect:

- The positive impact of capital outlay of one State can also spill over to other States through various demand and supply channels. This in turn leads to nation’s wellbeing.

CHALLENGES:

- High fiscal deficit:

- According to RBI data, the fiscal deficit rose from Rs 5.2 trillion in FY20 to Rs 9.3 trillion in FY21. In FY22, the deficit fell to Rs 8.1 trillion but stood much higher than the pre-pandemic level.

- Impact of pandemic:

- To tackle the COVID-19 pandemic, states relied on borrowings. This resulted in a sharp increase in outstanding liabilities and higher deficit levels.

- For instance, the state debt-to-GDP ratio is budgeted at 29.5% by the end of March 2023, considerably higher than the 20% level recommended by the Fiscal Responsibility and Budget Management (FRBM) review committee.

- Debt sustainability:

- In Punjab, Rajasthan, Bihar, Kerala and West Bengal, the debt growth outpaced their gross state domestic product growth in the last five years. This raises concern over their debt sustainability.

- Persisting revenue deficit:

- As per the recommendations of the 15th Finance Commission, the central government is estimated to provide a grant of Rs 86,201 crore to states to eliminate the revenue deficit. However, seven states are expected to observe a revenue deficit after accounting for the grant. This affects the space for capital outlay.

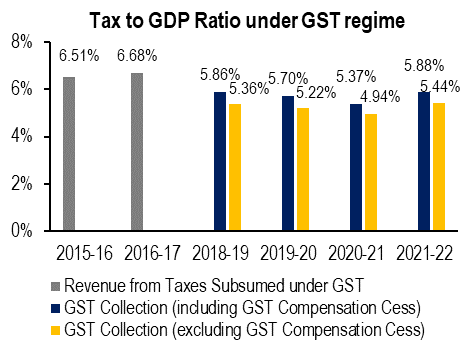

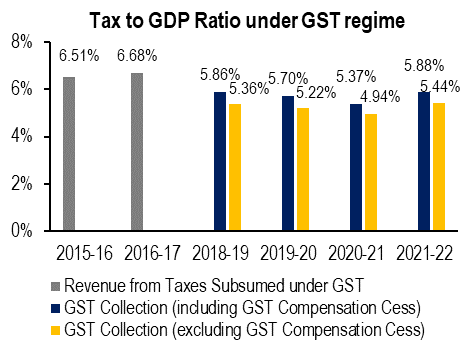

- Shortfalls in GST:

- Since the introduction of GST in 2017, State GST has become the largest source of own tax revenue for States (about 42%). However, revenue realisation has been lower than the pre-GST regime.

-

- GST compensation, which guaranteed 14% growth in SGST collection, was discontinued in June 2022. This is expected to create a challenge for maintaining revenue level in some states.

- Lax in revenue collection:

- The 15th Finance Commission had noted that certain richer states lag behind in collection of stamp duty and registration fees. Also, some states did not budget any revenue from taxes and duties on electricity.

- India also lags behind significantly in collection of property tax, which is the significant source of own tax revenue for local bodies.

- Issues in finances of local self-governments:

- Populist economic policies:

- Political compulsions and aspirations of electoral gains have resulted in state governments following populist policies which are financially inefficient. Eg: Loan waivers and freebies.

- Reverting to old pension scheme:

- Weakness of DISCOMs:

- State-owned power distribution companies have continued to make losses, requiring state governments to provide them with grants and guarantee their market borrowings. State-owned discoms registered cumulative losses of about three lakh crore rupees between 2017-18 and 2020-21.

- Increase in non-divisive cess and surcharges:

- The increased share of devolution, mooted by the 14th Finance Commission, from 32% to 42%, was subverted by raising non-divisive cess and surcharges that go directly into the Union kitty.

- This non-divisive pool in the Centre’s gross tax revenues shot up to 15.7% in 2020 from 9.43% in 2012, shrinking the divisible pool of resources for transfers to States.

- Centrally Sponsored Schemes:

- While the number of CSS have come down owing to rationalisation carried out by the central government, the overall allocation for these schemes have stayed at a similar level. For instance, between 2015-16 and 2022-23, grants for CSS have ranged between 25%-29% of the total transfers to states.

- Also, turning the states into mere implementing agencies of the Union’s schemes raises questions on fiscal decentralisation and autonomy of states.

- Issue of differential interest:

- States are forced to pay differential interest about 10% against 7% by the Union for market borrowings.

- Poor market discipline:

- Theoretically, states with relatively better fiscal health should be able to borrow from the market at a lower interest rate. Likewise, highly indebted states would have to offer a higher yield to make their bonds attractive.

- However, RBI observed that states were mobilising funds at similar or near similar yields irrespective of their fiscal position.

- Off Budget Borrowings:

- State governments are increasingly relying on off-budget borrowings to keep its fiscal deficit in check while financing the expenditures. However, such practices are against the norms of fiscal transparency and adversely impact fiscal sustainability.

|

Off-budget borrowings

- Off-budget borrowings involve the mobilisation of resources needed to finance the expenditure requirements of a particular year which do not appear in the budget documents of that year.

- Such expenditure is financed through borrowings by government owned entities such as public sector enterprises or departmental commercial undertakings. However, the government has to service the debt from its budgetary resources.

- The 15th Finance Commission had observed that there is a significant amount of off-budget expenditure that are not included in the calculation of debts and deficits.

- Such borrowings bypass the net borrowing ceiling of the state by routing loans outside the state budget. Also, since they do not form a part of the budget documents, they may remain outside the legislative oversight.

|

WAY FORWARD:

- The RBI report suggests that a glide path needs to be set, keeping in view the need for rebuilding fiscal space to deal with future shocks.

- Augment new revenue streams:

- Several states have been attempting to augment their revenue by making compliance easier, providing amnesty schemes etc. These measures can be adopted nationwide.

- For instance:

- Kerala, Rajasthan and Maharashtra announced amnesty schemes to clear pending tax disputes and mobilise revenue.

- Punjab proposed forming a tax intelligence unit to achieve better tax compliance under GST.

- Chhattisgarh is planning to raise revenue through data-based review of taxation rules and tax rates.

- Assam has introduced a liquidation scheme for settling of arrears.

- Haryana has a one-time scheme for settling old VAT dues, in addition to phased monetisation of assets.

- Assam and Kerala have green tax to discourage old vehicles.

- Strengthen GST regime:

- The 15th Finance Commission had observed that improving the efficiency of GST will strengthen the finances of central and state governments.

- For this, issues related to inverted duty structure, unavailability of invoice matching system and reliability of data under GSTN needs to be addressed.

- Improve Centre’s allocation to states:

- Centre should try to increase the divisible pool in tax revenue by various measures including widening the tax base, preventing tax evasion etc.

- Cess and surcharges must be shared with states to improve the financial capacity of states.

- Encourage intra-national trade:

- States need to encourage and facilitate higher inter-state trade and businesses to realise the full benefit of spillover effects across the country.

- Incentivize good performance:

- Greater market-based discipline on state government finances is imperative. States must be rewarded for their fiscal discipline.

- Acknowledge off budget borrowings:

- Both the Centre and states must make their finances transparent by including off-budget borrowings in budgetary statements. While the former has already started doing it, the latter should follow suit.

|

Fiscal Responsibility and Budget Management Act (FRBM Act), 2003:

- The FRBM Act aims to introduce transparency in India's fiscal management systems. The Act’s long-term objective is for India to achieve fiscal stability and to give the Reserve Bank of India (RBI) flexibility to deal with inflation in India.

Key features of the FRBM Act

- The FRBM Act made it mandatory for the government to place the following along with the Union Budget documents in Parliament annually:

- Medium Term Fiscal Policy Statement

- Macroeconomic Framework Statement

- Fiscal Policy Strategy Statement

- The FRBM Act proposed that revenue deficit, fiscal deficit, tax revenue and the total outstanding liabilities be projected as a percentage of gross domestic product (GDP) in the medium-term fiscal policy statement.

FRBM Act exemptions:

- On grounds of national security, calamity, etc, the set targets of fiscal deficits and revenue could be exceeded.

|

PRACTICE QUESTION:

Q. Analyse the need for and challenges faced in fiscal consolidation at the state level in India.

Q. What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2013? Discuss critically its salient features and their effectiveness. (GS 3, 2013)