Indian-China Trade Relations

2022 JUL 20

Mains >

International relations > India and Neighbours > India-China

IN NEWS:

- India-China trade has gone up to USD 67.08 billion in the first half of this year and is on track to surpass $100 billion for the second year in a row.

MORE ON NEWS:

- The trade imbalance is also on track for another record, with India’s exports to China down by 35% and accounting for only $9.57 billion of the $67.08 billion two-way trade.

- Two-way trade in 2021 crossed $100 billion for the first time, reaching $125.6 billion, with India’s imports accounting for $97.5 billion.

AN OVERVIEW OF INDIA-CHINA TRADE:

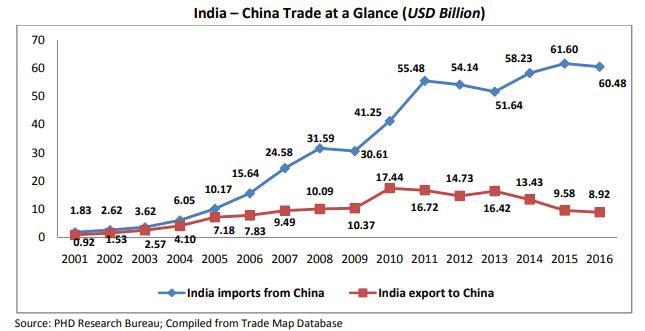

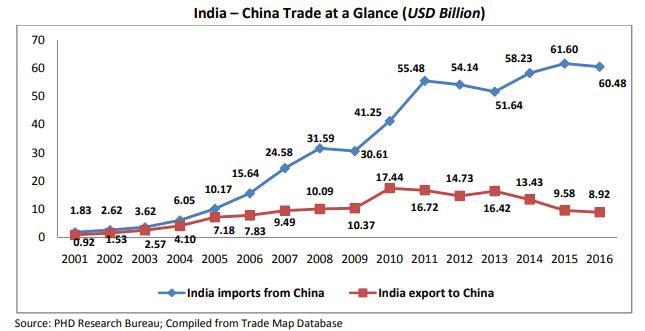

- Bilateral trade between India and China increased from USD 38 billion in 2007-08 to USD 125 billion in 2021.

- While Imports from China increased by USD 50 billion, exports increased by USD 2.5 billion during the period of 2007 to 2017. This has widened India’s trade deficit.

-------------------------------

- In 2021:

- India’s imports from China stood at USD 97.5 billion and

- India’s exports to China stood at USD 28.1 billion

- The sharp uptick in imports on a large base has pushed India’s trade deficit with China to a record high USD 69.4 billion in 2021, up from USD 56.8 billion in 2019.

- The sharp increase in imports has come despite moves by the Centre to hike tariffs on key imports from China, including components for electronic goods such as smartphones.

- India’s export basket comprises mainly primary goods while imports from china are dominated by value added items.

- In 2019-20, 5% of India’s exports were destined for China, while only 3% of China’s came to India. Also, 14% of India’s imports were from China, while only 0.9% of China’s were from India.

ITEMS IMPORTED:

- Some of India’s key imports from China include smartphones, components for smartphones and automobiles, telecom equipment, plastic and metallic goods, active pharmaceutical ingredients (APIs), and other chemicals.

- In several cases, China’s contribution is much higher than the second-largest exporter countries of these products to India. For example:

- China accounts for 45 per cent of India’s total electronics imports.

- A third of machinery and almost two-fifths of organic chemicals that India purchases from the world comes from China

- Of the total of India's import of APIs, the dependency on China is for about 65-70 per cent of the APIs.

- Automotive parts and fertilisers are other items where China’s share in India’s import is more than 25 per cent.

- Several of these products are used by Indian manufacturers in the production of finished goods, thus thoroughly integrating China in India’s manufacturing supply chain. For instance India sources close to 90 per cent of certain mobile phone parts from China.

ITEMS EXPORTED:

- Raw material exports constituted a significant portion of India’s outbound trade with China, with iron ore, organic chemicals and cotton figuring among key export items.

- Other key exports to China included iron and steel, seafood and engineering goods.

ISSUES/CHALLENGES IN TRADE WITH CHINA:

- Widening trade deficit:

- The widening trade deficit, with India’s imports from China now nearly four times its exports in value terms, is a cause for concern

- Trade with China constitutes more than 40% of India’s total trade deficit.

- The growth of trade deficit with China could be attributed to two factors:

- Chinese exports to India rely strongly on manufactured items to meet the demand of fast expanding sectors like telecom and power, while India’s exports to China are characterized predominantly by primary products.

- Exports of some value-added products like electrical machinery, auto components, marine products, drugs and pharmaceuticals have started, but these products are still sub-optimal on account of restricted market access by China

- Dumping:

- Dumping refers to the practice of exporting goods at a price lower than their market value in the originating country

- India’s anti-dumping duties on Chinese goods are being evaded by misclassification of products

- Illegal imports and smuggling:

- The value of seized smuggled goods from China was Rs 1,024 crore in 2016-17.

- Directorate of Revenue Intelligence (DRI), India’s chief anti-smuggling intelligence and investigations agency, works in a challenging environment with a small workforce.

- Unfair trade practices:

- Chinese goods are much more competitive than Indian goods. Chinese competitiveness is mainly the outcome of the efforts and support of the Chinese Government

- China is not recognized by WTO as a market economy mainly because of the lack of transparency in its trade policy.

- Parliamentary committee on commerce finds that Chinese Government gives export rebate to the tune of 17% to their exporters.

- Lack of competitiveness of Indian industry:

- Lending rates: The lending rates in China are very industry friendly while in India, the banks offer one of the highest lending rates to the industry. Our industry is borrowing anywhere between 11 and 14% while the Chinese are getting loans at 6%.

- Logistic costs in China are one of the lowest in Asia and much lower than India. The Chinese cost of logistics is 1% of their business. In India, it calculates to 3%.

- Cost of electricity: The effective cost of electricity in India is anywhere between twelve and fourteen rupees which is higher in comparison to China.

- In short, India suffers cost competitiveness by almost 9% to their competition with China on account of energy, finance and logistics.

- Heavy reliance on Chinese imports for raw materials in certain sectors:

- Pharmaceutical industry:

- India imports two-thirds of its active pharamaceutical ingredients (APIs), or key ingredients of drugs, from China.

- Solar Industry:

- 84% of the solar panel requirement of the National Solar Mission is met through imports from China.

- Misuse of FTAs:

- India has free trade agreements (FTAs) with countries such as Bangladesh.

- Chinese fabric is manufactured into garments in Bangladesh, and imported at cheap rates into India

- Impact on MSMEs:

- Poor quality Chinese products with cheap rate dominate the unorganized retail sector, largely affecting domestic MSMEs

- Health concerns:

- Some of Chinese imports contain items that involve severe public health concerns.

- For example most Chinese firecrackers contain potassium chlorate, a highly explosive chemical which is banned in India.

- Job loss:

- A number of industries that have been adversely affected by the import of Chinese goods are labour intensive.

- These industries have traditionally been large employment generators in India (e.g., textiles) or are likely to become so (e.g., solar industry)

- For example; a number of MSMEs have had to close down, particularly manufacturers of stainless steel due to Chinese import.

- Poor enforcement of quality control:

- Delays in firming up the Quality Control Orders (QCO) by the Government helps the Chinese industry monopolise its low quality goods in the market.

- Tax collection:

- Downsizing or closing down of units in India will naturally affect tax collections and impinge upon the Make in India programme.

- Affects banking sector:

- Closure of industry will also stress the banking sector which already is reeling under the burden of huge NPAs

- Environmental concerns:

- Low-quality Chinese imports also have an adverse impact on the environment.

- For instance, import of impure chemicals affects the environment, and results in low quality agrochemicals (pesticides) thus affecting Indian farmers

INDIA’S EFFORT TO REDUCE ITS DEPENDANCE ON CHINA:

- Strengthening anti-dumping initiatives:

- India has also tightened its watch on dumping of goods from China in the domestic market.

- In December 2021, India imposed anti-dumping duties on five Chinese products, including certain aluminium goods and chemicals, for five years to protect local manufacturers

- Restriction in Chinese FDI:

- The Government also modified foreign direct investment (FDI) rules, making its approval a must for any FDI in Indian firms from neighbouring countries — apparently aimed at preventing opportunistic takeovers of domestic firms by Chinese companies during the pandemic.

- Chinese apps blocked:

- Government blocked social media app TikTok and 58 other Chinese apps in India, calling them “prejudicial” to India’s sovereignty, integrity and national security.

- The blocks were converted into permanent bans by the Ministry of Electronics and Information Technology (MeitY) in 2021.

- In power sector:

- India recently banned the import of power equipment from China, citing cyber-security concerns in 2021.

- In telecom sector:

- The Government asked state-owned telecommunication companies, BSNL and MTNL, to exclude Chinese telecom equipment firms, including Huawei and ZTE, from its network upgrading process.

- Tarff hiked:

- Centre hiked tariffs on key imports from China, including components for electronic goods such as smartphones.

WAY FORWARD:

- Cooperation:

- India and China should work upon the areas of cooperation in the oil and gas sector to leverage upon the sheer size of the market of two countries

- India and China could cooperate in areas of health, education and sanitation, by sharing best practices and technology, to improve standard of living of its population.

- Recommendations of Parliamentary Standing Committee on Commerce:

- Implement the recommendations of Parliamentary Standing Committee on Commerce. The major recommendations include,

- The establishment of a single integrated national authority, the Directorate General of Trade Remedies (DGTR), which will be effective in providing a comprehensive and timely trade defence mechanism in India.

- Directorate General of Anti-Dumping (DGAD) should address the problem of lax implementation of anti-dumping duties, and rationalise the duties and make them more in line with current domestic production costs.

- Single Window Interface for Facilitating Trade (SWIFT) need to optimally utilised for effective quality control of all the imports of products

- Public procurement order giving preference to domestically manufactured goods must be put to good use and made an effective tool to counter imports.

- Support Indian domestic manufacturing industries through improved infrastructure and logistics facilities to make it more cost efficient and quality effective

- Predictable and transparent trade policy:

- Resorting to unpredictable and opaque moves, like delaying port clearances for pharma consignments from China in the wake of tensions LAC, may prove counterproductive as investors may feel insecure in India’s trade policy.

- Data localisation policy:

- A data localisation policy for regulating access to data, mandating data storage requirements and controlling cross-border data flows, needs to be put in place.

- Companies should be required to set up data centres in India to minimise the need for storing sensitive data on foreign servers

- Accountability in trans-border data flows:

- There are legal best practices to be learned from other countries. For example; “The 13 Australian Privacy Principles” are designed to effectively protect the collection, holding use and disclosure of all personal information

PRACTICE QUESTION:

Q. "India needs to scale up domestic production in key sectors like electronics and pharmaceuticals and also needs to undertake a series of reforms to reduce its dependence on China." Discuss.