International Monetary Fund

2020 APR 19

Mains >

International relations > International Institutions > World Bank & IMF

IN NEWS:

At the recent IMF-WB Spring meetings held virtually, a proposal for the IMF to issue an additional 500 billion of Special Drawing Rights (SDRs) was blocked by the US and India.

INTERNATIONAL MONETARY FUND:

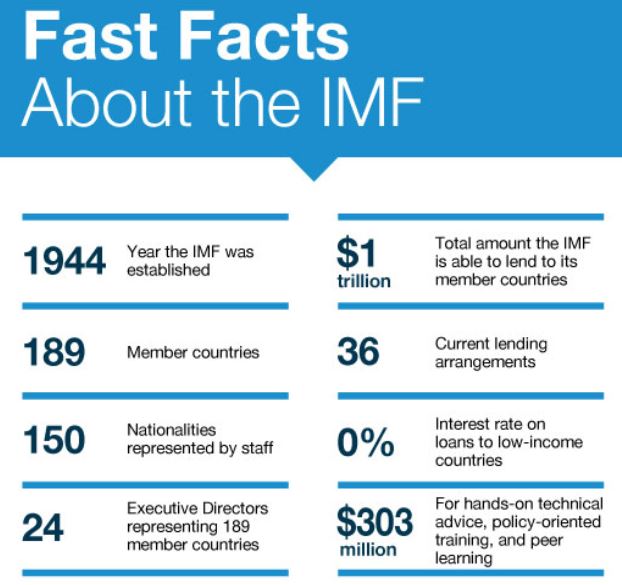

- The International Monetary Fund (IMF) is an organization of 189 countries. It was conceived in 1944 at the United Nations Bretton Woods conference in New Hampshire, United States.

- Primary aims:

- Promote international monetary cooperation

- Facilitate the expansion and balanced growth of international trade

- Promote exchange stability

- Assist in the establishment of a multilateral system of payments

- Make resources available to members experiencing balance-of-payments difficulties.

ACTIVITIES:

The IMF’s fundamental mission is to ensure the stability of the international monetary system. It does so in three ways:

1. Keeping track of the global economy and the economies of member countries:

- The IMF oversees the international monetary system and monitors the economic and financial policies of its member countries. The IMF highlights possible risks to stability and advises on needed policy adjustments.

- It also provides periodic assessments of global prospects in its World Economic Outlook report, of financial markets in its Global Financial Stability Report, of public finance developments in its Fiscal Monitor, and of external positions of the largest economies in its External Sector Report.

2. Lending to countries with balance of payments difficulties:

- The IMF provides loans to member countries experiencing actual or potential balance of payments problems to help them rebuild their international reserves, stabilize their currencies, continue paying for imports, and restore conditions for strong economic growth, while correcting underlying problems.

3. Giving practical help to members:

- The IMF works with governments around the world to modernize their economic policies and institutions, and train their people. This helps countries strengthen their economy, improve growth and create jobs.

ORGANISATION:

- Board of Governors:

- It is the highest decision-making body of the IMF. It consists of one governor and one alternate governor for each member country. The governor is appointed by the member country and is usually the minister of finance or the governor of the central bank.

- All powers of the IMF are vested in the Board of Governors. The Board of Governors may delegate powers to the Executive.

- The Board of Governors is advised by two ministerial committees. The Board of Governors normally meets once a year.

- Executive Board:

- It is a 24-member board elected by the Board of Governors. It conducts the daily business of the IMF.

- They also appoint IMF’s Managing Director is both chairman of the IMF’s Executive Board and head of IMF staff.

- Members: Any state, whether or not a member of the UN, may become a member of the IMF in accordance with IMF Articles of Agreement and terms prescribed by the Board of Governors. Membership in the IMF is a prerequisite to membership in the IBRD.

RESOURCES:

1. Quota:

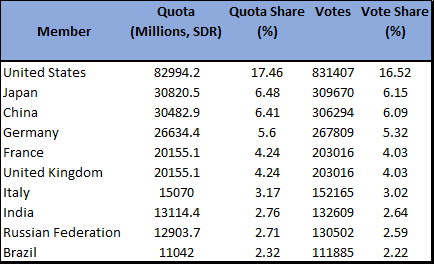

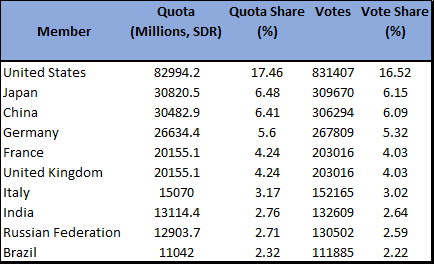

- Most resources for IMF loans are provided by member countries, primarily through their payment of quotas. Quota subscriptions are a central component of the IMF’s financial resources.

- Each member country of the IMF is assigned a quota, based broadly on its relative position in the world economy. Voting power in the IMF is based on a quota system.

2. Borrowing Arrangements:

- Quota subscriptions of member countries are the IMF's main source of financing. However, it also sources funds through Multilateral and bilateral borrowings from member nations in case it finds the quota insufficient.

3. Special Drawing Rights (SDR):

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The SDR serves as the unit of account of the IMF.

- A basket of currencies determines the value of the SDR. They are the US dollar, Euro, Japanese yen, Chinese renminbi and British pound sterling.

- SDR is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. SDRs can be exchanged for these currencies.

4. Gold:

- Gold remains an important asset in the reserve holdings of several countries, and the IMF is still one of the world’s largest official holders of gold. The IMF holds around 2,814.1 metric tons of gold at designated depositories.

INDIA & IMF:

- Following Independence, India had serious balance of payments deficits, particularly with the dollar and other hard currency countries. Hence, India relied on IMF for support.

- IMF granted loans to meet the difficulties during the Indo- Pak wars of 1965 and 1971. In 1981, India was given a massive loan of about Rs. 5,000 crores to overcome foreign exchange crisis

- However, in the 1990s, the crisis worsened and India had to pledge 67 tons of its gold reserves as collateral security to avail loans from the IMF. India promised IMF to launch several structural reforms, which later materialized as the LPG reforms (Liberalisation Privatization, Globalisation).

- Since then, India has had a credible place in the IMF, which is helping her play an important role in determining the policies of the IMF.

CRITICISM:

- Conditional loans: On giving loans to countries, the IMF make the loan conditional on the implementation of certain economic policies such as reducing government borrowings, deregulation and several macroeconomic interventions. This not only undermines a country’s sovereignty, but can also make difficult economic situations worse. This was seen in the 1997 Asian economic crisis.

- Under-representation of the Global South: The distribution of voting power remains severely imbalanced in favor of the US, European countries and Japan. The US, with around 17% quota share, holds an effective veto in decision making.

- Opaque decision-making: The IMF has been criticized for imposing policy with little or no consultation with the affected countries.

- Inconsistent decision making: It has been heavily criticized for the role played by the important shareholders in its decision-making and choice of interventions, including its support to dictatorships. For instance, In the 1960s, the IMF supported the government of Brazil’s military dictator Castello Branco who received millions of dollars of loans and credit that were denied to other countries.

- Neo liberal policies: IMF pushes for liberalization, privatization and free market capitalism irrespective of the country they are helping. But these policies will not always be suitable for the situation of the country. For example, privatisation can create lead to the creation of private monopolies who exploit consumers.

- Moral hazard in bailouts: Because of the possibility of getting bailed out, it encourages countries to borrow more. For eg: Some member nations, such as Italy and Greece, have been accused of pursuing unsustainable budgets because they believed the world community, led by the IMF, would come to their rescue.

WAY FORWARD:

- The coronavirus pandemic and the subsequent economic crisis is an ideal scenario for the IMF to fulfill the explicit purpose for which it was created. However, to realize this, the Fund first needs to abandon some bad old ideas.

- Major reforms, which have been pending since 2010, are essential to bring back the lost faith in the institution. The reforms should reflect the increasing role of emerging market and developing countries such as India. This should include a more democratic & transparent decision-making process and retreatment from ‘one-size-fits-all’ approach in lending.

- Due to its credibility in the IMF, India has a key role to play in initiating reforms as well as creating consensus among the global north and south.

PRACTICE QUESTION:

Q. Discuss the relevance of the International Monetary Fund in modern day global economy?