The World Bank

2020 SEP 25

Mains >

International relations > International Institutions > World Bank & IMF

IN NEWS:

- The government has informed the Parliament that India has received three loans worth $2.5 billion from World Bank to fight the coronavirus outbreak.

WORLD BANK:

- The World Bank is an international financial institution that provides loans and grants to the governments of poorer countries for the purpose of pursuing capital projects.

- The International Bank for Reconstruction and Development (IBRD) and International Monetary Fund (IMF) were established at the Bretton Woods Conference in 1944. IBRD was the original World Bank institution.

- It is headquartered in Washington, D.C.

ORGANISATIONAL STRUCTURE:

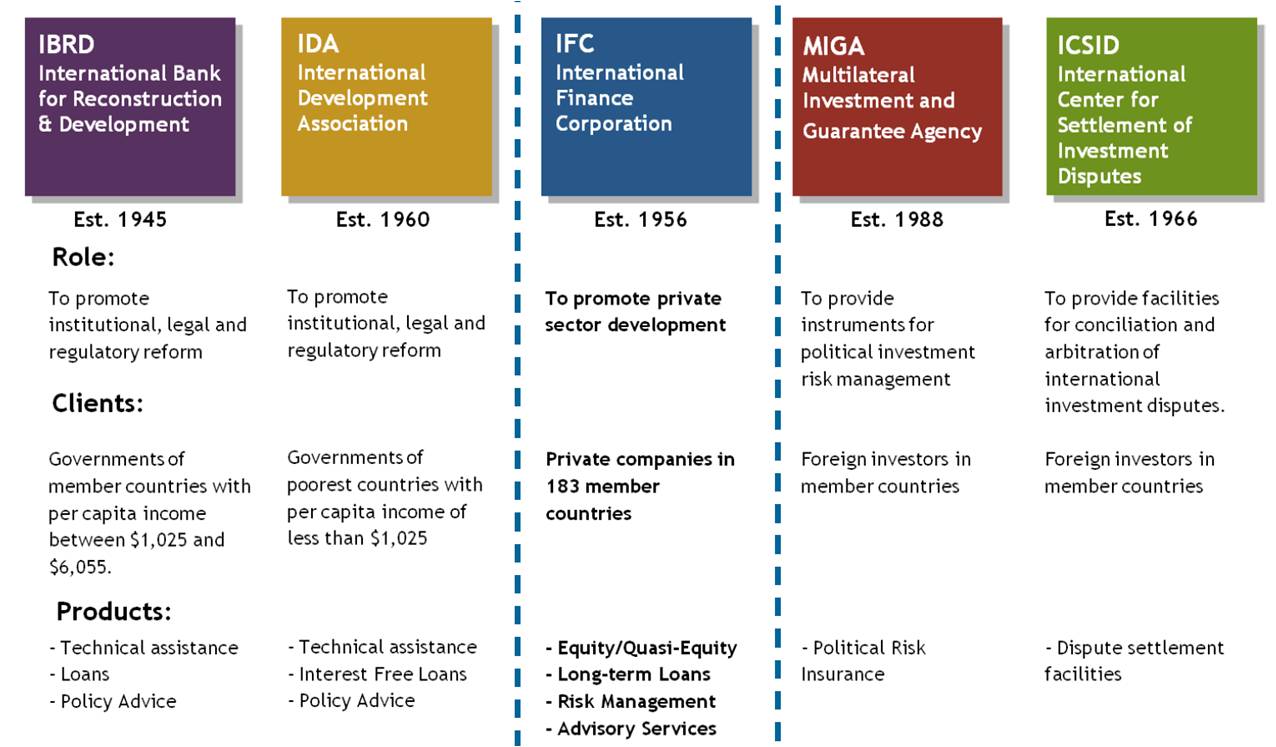

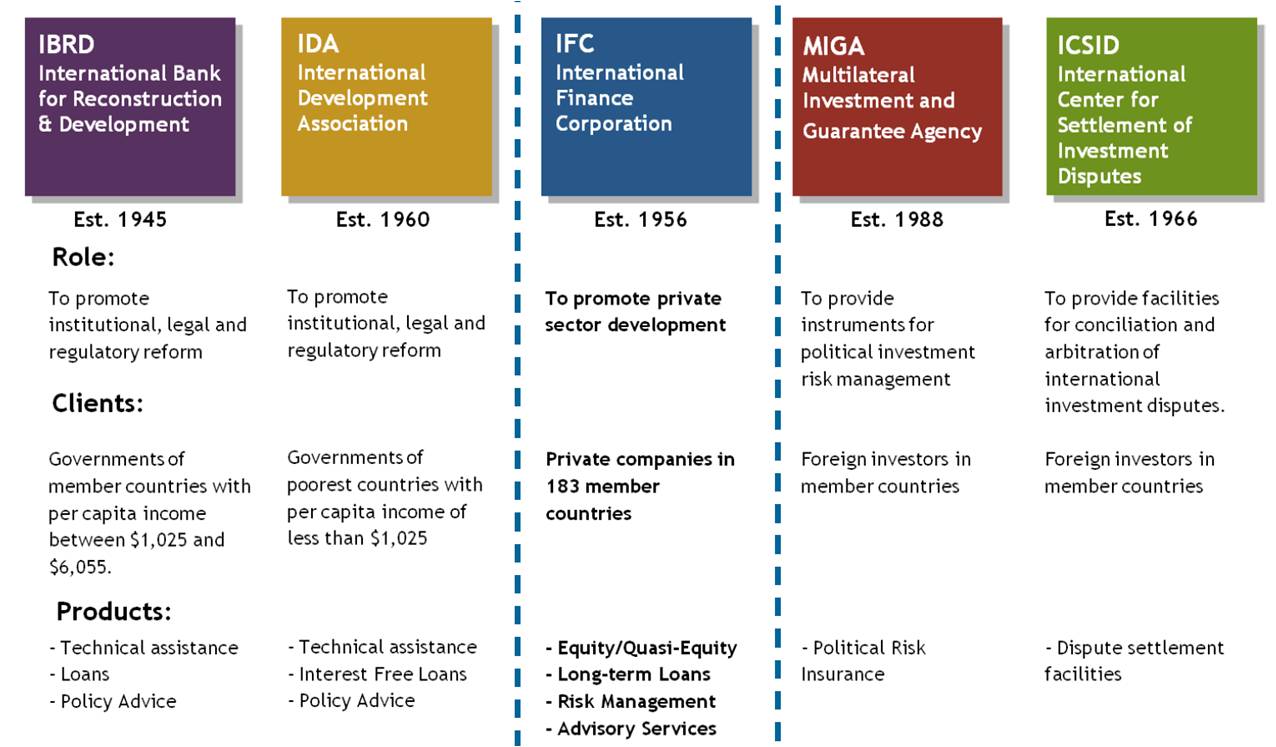

- The World Bank Group (WBG) is a family of five international organizations that make leveraged loans to developing countries.

- The term "World Bank" generally refers to just the IBRD and IDA, whereas the term "World Bank Group" or "WBG" is used to refer to all five institutions collectively.

- The IBRD offers assistance to middle-income and poor, but creditworthy, sovereign countries. It also works as an umbrella for more specialized bodies under the World Bank.

- The IDA offers loans to the world's poorest countries. These loans come in the form of "credits" and are essentially interest-free. They offer a 10-year grace period and hold a maturity of 35 years to 40 years.

- The IFC works to promote private sector investments by both foreign and local investors. It provides advice and information to investors and businesses, and also acts as an investor in capital markets.

- The MIGA offers insurance against the political risk that an investment in a developing country may bear. These guarantees come in the form of political risk insurance.

- The ICSID facilitates and works toward a settlement in the event of a dispute between a foreign investor and a local country.

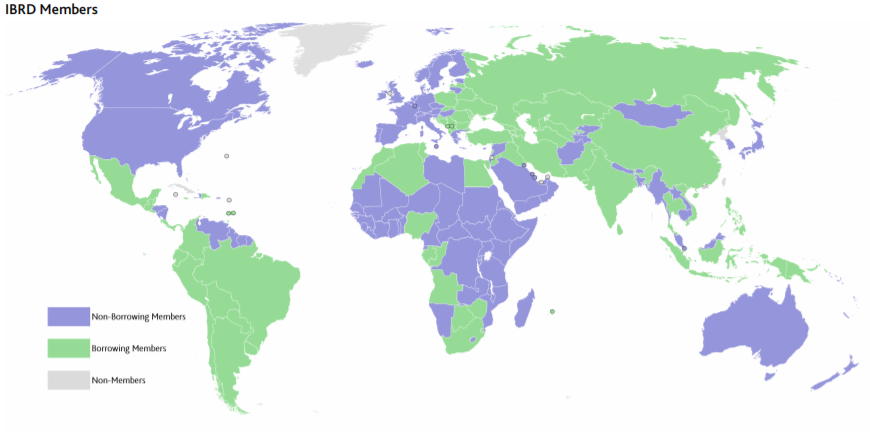

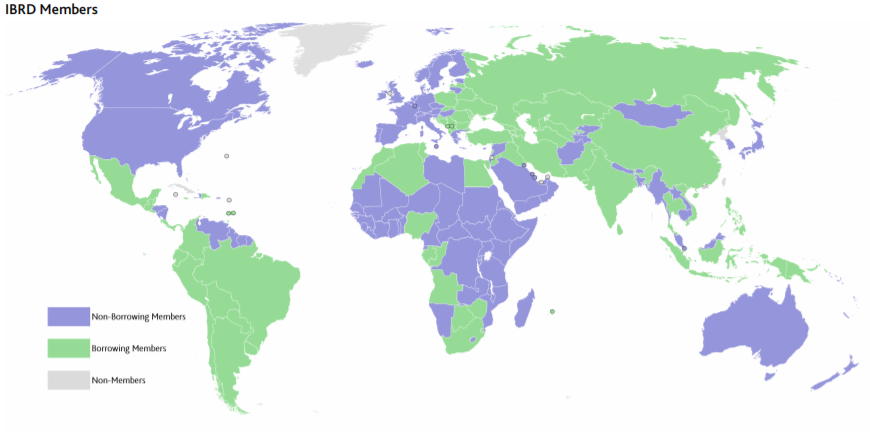

MEMBERS:

- To become a member of the Bank, a country must first join the International Monetary Fund (IMF).

- Membership in IDA, IFC and MIGA are conditional on membership in IBRD.

- The World Bank is like a cooperative, made up of 189 member countries.

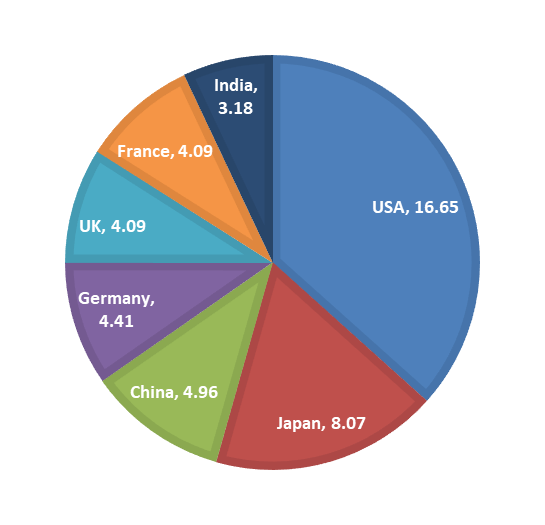

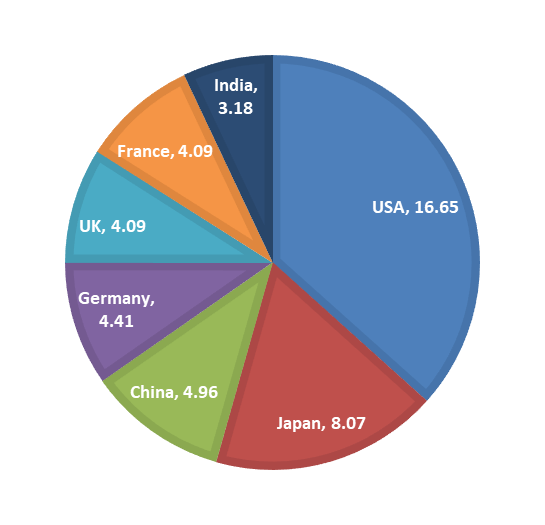

- The size of the World Bank's shareholders depends on the size of a country's economy.

GOVERNANCE STRUCTURE:

- Board of Governors:

- It is the highest decision-making body of the World Bank.

- It consists of one governor and one alternate governor from each member country. The office is usually held by the country's minister of finance, governor of its central bank, or a senior official of similar rank.

- The Governors and alternates serve for terms of five years and can be reappointed.

- All powers of the IMF are vested in the Board of Governors. The Board of Governors may delegate powers to the Executive.

- Board of Directors:

- It is a 25-member board who work on-site at the Bank and conducts the daily businesses.

- The five largest shareholders each have an individual member, and the additional 19 EDs represent the rest of the member states as groups of constituencies.

- The World Bank Group President chairs its meetings and is responsible for overall management of the Bank. He is nominated by the largest shareholder ie USA.

LENDING ACTIVITIES:

- The Bank lends money to middle-income countries at interest rates lower than the rates on loans from commercial banks.

- The Bank also lends money at no interest to the poorest developing countries, those that often cannot find other sources of loans.

- Countries that borrow from the Bank also have a much longer period to repay their loans than commercial banks allow and don't have to start repaying for several years.

- The Bank's financial reserves come from several sources, such as:

- Funds raised in the financial markets

- Earnings on its investments

- Fees paid in by member countries

- Contributions made by members, particularly the wealthier ones

- Borrowing countries themselves when they pay back their loans

VOTING POWER:

- Member countries are allocated votes at the time of membership and subsequently for additional subscriptions to capital. Votes are allocated differently in each organization.

- Vote share:

INDIA AND WORLD BANK:

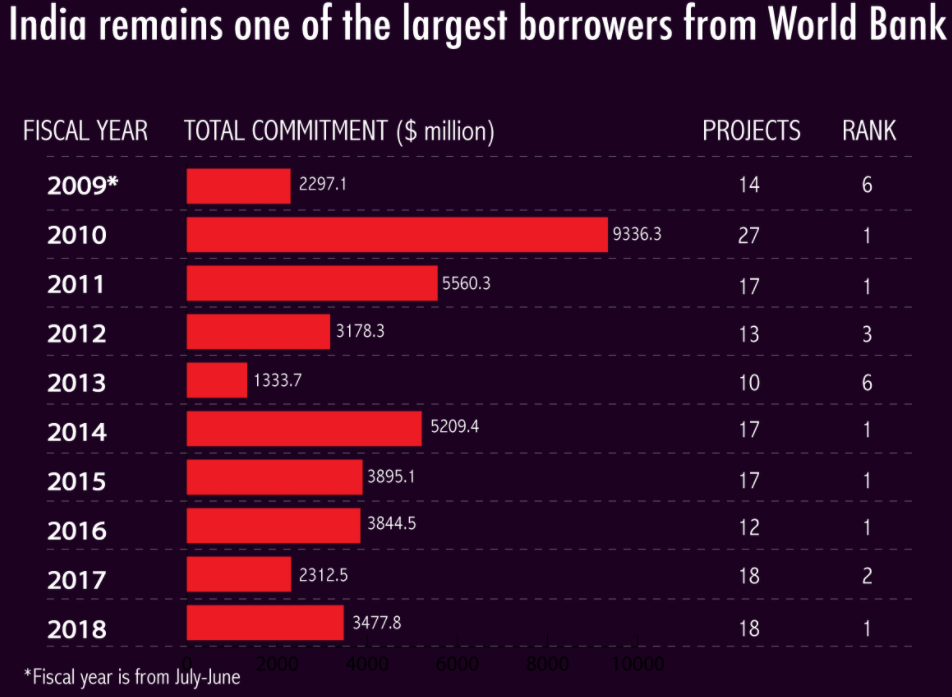

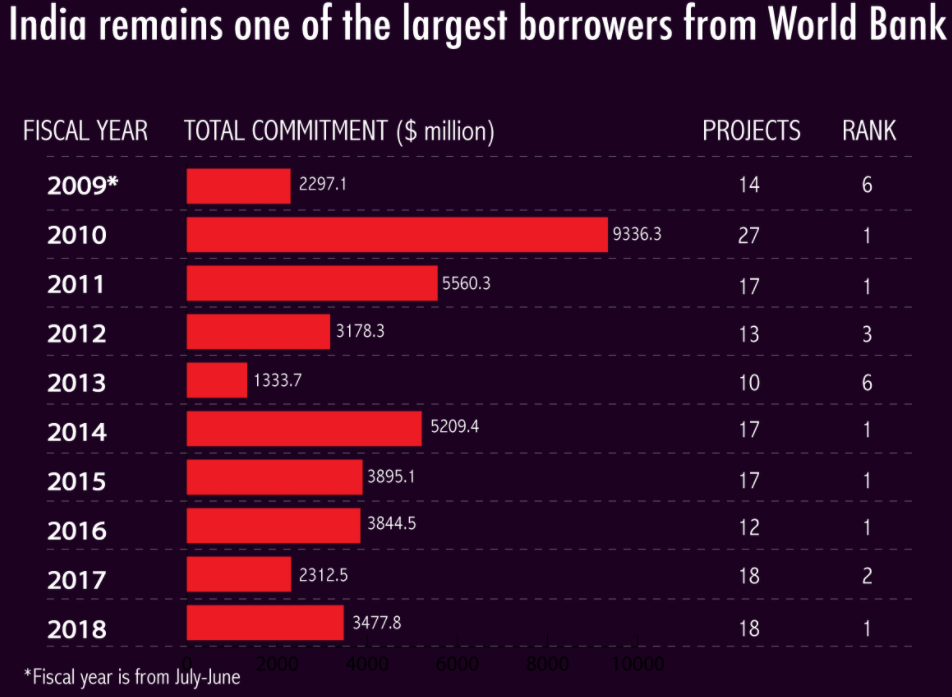

- India is a founding member of the World Bank. Today, India is a member of four of the five constituents of the World Bank Group viz., IBRD, IFC, IDA and MIGA.

- India is a major recipient of the World Bank loans.

- Some World Bank funded projects in India include:

- Sarva Shiksha Abhiyan (SSA)

- Pradhan Mantri Gram Sadak Yojana Project

- National Ganga River Basin Project

- Green National Highways Corridor Project

- National Nutrition Mission

SIGNIFICANCE OF WORLD BANK:

- Eliminating poverty: Elimination of poverty is unlikely to happen if relied solely on private investors, bilateral aid or non-governmental organizations. This calls for a global institution such as World Bank which is mandated towards elimination of poverty.

- Aligns with India’s development policy: Since Independence, India had decided not to take any aid from any bilateral source. But it is open to take assistance from multilateral lending institutions to meet its funding requirements. In this regard, the Bank is ideally poised to meet India’s need.

- Funds India’s growth: The bank’s loans have been a conduit for major developmental activities in India. For India to keep up its growth, cooperation with World Bank is vital.

- Knowledge bank: The World Bank is a repository of ‘development expertise’, such as knowledge, experience and best-practices. The Bank also provides training, assistance, information, and other means that aids sustainable development in India.

- Prevent global economic disasters: The 2008 has resulted in a greater focus on the global economy. Hence, an international institution like WB is essential to scan the horizon for potential crises and deal with them to prevent contagion.

- Address global problems: The bank provides a forum for forging holistic approaches and promoting dialogue among actors towards addressing global issues such as climate change. Without the World Bank, efforts by a variety of actors at addressing global issues would remain fragmented.

- Inclusive multilateralism: World Bank is a vital institution that ensures the growth of a rule based multilateral world order. With protectionism and regionalism on the rise, such an institution is vital for the survival of inclusive multilateralism.

CRITICISM OF WORLD BANK:

- Under-representation of Global South: Despite being major beneficiaries, the developing countries have limited role in decision making. The distribution of voting power remains severely imbalanced in favor of the US, European countries and Japan. The US, with its majority in shares, holds an effective veto in decision making.

- Conditional loans and biases: The bank often make the loan conditional on the implementation of its Structural Adjustment Programme, such as fiscal consolidation and liberalisation. This undermine the sovereignty of borrower nations, limiting their ability to make policy decisions and eroding their ownership of national development strategies.

- Undermines democratic ownership: The system allows the largest shareholders to dominate the vote, resulting in the policies being decided by the rich, but implemented by the poor. It has also been criticized for the role played by the important shareholders in its decision-making and choice of interventions, including its support to dictatorships.

- Neo liberal policies: The bank, along with IMF pushes for liberalization, privatization and free market capitalism irrespective of the country they are helping. But this one-size-fits-all approach will not always be suitable for the situation of the country.

- Opaque decision-making: The IFC investments in financial institutions are opaque. The lack of public disclosure of these investments makes it difficult for communities and civil society to evaluate the operations of the bank.

- Undermining climate goals: The growth-based approach of the Bank continues to fund a considerable number of fossil fuel projects and mega-infrastructure projects such as dams. This undermines the global efforts towards sustainable development and abating climate change.

- Rise of regional development banks: Regional MDBs such as AIIB and New Development Bank (NDB) have been successful in catering to the needs of countries. These organisations are more democratic and the developing world has a better say in them.

- Violation of human rights: The World Bank funded projects have often resulted in mass evictions and forced displacements. Also, labour unions have long opposed the banks’ systematic weakening of labour rights either directly through conditionality or indirectly through policy advice.

WAY FORWARD:

- The coronavirus pandemic and the subsequent economic crisis is an ideal scenario for the World Bank to fulfill the explicit purpose for which it was created.

- Major reforms, which have been long pending, are essential to bring back the lost faith in the institution. The reforms should reflect the increasing role of emerging market and developing countries such as India. It should include a more democratic & transparent decision-making process and retreatment from ‘one-size-fits-all’ approach in lending.

- Due to its credibility in the global governance forum, India has a key role to play in initiating reforms as well as creating consensus among the global north and south.

For a world in which global challenges are on the rise and in which there is an urgent need for international cooperation to overcome distrust, discord and disorder, an institution such as World Bank has a key role to play.

PRACTICE QUESTION:

Q. The coronavirus pandemic has raised questions over the effectiveness of global governance institutions. In this regard, critically examine the relevance of World Bank in a post-covid world?