MSME SECTOR IN INDIA

2020 NOV 10

Mains >

Economic Development > Indian Economy and issues > MSMEs

WHY IN NEWS:

- Government of India launched the technology platform - CHAMPIONS on 1st June 2020 for making the smaller units big by solving their grievances, encouraging, supporting, helping and handholding. It is a real one-stop-shop solution of MSME

SIGNIFICANCE OF MSME SECTOR:

- Indian MSME sector is the backbone of the national economic structure and acts as a bulwark for Indian economy, providing resilience to ward off global economic shocks and adversities.

- They are accepted as growth engine of India and source of equitable development:

- In India, at present, there are 55.8 million enterprises in various industries, employing close to 124 million people.

- Of these, nearly 14 per cent are women-led enterprises, and close to 59.5 per cent are based in rural areas.

- In all, the MSME sector accounts for 31 per cent of India’s GDP and 45 per cent of exports.

- It is the second largest employment generating sector after agriculture.

- MSME ministry has put a target to up its GDP contribution by 50% by 2025

- Inclusive growth:

- MSMEs promotes growth in rural areas and generate employment especially for weaker sections of society

- Eg: Khadi and Village industries require low per capita investment and employ a large number of women in rural areas.

- Financial inclusion:

- Small industries and retail businesses in tier-II and tier-III cities create opportunities for people to use banking services and products.

- Promote innovation:

- It provides opportunity for budding entrepreneurs to build creative products boosting business competition and fuels growth.

CONCERNS:

- Lack of adequate and timely access to credit:

- Lack of adequate and timely access to finance continues to remain the biggest challenge for MSMEs

- 90% of the MSMEs are dependent on informal sources for funding

- Lack of sufficient collateral and high working capital needs

- Lack of access to markets:

- Low outreach and non-availability of new markets.

- Lack of skilled manpower and ineffective marketing strategy.

- Difficult for MSMEs to sell products to government agencies.

- Competition from MNCs and other big industries.

- Technology is a big issue for MSMEs.

- Limited human resources and weak financial standing.

- MSMEs, particularly in the unorganised sector, show lower adaptability of new technology and innovation.

- Quality and export issues:

- Low quality products impact export competitiveness.

- Inadequate access to quality raw materials.

- Use of traditional machines causes low productivity.

- Regulatory hurdles:

- GST has emerged as the biggest compliance issue before the MSMEs.

- Cumbersome government procedures and rules for establishing new units.

- It takes 69 days to register a piece of property and costs about 8% of its value in India. To compare New Zealand gets this done in a single day.

- Bureaucratic delays in getting clearances.

- Poor litigation system in the country.

STEPS TAKEN BY GOVERNMENT:

- FINANCE RELATED:

- Credit Guarantee Trust Fund for Micro and Small Enterprises:

- Collateral free loan up to a limit of ? 100 lakh is available for individual MSE on payment of guarantee fee to bank by the MSE.

- Both existing and new enterprises are eligible under the scheme.

- Launch of the 59 minute loan portal to enable easy access to credit for MSMEs.

- 2 percent interest subvention for all GST registered MSMEs, on fresh or incremental loans.

- Trade Receivables e-Discounting System (TReDS) to enable access to credit from banks, based on their upcoming trade receivables from corporate and other buyers.

- Udyami Mitra Portal:

- Launched by SIDBI to improve accessibility of credit and handholding services to MSMEs.

- Prime Minister Employment Generation Programme :

- It is a credit linked subsidy program under Ministry of MSME

- TO IMPROVE MARKET ACCESS:

- Increased public procurement:

- Mandatory procurement obligation:

- Public sector companies need to compulsorily procure 25%, of their total purchases, from MSMEs.

- GeM portal:

- More than 40,000 MSMEs registered on Government e-Marketplace (GeM) portal.

- It provides transparency in procurement and facilitates MSMEs to directly reach out to the buyers.

- MSME Sambandh:

- To monitor the implementation of the public procurement from MSMEs by Central Public Sector Enterprises.

- MSME Samadhaan:

- MSME Delayed Payment Portal will empower MSMEs across the country to directly register their cases relating to delayed payments by Central Ministries/Departments/CPSEs/State Governments.

- Government supported E-commerce platform – ‘Bharat Craft’:

- Union government announced to launch an e-commerce platform on the lines of “Amazon and Alibaba" to sell products from MSMEs and the Khadi and Village Industries Commission.

- TO IMPROVE PRODUCTIVITY AND COMPETITIVENESS:

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE):

- Creates new jobs and reduce unemployment, promotes entrepreneurship culture, facilitates innovative business solution etc.

- National Manufacturing Competitiveness Programme (NMCP):

- To develop global competitiveness among Indian MSMEs by improving their processes, designs, technology and market access.

- Micro & Small Enterprises Cluster Development Programme (MSE-CDP)

- Adopts cluster development approach for enhancing the productivity and competitiveness as well as capacity building of MSMEs.

- Financial assistance is provided for implementation of lean manufacturing techniques to enhance the manufacturing competitiveness of MSMEs.

- EXPORT PROMOTION AND QUALITY ENHANCEMENT:

- Financial support to MSMEs in ZED (Zero Defect Zero Effect) certification to improve quality of products.

- Government provides subsidy towards the expenditure incurred by enterprises to obtain the product certification licenses from national and international bodies.

- IMPROVING EASE OF DOING BUSINESS:

- The return under 8 labour laws and 10 Union regulations must now be filed only once a year.

- Computerised random allotment for inspector visits to the establishment.

- Environmental Clearance under air pollution and water pollution laws, have been merged into one. Also, the return will be accepted through self-certification.

- For minor violations under the Companies Act, the entrepreneur will no longer have to approach the courts, but can correct them through simple procedures.

- DIGITAL INITIATIVES:

- Digital MSME Scheme:

- It involves usage of Cloud Computing where MSMEs use the internet to access common as well as tailor-made IT infrastructure

- Udyog Aadhar:

- It is a twelve digit Unique Identification Number provided by the Ministry of MSME for MSME units

- CHAMPIONS portal:

- To assist Indian MSMEs by solving their grievances and encouraging, supporting, helping and hand holding them.

- It is a technology driven Control Room-Cum-Management Information System which utilises modern ICT tools.

- The system is also enabled by Artificial Intelligence, Data Analytics and Machine Learning.

- SIX MEASURES UNDER ATMA-NIRBHAR BHARAT ABHIYAN (ANBA):

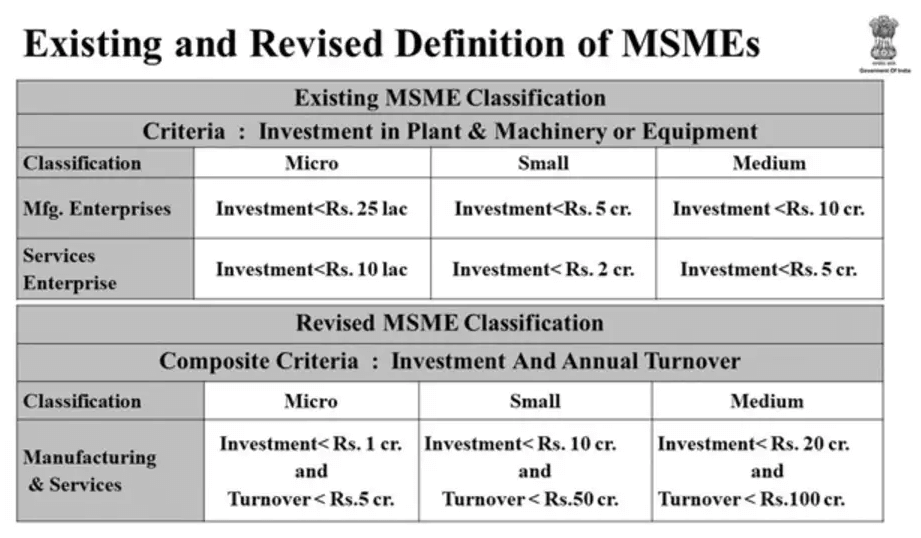

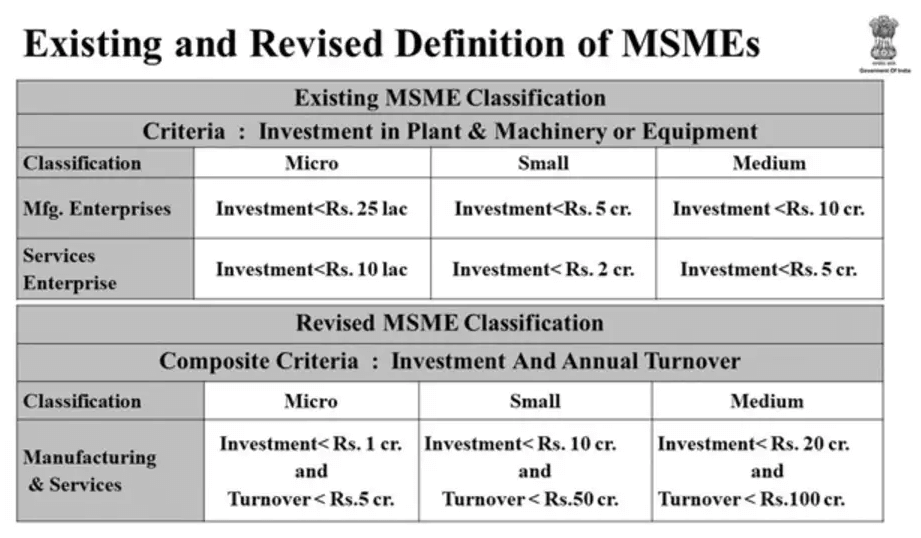

- Definition:

- Revising the definition of MSME under applicable law is intended to bring more MSME enterprises under the purview of being classified as MSMEs so that they can reap benefits associated with it

- Credit:

- The collateral-free automatic credit line and the subordinate debt to MSMEs.

- It will make it lucrative for risk-averse banks to resume lending operations as the government will act as 100 per cent guarantor on both the principal and the interest.

- The guarantee from the government will ease pressure on banks and other financial institutions as they will not have to make provisions in case the loan account turns into a non-performing one

- Capital infusion:

- The Finance Minister also announced the creation of ‘Fund of Funds’ with a corpus of Rs 10,000 crores where the government through the funds will pick up an equity stake in the MSMEs with growth potential and viability.

- These equity infusions will lead to increase in size and capacity of the MSMEs

- Marketing support:

- Online marketplace for MSMEs is intended to help all market participants, including end-consumer

- Import substitution:

- Steps for import substitution under ANBA will empower MSMEs to gain greater strength in domestic market

- DEVELOPMENT OF KHADI, VILLAGE AND COIR INDUSTRIES

- Revamped Scheme Of Fund for Regeneration Of Traditional Industries (SFURTI):

- Organizes traditional industries and artisans into clusters and make them competitive by enhancing their marketability and equipping them with improved skills.

- Coir Vikas Yojana (CVY)

- Skill Upgradation and Mahila Coir Yojana (MCY)

- Export Market Promotion (EMP)

- Domestic Market Promotion Scheme (DMP)

BEST PRACTICES:

- International:

- Micro and Small Enterprise (MSE) Development Programme of Thailand

- The programme helped them to alleviate poverty from more than 35% in 1995 to 8% in 2017

- Local:

- Odisha industrial development scheme

- Coir industry in Kerala – 85% of national coir products are contributed from MSMEs in Kerala

WAY FORWARD:

- Adopt best practices:

- MSME need to adopt best practises and follow international standards to go forward for offering innovative solutions.

- Technology transfer and upgradation:

- Concerted efforts are needed to appraise MSMEs of new developments and technologies and how these can be usefully employed by them keeping in view the local conditions, in the language and mode which the locals can understand and assimilate.

- Focus should be on transfer of information and skill development to effectively use the transferred technology.

- MSMEs need a lot of handholding on several fronts:

- Clusters of MSMEs spread all across the country may be listed out and Common Facility Centers may be established at each MSME cluster, which, besides extending other common facilities like maintenance and provision of common facilities, facilitating availability of raw materials, marketing support, easy movement of goods and services etc., can guide and help in safeguarding the Intellectual Property Rights of the entities.

- These centres can facilitate individuals and entities in obtaining patents in respect of new technologies/products/innovations, in a cost-effective manner.

PRACTICE QUESTION:

Q. “MSME sector has come to represent the ability of the Indian entrepreneur to innovate and create solutions despite the logistical, social, and resource challenges”. Elaborate?