NATIONAL STRATEGY FOR FINANCIAL EDUCATION (NSFE)

2020 AUG 24

Mains >

Economic Development > Indian Economy and issues > Financial inclusion

WHY IN NEWS:

- The Reserve Bank of India on 20th August 2020 released a National Strategy for Financial Education (NFSE) to be implemented in the next five years.

- It is the second NSFE, the first one being released in 2013.

BACKGROUND:

|

Financial Literacy:

According to OECD ‘Financial Literacy’ is defined as a combination of financial awareness, knowledge, skills, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being

Financial Education:

According to OECD ‘Financial Education’ is defined as the process by which financial consumers/investors improve their understanding of financial products, concepts and risks and through information, instruction and/or objective advice, develop the skills and confidence to become more aware of financial risks and opportunities, to make informed choices, to know where to go for help and to take other effective actions to improve their financial well-being

|

- Financial literacy supports the pursuit of financial inclusion by empowering the customers to make informed choices leading to their financial well-being.

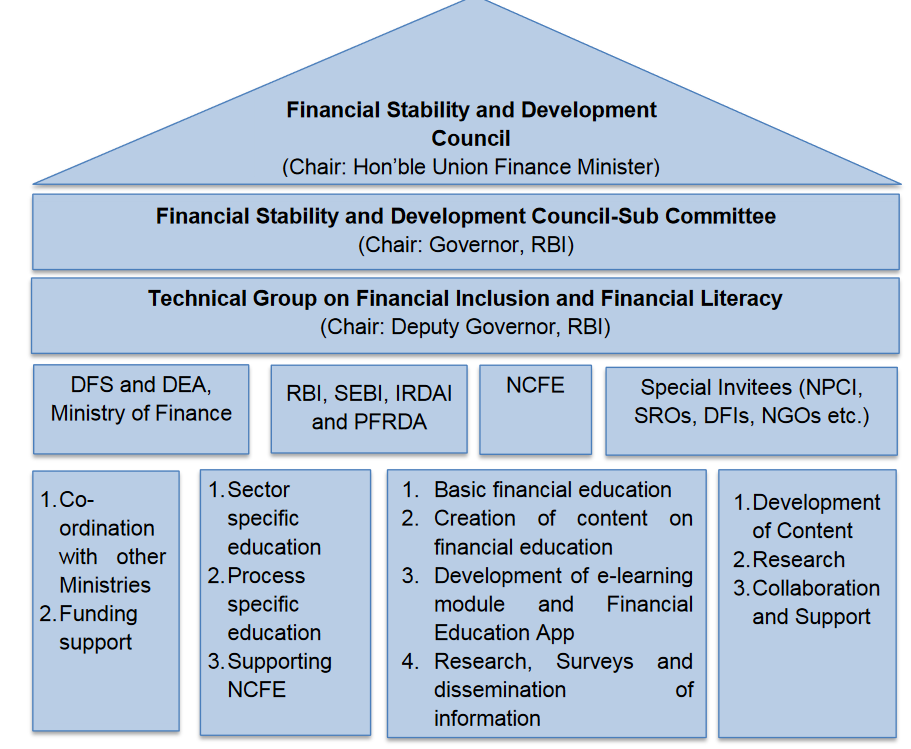

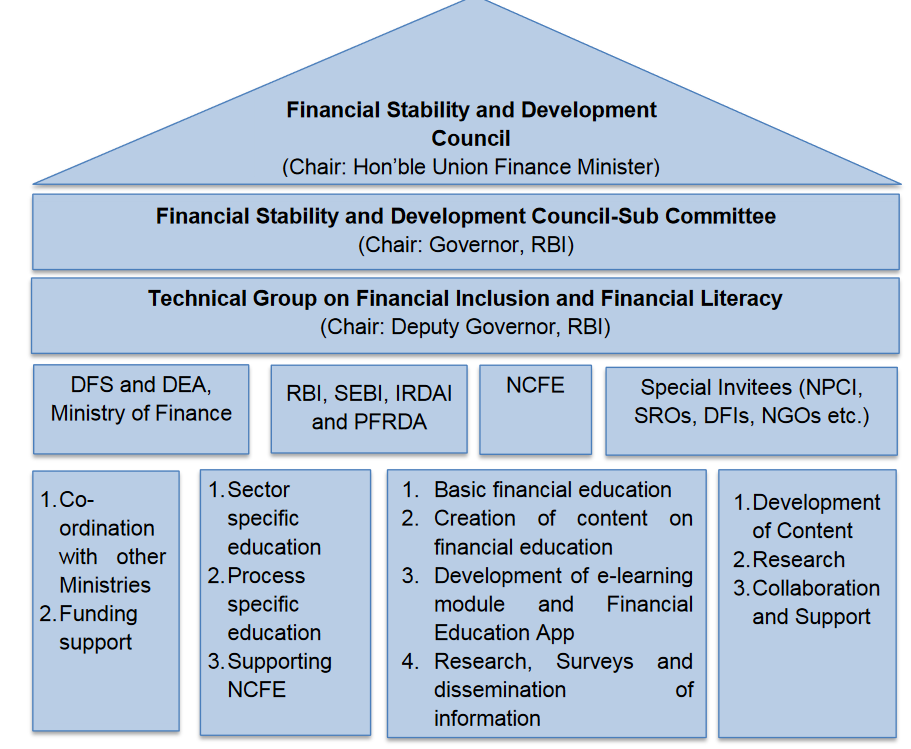

- NSFE for the period 2020-2025 has been prepared by the National Centre for Financial Education (NCFE) in consultation with all the Financial Sector Regulators viz. RBI, SEBI, Insurance Regulatory and Development Authority of India (IRDAI), Pension Fund Regulatory and Development Authority (PFRDA), etc. under the aegis of the Technical Group on Financial Inclusion and Financial Literacy (TGFIFL).

NEED FOR NFSE:

- Changing financial landscape:

- The financial service sector in India has undergone significant changes in the last 5 years and the sector has been ever widening.

- World Bank’s Findex 2017 Report had brought out that the proportion of adults with a formal account in the country has risen from 35% in 2011, to 53% in 2014, to 80% in 2017

- Over the last few years there is a paradigm shift in digital transactions and Payment Infrastructure in the country

- Poor financial literacy in India:

- According to a survey on Global Financial Literacy in 2012 conducted by VISA, only 35% of Indians were financially literate and India was among the least financially literate countries

- Financial illiteracy puts a burden on the nation in the form of higher cost of financial security and lesser prosperity.

- An example of this is the fact that most people resort to investing more in physical assets and short-term instruments, which conflicts with the greater need for long-term investments

- Increasing cyber financial crimes:

- A research released by Fidelity National Information Services(FIS) found that financial fraud in India has grown substantially since 2019, with the share of victims doubling to 37 percent of respondents, and all age segments falling victim to fraudsters

- Ensuring greater effectiveness of financial inclusion measures:

- Financial education plays a vital role in creating demand side response to the government initiatives towards financial inclusion

- To ensure economic security:

- Financial literacy enhances individuals’ ability to ensure economic security for their families.

ABOUT THE NSFE:

- It emphasizes a multi-stakeholder-led approach for empowering various sections of the population to develop adequate knowledge, skills, attitudes and behaviour which are needed to manage their money better and to plan for the future i.e. ensuring their financial well-being.

- To achieve this vision, the following Strategic Objectives have been laid down:

- (1) Inculcate financial literacy concepts among the various sections of the population through financial education to make it an important life skill

- (2) Encourage active savings behaviour

- (3) Encourage participation in financial markets to meet financial goals and objectives

- (4) Develop credit discipline and encourage availing credit from formal financial institutions as per requirement

- (5) Improve usage of digital financial services in a safe and secure manner

- (6) Manage risk at various life stages through relevant and suitable insurance cover

- (7) Plan for old age and retirement through coverage of suitable pension products

- (8) Knowledge about rights, duties and avenues for grievance redressal

- (9) Improve research and evaluation methods to assess progress in financial education

- In order to achieve the Strategic Objectives laid down, the document recommends adoption of a ‘5 C’ approach for dissemination of financial education

- The ‘5 C’ approach of strategy includes emphasis on:

- Content:

- Financial Literacy content for school children, teachers, young adults, women, new entrants at workplace/entrepreneurs (MSMEs), senior citizens, persons with disabilities, illiterate people, etc.

- Capacity:

- Develop the capacity of various intermediaries who can be involved in providing financial literacy.

- Develop a ‘Code of Conduct’ for financial education providers.

- Community:

- Evolve community led approaches for disseminating financial literacy in a sustainable manner.

- Communication:

- Use technology, mass media channels and innovative ways of communication for dissemination of financial education messages.

- Identify a specific period in the year to disseminate financial literacy messages on a large/ focused scale.

- Leverage on Public Places with greater visibility for meaningful dissemination of financial literacy messages.

- Collaboration:

- Preparation of an Information Dashboard.

SUGGESTIONS:

- Target Specific Modules:

- A one size fits all approach for delivering financial literacy results in sub-optimal outcomes.

- Target specific modules need to be developed for effective dissemination of financial literacy messages

- Contextual & Vernacular Approach:

- The language and mode of delivery of financial literacy messages should be appealing to the target audience in an easy to understand language.

- For example, Nukkad Natak (Street plays in local languages) was found to be an effective tool for delivering financial literacy.

- Learning While Doing & Peer-to-Peer Learning:

- Learning is long lasting when accompanied by a hands-on effort/ demonstration besides repetitive relaying of messages.

- For example, practical training on usage of digital financial transaction using mobile vans (Digital Vans) etc.

- Efficacy in Mass Media Outreach:

- Among mass media campaigns, messages broadcast through television had the highest recall among the audience as compared to other modes of broadcasting.

- Rationalising Stakeholder Collaborations:

- Collaboration among all the stakeholders of financial education is important.

- For example, RBI is piloting the concept of Centre for Financial Literacy (CFL) which aims to leverage the strengths of banks and NGOs to explore innovative channels for delivery of financial literacy.

- Similarly, SEBI is undertaking investor education program in collaboration with Stock Exchanges and Depositories for delivery of financial literacy.

- Creating Positive Behavioural Outcomes:

- More efforts are needed to understand how financial education programmes can be curated to translate into positive behavioral outcomes.

- Financial literacy messages when co-related with real life events (e.g. marriage, parenting) seem to have higher connect to various target audiences

CONCLUSION

- India has made tremendous progress in bringing its citizens into the formal financial system over the last many years.

- Since India’s first NSFE was released in 2013, there have been many developments in the financial inclusion scenario of the country.

- During this period, important financial inclusion initiatives by Government of India such as Pradhan Mantri Jan-Dhan Yojana (PMJDY), social security schemes viz. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Pradhan Mantri Kisan Maan Dhan Yojana (PMKMY), Pradhan Mantri Shram Yogi Mann Dhan Yojana (PM-SYM) and Pradhan Mantri Mudra Yojana (PMMY) have changed the financial inclusion landscape.

- However,the country still needs to tread a long path to achieve a respectable financial literacy rate which is crucial for inclusive growth.

ADD ON:

- RBI had earlier released the National Strategy for Financial Inclusion (NSFI) for the period 2019-2024.

- It prepared under the aegis of the Financial Inclusion Advisory Committee.

- It aims to strengthen the ecosystem for various modes of digital financial services in all Tier-II to Tier VI centres to create the necessary infrastructure to move towards a less-cash society by March 2022.

PRACTICE QUESTION:

Q. Explain the major components of National Strategy for Financial Education (NFSE). How far the financial education programmes can contribute to socio-economic development in India?