NEW DEVELOPMENT BANK

2022 JAN 3

Mains >

International relations > International Institutions > Development Banks

WHY IN NEWS?

- India on December 30,2021 welcomed Egypt's entry as the 4th new member to the New Development Bank (NDB). NDB had admitted Bangladesh, UAE & Uruguay as its 3 new members in September,2021.

HISTORY OF NDB

- 2012:

- At the 4th BRICS Summit in New Delhi (2012), the leaders of Brazil, Russia, India, China & South Africa considered setting up a new Development Bank to mobilize resources for infrastructure & sustainable development projects in BRICS & other emerging economies.

- 2014:

- At the 6th BRICS Summit in Fortaleza, Brazil (2014), the leaders signed the Agreement establishing the New Development Bank (NDB).

- 2015: NDB formally came into existence. Its headquarters is at Shanghai, China.

- Initial authorized capital was US$ 100 billion. The initial subscribed capital shall be US$ 50 billion, equally shared among founding members.

- Voting power depends on subscribed share capital. No country has any veto power.

- 2018:

- NDB received observer status in United Nations General Assembly, establishing a firm basis for active and fruitful cooperation with the UN.

AIMS

- To mobilise resources for infrastructure and sustainable development projects in emerging economies.

- To complement the efforts of multilateral and regional financial institutions, toward global growth and development.

ORGANIZATION

a) MEMBER COUNTRIES

- NDB) was established in 2015 by BRICS countries

- Bank’s membership is open to members of the United Nations

- The recent membership expansion is in line with its strategy to become the premier development institution for emerging economies and developing countries.

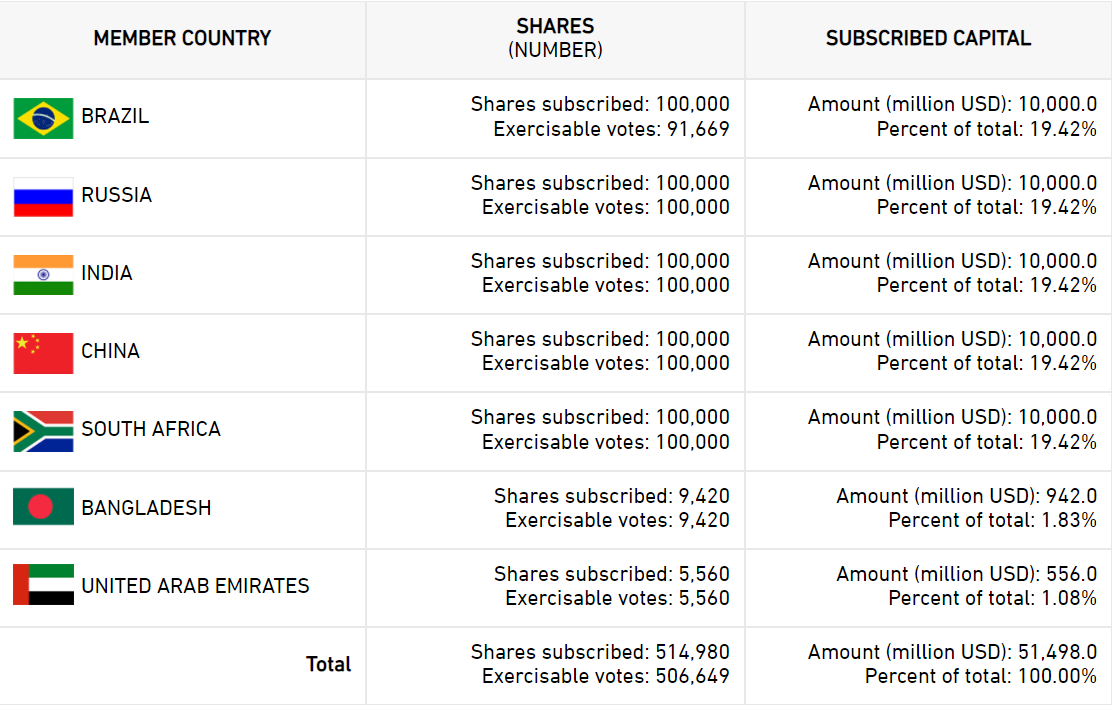

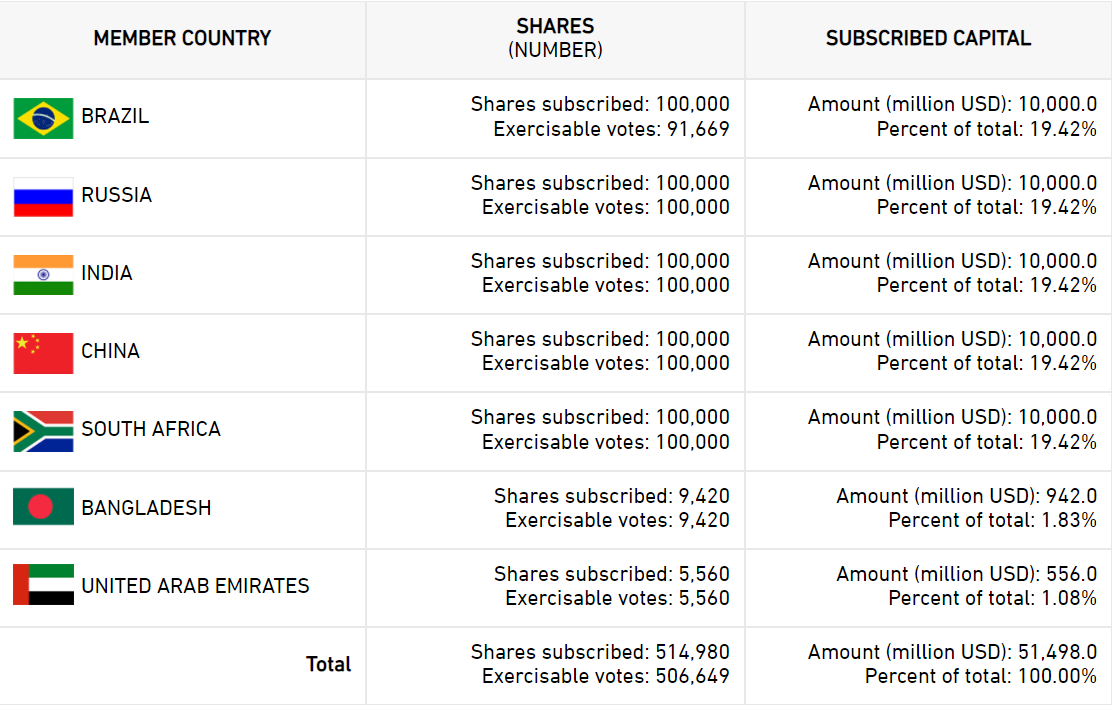

b) SHAREHOLDING AT NDB (As of October 4 ,2021)

c) GOVERNANCE

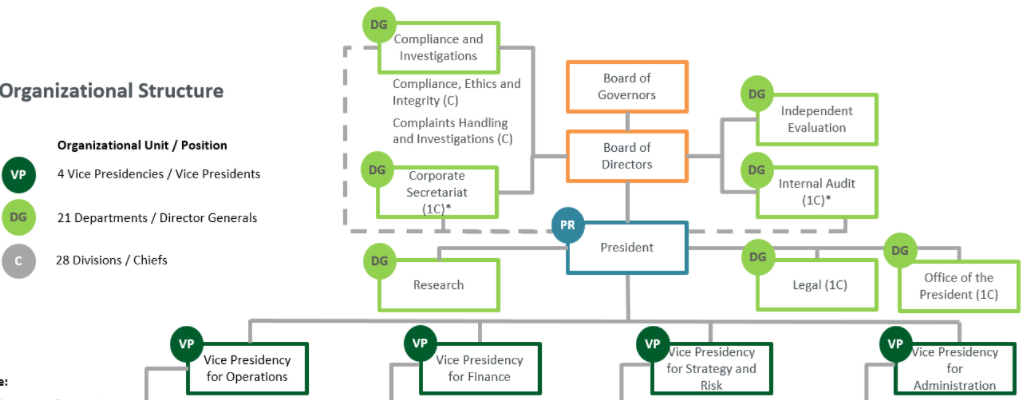

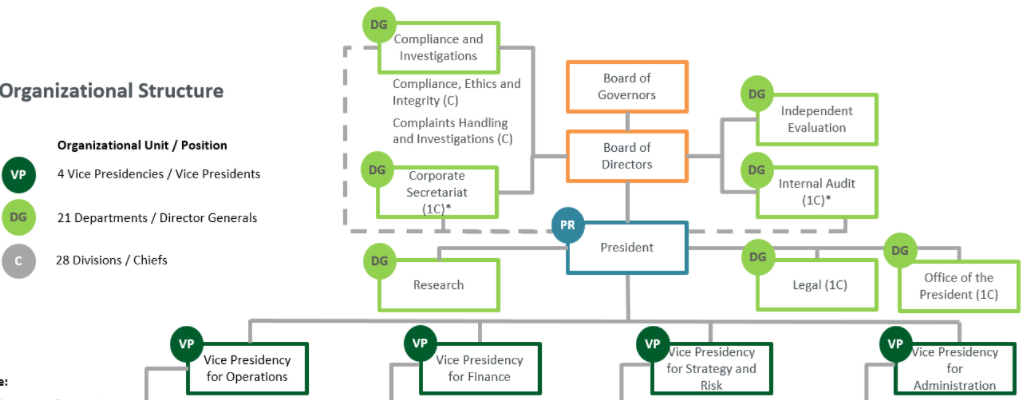

According to the Articles of Agreement, the main organs of the bank are:

- Board of Governors: Bank’s highest authority, composed of one Governor and an alternate Governor appointed by each member

- Board of Directors: It is responsible for the direction of the general operations of the Bank. Each member has representation in the form of Director and alternate director.

- President: Board of Governors elects a President from one of the founding member countries on a rotational basis. The President is the chief of the operating staff of the NDB, conducting, under the direction of the Directors, the ordinary business of the Bank.

- Vice-Presidents: Four Vice Presidents preside over functioning of the bank under 4 heads - Operations, Finance, Strategy and Risk, Administration.

HOW NDB WORKS?

- Supports public or private projects through loans, guarantees, equity participation and other financial instruments.

- Provides technical assistance for projects and engages in information, cultural and personnel exchanges with the purpose of contributing to the achievement of environmental and social sustainability.

- Collaborate with other MDBs, governments, ?nancial institutions and social organizations.

AREAS OF OPERATION

- NDB has so far approved about 80 projects in all of its member countries, totalling a portfolio of USD 30 billion.

- NDB funded projects are located within the following key Areas of Operation:

ACHIEVEMENTS:

- Loans:

- NDB’s infrastructure loans have covered sectors from transport to renewable energy, water and urban renewal. A major recepient

- Sustainable investments:

- It is prioritizing investments in renewable energy, energy efficiency, sustainable waste management and clean transportation.

- Credit Rating:

- NDB has top credit ratings(A++) from international credit rating agencies. Bonds issued by high rated institutions have the highest credit quality i.e. the smallest risk of default.

- Local currency financing:

- NDB has successfully registered local currency bond programs in China, South Africa and will soon roll out in currencies of other member countries. This will protect borrowing countries from a stronger dollar.

- Breaking hegemony:

- The bank aims to break the hegemony of financing structures created by developed countries and embodied by the International Monetary Fund (IMF) and World Bank.

- Emergency relief:

- NDB extends relief at times of crisis. Eg: The bank had fully disbursed USD 1 billion loan to India under emergency assistance programme in 2020, to support the government in containing the COVID-19 outbreak and reduce human, social and economic losses.

- Partnership with other Development Banks:

- Such as Latin American regional development bank CAF, China-led Asian Infrastructure Investment Bank.

CHALLENGES

- Low level of Loan disbursal:

- Amounts disbursed as loans against the loans sanctioned is very low when compared to other multilateral institutions.

- External factors affect bank’s activities:

- Bilateral strains and other geopolitical events are affecting the smooth operation of the agency.

- Eg: Political and military conflicts between India and China, US sanctions on Russia made it difficult to lend to Russian companies and Political & economic instability in South Africa and Brazil made operations difficult in these countries.

- Environmental sustainability:

- There has been criticism that some of the projects in Brazil and India categorised as sustainable, projects that are not sustainable to the environment

- Eg: Trans-Amazonian highway in Brazil >> environmentalists blame it for exacerbating deforestation in the world’s largest tropical rainforest.

- Eg: In India, a road modernization project in Madhya Pradesh is suspected for land grabbing and property destruction.

- Lack of Transparency and accountability:

- Failure to consult the stakeholders directly impacted by the projects as well as failure to disclose project documents and social-environmental assessments can compromise the bank’s development impact.

- Protectionism:

- Recent worrying trends of protectionism and more inward-looking policies from various countries will pose a challenge to the bank’s expansion activities.

NDB IN INDIA:

- The Centre had recently decided to give nod to the setting up of the New Development Bank’s Indian regional office at the GIFT SEZ IFSC (International Financial Services Centre), in Gandhinagar.

- The NDB has so far approved 14 Indian projects for an amount of nearly USD 4.2 billion. Examples:

- Mumbai Metro rail

- Delhi-Ghaziabad-Meerut Regional Rapid Transit System

- Himachal Pradesh Rural Water Supply Project

- Renewable Energy projects

- Andhra Pradesh Road Sector Project

- In 2020, India announced a 1 billion USD loan pact with NDB to boost rural employment and infrastructure.

CONCLUSION:

The creation of the BRICS bank is rooted in the real and continuing power shift in the international system from the developed industrialized world towards emerging market economies. In this sense, the bank is a physical expression of the desire of emerging markets to play a bigger role in global governance.

In the initial years, its lending activities were directed towards governments and state-owned enterprises. The focus is now shifting towards lending to the private sector and expanding the products beyond loans to include equity, guarantees and credit enhancement.

PRACTICE QUESTION:

Q. The creation of the New Development Bank by the BRICS nations was an act of great foresight. Discuss?