NPA Crisis In India

2021 JUN 22

Mains >

Economic Development > Indian Economy and issues > Banking sector

WHY IN NEWS:

- With a number of large banks and NBFCs facing fresh challenges posed by the second COVID wave, analysts estimate that non-performing assets (NPAs) will jump from 8 per cent in 2020-21 - helped by restructuring, write-offs and regulatory relaxations including a loan moratorium - to 13-15 per cent in 2021-22

WHAT IS NON PERFORMING ASSET (NPA)?

- A Non-Performing Asset (NPA) refers to a classification for loans or advances that are in default or in arrears.

- It is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- While 90 days is the standard, the amount of elapsed time may be shorter or longer depending on the terms and conditions of each individual loan.

- For agricultural loans, if the interest and/or the installment or principal remains overdue for two harvest seasons; it is declared as NPAs. But, this period should not exceed two years. After two years any unpaid loan/installment will be classified as NPA.

- Banks are required to classify NPAs into three:

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.

STATISTICS

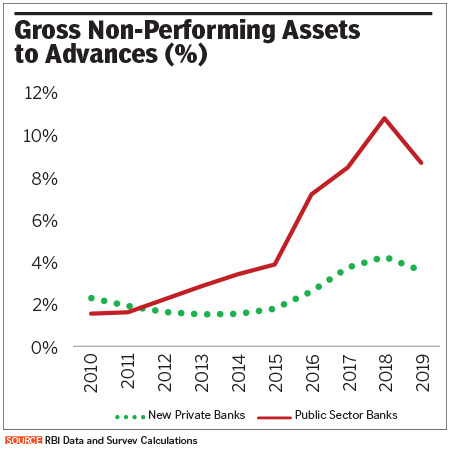

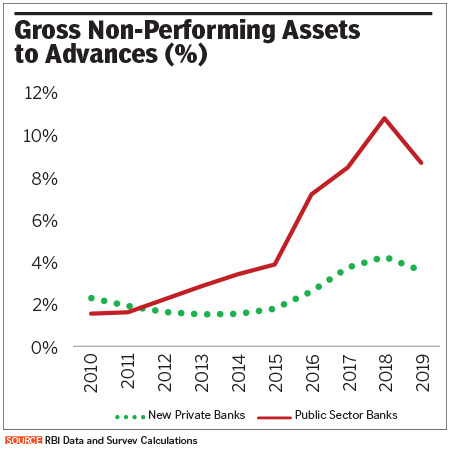

- Gross NPAs of banks (as a percentage of total loans) have increased from 2.3% of total loans in 2008 to 11.5% in 2017

- India’s NPA ratio saw a surge in 2016 after the RBI carried out an expansive Asset Quality Review >> The review resulted in identification of many large loan accounts which had gone bad resulting in a huge jump in NPAs in India

- However, the share of Gross Non-Performing Assets (GNPAs) among total loans declined to 9.1% in FY19 after having risen for seven consecutive years.

- In light of the pandemic, the Financial Stability Report (FSR) of the RBI in July 2020 presented a grim picture of the status of NPAs in India >> It stated that situation posed by COVID-19 could result in the Gross NPAs increasing to 12.5 percent by March 2021 as against 8.5 percent in March 2020.

- As per Standard and Poor's estimates >> Gross NPA could rise to 13-14 percent for India in 2021.

- India’s Non-Performing loans ratio (%) is the worst among emerging economies.

BACKGROUND

- The problem of NPAs is not new for India's banking sector.

- Since the reforms of 1991, India has had two episodes of NPA problems, one during 1997-2002 and the current one after the global financial crisis of 2008.

- The problem of NPAs in the current episode started around 2010 and aggravated after 2013.

- The current crisis has following characteristics:

- Crisis has been accompanied by other Macroeconomic problems:

- The NPA problem this time has been broad based and has coincided with slowing economic growth, leading to generation of issues like Twin Balance Sheet Problem (TBS).

- Broad based crisis:

- The current NPA crisis facing banks in India is much larger than the previous one.

- GNPAs have ranged from 9.5% in 2017 to 7.5% in 2020 and moving towards 13.5% in the wake of COVID-19 (as per RBI's Financial Stability Report).

- The significant increase observed after 2015 could be on account of the implementation of the Asset Quality Review which made banks recognize and report stressed assets.

- Disproportionate share of Public Sector Banks:

- About 9/10th of NPAs are from loans and advances of public sector banks.

- For instance, NPAs in the State Bank of India alone constitute close to 1/5th of the total NPAs in the Banking system

- Dominated by the infrastructure sector:

- Close to half of the Gross NPAS (GNPAs) can be attributed to the infrastructure sector.

REASONS FOR NPA ISSUE IN INDIA

- Economy related issues:

- Economic crisis of 2008:

- Between early 2000’s and 2008 Indian economies were in the boom phase.

- During this period banks lent extensively to corporate.

- However, the profits of most of the corporate dwindled due to slowdown in the global economy >> due to global financial crisis of 2008

- This is further aggravated by internal issues like ban in mining projects, and delay in environmental related permits, volatility in prices of raw material and the shortage in availability.

- This has affected their ability to pay back loans and is the most important reason behind increase in NPA of public sector banks.

- Unforseen economic shocks

- Like demonetization of 2016 and lockdown induced economic slowdown due to Covid 19

- Due to the lockdown imposed >> proportion of banks’ gross NPAs is expected to rise sharply from 7.5% of gross advances in 2020 to 13.5% of gross advances in 2021

- Economic shocks due to natural reasons such as floods, droughts, disease outbreak, earthquakes etc. also acts as major driver of NPAs

- Structural issues in economy:

- NPAs can also be attributed to poor ease of doing business in India >> which results in time and cost overruns in projects

- Inflation:

- Persistently high inflation erodes the real value of money and creates cost overruns for economic projects. As a result, rising inflation indirectly aids creation of NPAs.

- Growth rate:

- The NPAs growth is inversely related to the GDP growth i.e. Low GDP growth translates in to higher NPAs

- India’s GDP witnessed a contraction of 7.3 per cent for the fiscal year 2020-21 due to Covid pandemic >> this will result in increase in NPAs

- Administrative issues:

- Policy paralysis

- Mis-governance and policy paralysis >> hampers the timeline and speed of projects, therefore, loans become NPAs.

- For example: Infrastructure Sector

- Lax from the side of lending institutions:

- Banks relaxed lending norms especially for the corporate without properly analyzing their financial status and credit rating. Also, to face competition banks sold unsecured loans, which today form a crucial share of NPAs.

- Banks did not conducted adequate contingency planning, especially for mitigating project risk.

- Lapses in the initial borrower pre-sanction process and inefficiencies in post-disbursement monitoring have played a key role in the NPA mess.

- Ever-greening:

- When the project for which the loan was taken started underperforming, borrowers lost their capability of paying back the bank.

- The banks at this time took to the practice of ‘evergreening’, where fresh loans were given to some promoters to enable them to pay off their interest.

- This effectively pushed the recognition of these loans as non-performing to a later date, but did not address the root causes of their unprofitability

- Laxity on part of financial regulators

- It is noticed that there is absolute laxity on the part of the RBI as the banking regulator, especially, when it comes to having in place effective steps to pre-empt and prevent slippages in the asset quality well in time long before the advances turn out to be ‘bad’ or ‘NPA’.

- Lack of easier exit option:

- As per the Industrial Disputes Act >> a firm with 100 or more workers requires permission from the state government for retrenchment, closures and layoffs.

- For state governments to grant approval for closure and retrenchment, political will and backing are required.

- Thus, for a business tending towards industrial sickness, exiting from the industry is a long and tedious process.

- For companies which are operating at their 'shut-down' points and not being able to also recover their variable costs, it is advisable for them to close operations.

- However, the lengthy process of initiating closure formalities discourages the promoter from closing down and he/she opts for the easier path of borrowing more from banks, thereby getting into a debt trap resulting in higher NPAs for the banking industry

- Issues with Public Sector Banks

- Obligation to fulfill social obligations

- PSBs are forced to lend to certain sectors even if they come with higher risk >> due to government agenda

- Political interference in decision making

- PSBs are subjected to political decisions because government hold largest stake in those banks >> this results in inefficient lending practices, continuance of unprofitable branches etc.

- Failures in corporate sector:

- High optimism:

- Unplanned expansion of corporate houses during boom period and loan taken at low rates later being serviced at high rates, therefore, resulting into NPAs

- Corporate frauds:

- Recently there have been frauds of high magnitude that have contributed to rising NPAs.

- Corporate collusion with senior bank officials has resulted in the issue of unsecured loans of large denominations.

- As per RBI Annual Report, 2020 >> total number of cases of fraud (minimum size of ?1 lakh) at banks and financial institutions rose 28% by volume

- For ex: Punjab National Bank scam >> It relates to issuance of fraudulent letter of undertaking to a billionaire jeweller Nirav Modi

- Diversification of funds to unrelated business

- Diversion of funds by corporates to unrelated activities through fraudulent means is one of the primary reasons for the rising non-performing assets in the banking and financial services industry

IMPACT OF NPAs

- Affect banking sector:

- Lenders suffer a lowering of profit margins >> as they stops earning income from bad loans and attract high provisioning

- Lower availability of credit

- Stress in banking sector causes less money available to fund other projects, therefore, negative impact on investment and hence reduce growth in overall economy >> also result in increased unemployment

- Detrimental to business:

- Banks may be forced to charge higher interest rates on loans due to decreased profit margin >> cost of investment increases >> affects business growth

- Weak monetary policy transmission:

- High incidence of non-performing assets in banks may weaken monetary policy transmission.

- This is because better asset quality the banks' lending channels and helps in smoothening the transmission of monetary policy.

STEPS TAKEN TO TACKLE NPAs

- Remedial measures

- 5:25 scheme of RBI

- RBI had first introduced this flexible financing scheme 2014.

- Popularly known as the 5:25 scheme, it allows banks to extend long-term loans of 20-25 years to match the cash flow of projects, while refinancing them every five or seven years.

- Joint Lenders Forum, 2014

- It was created by the inclusion of all PSBs whose loans have become stressed.

- It is present so as to avoid loans to the same individual or company from different banks.

- It is formulated to prevent instances where one person takes a loan from one bank to give a loan of the other bank.

- Strategic debt restructuring (SDR), 2015

- Under this scheme banks who have given loans to a corporate borrower gets the right to convert the complete or part of their loans into equity shares in the loan taken company.

- Its basic purpose is to ensure that more stake of promoters in reviving stressed accounts and providing banks with enhanced capabilities for initiating a change of ownership in appropriate cases.

- Sustainable structuring of stressed assets (S4A) – 2016

- It has been formulated as an optional framework for the resolution of largely stressed accounts.

- It involves the determination of sustainable debt level for a stressed borrower and bifurcation of the outstanding debt into sustainable debt and equity/quasi-equity instruments which are expected to provide upside to the lenders when the borrower turns around.

- Insolvency and Bankruptcy code Act-2016

- With its time bound procedures, the IBC has paved the way for a better and more efficient mode for recovery of debts.

- Non-performing asset recovered by scheduled commercial banks by way of Corporate Insolvency Resolution Process under the IBC increased to about 61 per cent of the total amount recovered

- National Asset Reconstruction Company Ltd (NARCL)

- It is the name coined for the bad bank announced in the Budget 2021-22

- It is expected to be operational in June 2021

- Bad bank refers to a financial institution that takes over bad assets of lenders and undertakes resolution.

- It could help improve bank lending not by shoring up bank reserves, but by improving banks’ capital buffers

- Project Sashakt

- It was launched on the recommendations of Sunil Mehta Committee.

- It helps to consolidate stressed assets.

- Under this, Bad loans of up to ? 50 crore will be managed at the bank level, with a deadline of 90 days.

- For bad loans of ? 50-500 crore >> banks will enter an inter-creditor agreement, authorizing the lead bank to implement a resolution plan in 180 days, or refer the asset to NCLT.

- For loans above ? 500 crore >> the panel recommended an independent Asset Management Company, supported by institutional funding through the Alternative Investment Fund.

- Recognition of NPAs

- Asset Quality Review 2015

- RBI) has conducted an asset quality review with a view to cleaning up balance sheets of banks.

- This was conducted because RBI believed that asset classification was not being done properly and that banks were resorting to ever-greening of accounts

- Bad loans in the Indian banking system jumped 80 per cent in FY16, according to RBI data, mainly on account of the AQR.

- Prompt corrective action

- PCA is a framework under which banks with weak financial metrics are put under watch by the RBI.

- The RBI introduced the PCA framework in 2002 as a structured early-intervention mechanism for banks that become undercapitalised due to poor asset quality, or vulnerable due to loss of profitability.

- For example: RBI had placed IDBI Bank under the framework in May 2017 (removed it in 2021)

- Tackling corporate fraud:

- Fugitive Economic Offenders Act, 2018:

- It empowers any special court (set up under the Prevention of Money Laundering Act, 2002) to confiscate all properties and assets of economic offenders who are charged in offences measuring over INR 100 crores and are evading prosecution by remaining outside the jurisdiction of Indian courts.

- National Financial Reporting Authority (NFRA)

- It recommends accounting and auditing policies and standards to be adopted by companies >> thereby ensuring due diligence in obtaining credit >> hence reducing the risk of debt default.

- Reforming banking sector:

- Bank consolidation:

- In 2021, the government of India merged 10 Public Sector (PSU) Banks into 4 banks.

- With this, the number of public sector banks in India will come down to 12 from 27 in 2017

- Merger enables combined business and capital >> hence a lower gross NPA ratio

- Recapitalization of banks:

- Bank recapitalisation, means infusing more capital in state-run banks so that they meet the capital adequacy norms.

- The government, using different instruments, infuses capital into banks facing shortage of capital

- In October 2017, Government announced a massive Rs 2.11 lakh crore bank recapitalisation programme

- In 2019-20 Budget government had proposed Rs 70,000 crore capital infusion into PSBs, and in 2021-22 Budget, the government had proposed further Rs 20000 crore

- Mission Indradhanush 2015

- It is a 7 point reforms to revamp public sector banks and its performance, such as:

- Appointments:

- Besides induction of talent from the Private Sector into the public banks, separation of the posts of Chief Executive Officer and the Managing Director, in order to check the excessive concentration of power and smooth functioning of the banks.

- Bank Boards Bureau:

- The appointments Board of the Public Sector Banks would be replaced by the Bank Boards Bureau (BBB).

- Advice would be rendered to the banks in the matters of raising funds, mergers and acquisitions etc by the BBB.

- It would also hold the bad assets of the Public Sector Banks.

- The BBB separates the functioning of the PSBs from the government by acting as a middleman.

- Capitalisation:

- Due to the high NPAs and the need to meet the provisions of the Basel III norms, capitalization of banks are carried out through budgetary allocations.

- De-stressing:

- Solving issues arising in the infrastructure sector in order to check the stressed assets in the banks by strengthening the asset reconstruction companies.

- Development of a vibrant debt market for PSBs.

- Empowerment:

- Providing greater flexibility and autonomy to PSBs in hiring manpower.

- Framework of Accountability:

- The assessment of the banks would be based on a few key performance indicators

WAY FORWARD

- Enabling environment facilitating smooth entry and exit for firms

- This would ensure that firms which are tending towards industrial sickness and being non-performing have policy measures to take recourse to and enable them for a smooth exit option

- Hence saves firms from further debt trap

- Structural reforms in the financial ecosystem

- For ex: with Know Your Customer (KYC) norms in place, it is possible for banks to ensure that their customers have the capacity to service the loan.

- Bankers should be consistently monitoring and assessing risks associated with their customers through the KYC norms and taking action accordingly.

- Adequate functional autonomy to banks

- So that they can ensure that NPAs are kept to a minimum.

- RBI’s suggestion for reducing shareholding of the government in public sector banks to 26 percent is worth serious deliberations.

- Political discretion in loan allocations should be discouraged and all efforts should be aimed at curbing cronyism.

- Accountability:

- Junior executives are often made accountable for lapses, however, major decisions are made by the Credit Sanction Committee consisting of senior-level executives.

- Hence it’s important to make senior executives accountable, if PSBs need to tackle NPAs.

- Corporate Governance:

- Even though, the government had set up Banks Board Bureau in April 2016 to attract talent, corporate governance hasn’t improved to the desired level with certain issues persisting and need to be resolved urgently.

- Integration with financial system:

- Creating links between sub-sectors of banking sector such as Fin-Tech and NBFCs are vital for resolution of NPAs

- Credit Risk Management:

- Proper credit appraisal of the project, creditworthiness of clients and their skill and experience should be carried out.

- While conducting these analyses, banks should also do a sensitivity analysis and should build safeguards against external factors.

- Effective Management Information System (MIS) needs to be implemented to monitor early warning signals about the projects.

- Use of technology:

- Machine Learning (ML), Artificial Intelligence (AI) as well as Big Data and matching provide banks the ability to recognize patterns quickly by analysing vast datasets >> It could help in prevention of NPAs

PRACTICE QUESTION:

Q. Discuss the steps taken by Government to improve the capital position of public sector banks in India. Also analyze how such steps would help in addressing the challenge of non-performing assets in the banking sector