Review of five years of GST

2022 JUL 5

Mains >

Economic Development > Indian Economy and issues > Goods and Servies tax

IN NEWS:

- 1st July 2022 marked five years of implementation of the goods & service tax (GST) regime.

WHAT IS GST?

- The Goods & Services Tax (GST) in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

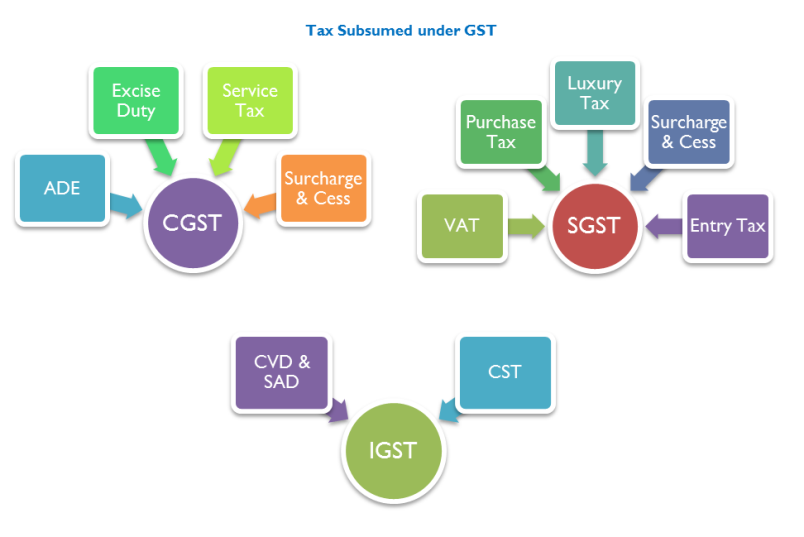

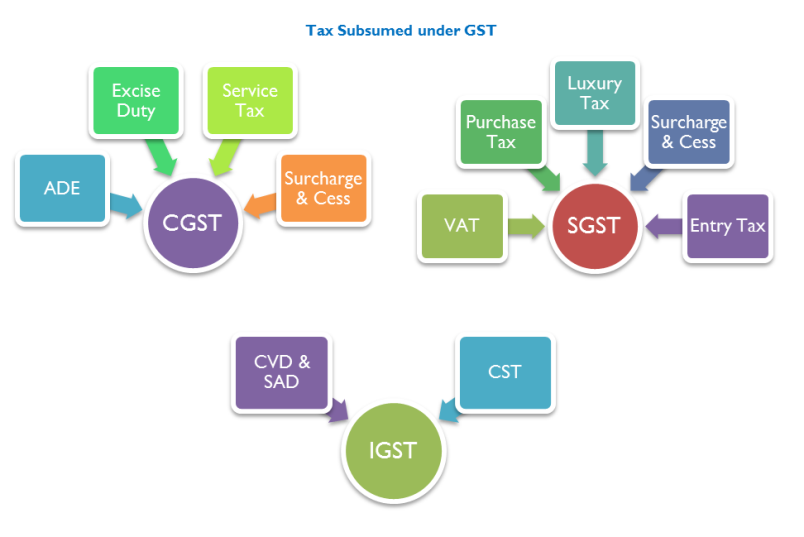

- It is an Indirect Tax which has replaced many Indirect Taxes in India.

- GST is a dual levy where the Central Government will levy and collect Central GST (CGST) and the State will levy and collect State GST (SGST) on intra-state supply of goods or services.

- The Centre will also levy and collect Integrated GST (IGST) on inter-state supply of goods or services.

- CGST collected is appropriated by the Centre, SGST is shared to the states while IGST is shared between the Centre and the states.

- Another very significant feature of GST will be that input tax credit will be available at every stage of supply for the tax paid at the earlier stage of supply. This feature would mitigate cascading or double taxation in a major way.

- The GST regime follows a four-rate structure that exempts or imposes a low rate of tax 5 per cent on essential items and levies the highest tax rate of 28 per cent tax on luxury and sin goods.

- The other two tax slabs are 12 and 18 per cent.

- Taxes subsumed under GST:

- The tax came into effect from 1 July, 2017 through the implementation of the One Hundred and First Amendment of the Constitution of India by the Indian government.

|

Article 279A: GST Council:

- This Article gives power to the President to constitute a joint forum of the Centre and States called the GST Council.

- GST Council is an apex member committee to modify, reconcile or to procure any law or regulation based on the context of Goods and Services Tax in India

- Its chairman is Union Finance Minister of India with ministers nominated by the state governments as its members.

- The council is devised in such a way that the Centre will have 1/3rd voting power and the states have 2/3rd.

- The decisions are taken by 3/4th majority.

|

ACHIEVEMENTS OF THE GST REGIME

- Widening tax base:

- The number of registered taxpayers at the time when the GST was rolled out was 65 lakhs.

- The tax base has significantly increased since July 1, 2017.

- As of March 31, 2022, there are 1.36 crore active GST registrations in the country.

- Increase in GST revenue collection:

- The increase in GST collections is the result of efforts taken by the government which includes extensive automation of business processes, application of e-way bill mechanism, targeted action on compliance verification, enforcement based on risk assessment and introduction of electronic invoice system.

- As per the data, GST revenues in May 2022 reached Rs 1.41 lakh crore, representing an increase of 44 % from the previous year and also the fourth time to breach the Rs 1.40 lakh crore mark.

- Unorganized sector is regulated:

- In the pre-GST era, it was often seen that certain industries in India like construction and textile were largely unregulated and unorganized.

- Under GST, however, there are provisions for online compliances and payments, and for availing of input credit only when the supplier has accepted the amount. This has brought in accountability and regulation to these industries.

- Rate rationalisation:

- In 2017, nearly 19 percent of items were under the 28 percent GST rate.

- But currently only 3 percent of the items subject to the 28 percent GST rate.

- Removal of cascading effect of taxes:

- In the pre-GST era, the total of VAT, excise, CST and their cascading effect led to 31% as tax payable, on an average, for a consumer.

- As per a report by the RBI, the weighted average GST rate fell from 14.4 per cent at the time of inception to 11.6 per cent in 2019.

- Promote Cooperative Federalism:

- GST council has emerged as a successful example of cooperative federalism and its functioning has been free from political biases.

- The federal nature of the GST regime was on display during the pandemic.

- In 2020-21, the revenue from State GST (or SGST) declined due to economic contraction.

- However, given the compensation paid to states and the arrangement of back-to-back loans, overall GST revenues for states stood at ?7.69 trillion in 2020-21 (including back-to-back loans and compensation cess), versus ?6.86 trillion in 2019-20.

- That was a growth rate of 12.1% in a covid-affected year.

- Better growth rate for states:

- In the five years (2017-18 to 2021-22) since the introduction of GST, the overall resource growth for states was 14.8% per annum, versus an annual average growth rate of 9% between 2012 and 2015.

- This clearly demonstrates that the states are better off than they were prior to the implementation of GST.

- Improved transparency:

- Taxpayers can track their compliances online on the GST Portal.

- Also, they can easily get the basic information about any business by entering the respective PAN or GSTIN which has increased transparency in the system.

- Ease of compliance:

- It has also brought in efficiencies in indirect tax compliances and reduced the number of indirect tax authorities that business needed to interact with.

- “E-Invoicing” has also ensured that a trade invoice is identified by a unique identification number which is generated by automated government-backed online portals.

- Increased Logistics efficiency:

- GST has eliminated all the inter-state barriers by removing check-posts, introducing a nationwide e-way bill, eliminating the entry tax.

- Thus, it has reduced transit time of movement of goods within the country. As per an estimate more than 50% of logistics effort and time is saved in GST regime.

CHALLENGES AND SHORTCOMINGS:

- Reduction in the fiscal autonomy of the States:

- With the introduction of GST, many indirect taxes levied by the states have been replaced.

- While these taxes were completely under the control of each state, GST rates are now decided by the GST Council.

- This implies that states have limited flexibility in making decisions regarding tax rates on goods and services.

- GST’s collection shortfall and compensation:

- Though GST limits the flexibility of states, the Centre’s guarantee of 14 per cent annual growth in this tax revenue, for a period of five years

- This was offered to achieve consensus for the introduction of GST.

- In case of less than 14 per cent growth, states will receive compensation from the Centre.

- This issue became controversial when GST collections fell because of the Covid-19 pandemic

- The economic impact of the pandemic has led to higher compensation requirement due to lower GST collection and at the same time lower collection of GST compensation cess.

- Also many states have demanded that the GST compensation cess regime be extended for another five years and the share of the Union government in the centrally-sponsored schemes be raised as the COVID-19 pandemic has impacted their revenues.

- Overestimation of GST collection:

- In the initial year government has overestimated the GST collection, which was not fulfilled, and hence created a sense of failed taxation regime.

- Multiple Tax Rates:

- Unlike many other economies which have implemented this tax regime, India has multiple tax rates.

- This hampers the progress of a single indirect tax rate for all the goods and services in the country.

- Higher tax rates:

- Though rates are rationalised, there is still 50 percent of items are under the 18 percent bracket.

- Apart from that, there are certain essential items to tackle the pandemic that was also taxed higher.

- For example, the 12% tax on oxygen concentrators, 5% on vaccines etc.

- Failed to check tax evasion

- GST tax evasion and tax fraud, including use of fraudulent invoices, fake e-way bills, etc has led to massive losses in revenue collection.

- Failed to bring petroleum under GST:

- Petroleum products are used as inputs for production or supply of other goods and services. Excluding them from GST results in cascading of taxes

- The Centre and states have been increasingly dependent on excise duties on petroleum products to shore up their revenues.

- Hence, the GST council has been reluctant to discuss the matter, as around 30 per cent of the states’ revenue comes from excise duties on petrol and diesel.

- Transitional Issues:

- Even after four years, many assesses are still experiencing technical/legal issues as a result of the transition from the old to the new GST system.

- Complex tax slabs:

- The complex slab structure and continually switching between them has created an undesired confusion in the compliance system.

- Additionally, fluctuating tax rates often led to unethical profiteering practices.

- Cumbersome compliance processes

- Filing returns remains challenging also there are multiple registration for service providers.

- Jurisdiction divided between states and Centre

- For instance, any company operating throughout India needs to register and be assessed in all the states where it operates. In case of services, where the payment and delivery of service do not happen simultaneously (e.g. advance booking for travel), the GST credit has to be held back by the party providing the service.

- Issues with anti-profiteering provisions:

- The anti-profiteering provisions, namely Section 171 of CGST Act and Rules 126, 127, and 133 of the CGST Rules , have been challenged in the courts for violating Articles 14, 19(1)(g), 265, and 300A of the Constitution of India.

- Companies are arguing that given that it has already been five years since the introduction of GST, and considering that the pandemic has materially changed the business environment for companies, the government must bring forth a sunset clause on the anti-profiteering provisions, to have market-driven pricing of goods and services.

WAY FORWARD:

- Simplifying tax structure and rationalize GST rates:

- A simpler tax slab structure limiting commodities to three tax slabs is the need of the hour. Experts have recommended a three-slab structure that will help rationalize this indirect tax system.

- Currently there are four main slabs—5%, 12%, 18% and 28%. One option, reportedly being proposed by the tax authorities, is to merge the 5% and 12% slabs into an 8% slab. Since the items in the 12% slab are relatively few in number, the loss of revenue would be minimal.

- GST tribunals and Central appellate body for advance rulings:

- Conflicting decisions passed by various State Authorities for Advance Rulings (AAR) under GST lead to confusion amongst businesses and make it difficult for India to truly achieve uniformity across jurisdictions.

- This has made setting up of a Central Appellate Authority for Advance Ruling one of the key demands of the industry players.

- Also, industry players requested to expedite the setting up of the GST tribunal.

- The 47th GST Council has decided to constitute a Group of Ministers to look into the setting up of GST Tribunal.

- Ensuring tax predictability:

- The GST Council should adjust the rates only once a year.

- Further, the Center shouldn’t bypass GST by introducing any Cess.

- The Center can also rationalise the present Cess ecosystem in India to a bare minimum. This will ensure tax predictability to states and enhance the ease of doing business.

- Expanding the GST network:

- Electricity and petroleum products should be brought under GST to avoid the cascading effect of taxes, as these are used as input by the majority of manufacturers and service providers.

- Simplify procedures and optimising digital resources:

- Filing system should be made more user-friendly.

- A major issue for taxpayers under the GST framework is claiming input tax credit; the process is unnecessarily cumbersome and time-consuming.

- Moreover, the current GST portal is not capable of handling large amounts of processing tasks all at once.

- Optimising digital resources will help accelerate the process of claiming input tax credit and increasing the capacity of the portal to handle higher numbers of data processing.

- Improve digital connectivity and digital literacy.

- Solving the issues between Centre and States:

- The Centre needs to urgently figure out and put to rest the battle between the Central and State Governments on sharing of revenue collections.

- Center has to be more accommodative to State’s needs such as granting compensation amount without delays, extension of compensation period etc.

PRACTICE QUESTION:

Q. “The GST regime in the last 5 years has moved forward with alacrity but it is still a long way to go to achieve its full potential of GST”. Discuss.