Sugar industry in India

2022 OCT 20

Mains >

Geography > Economic geography > water management

IN NEWS:

- India has emerged as the world’s largest producer and consumer of sugar as well as the world’s second largest exporter of sugar.

SUGAR INDUSTRY IN INDIA:

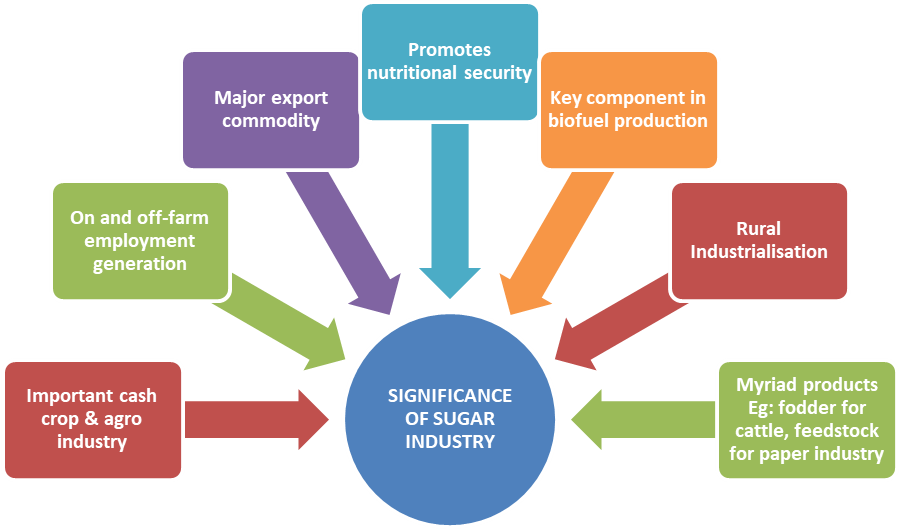

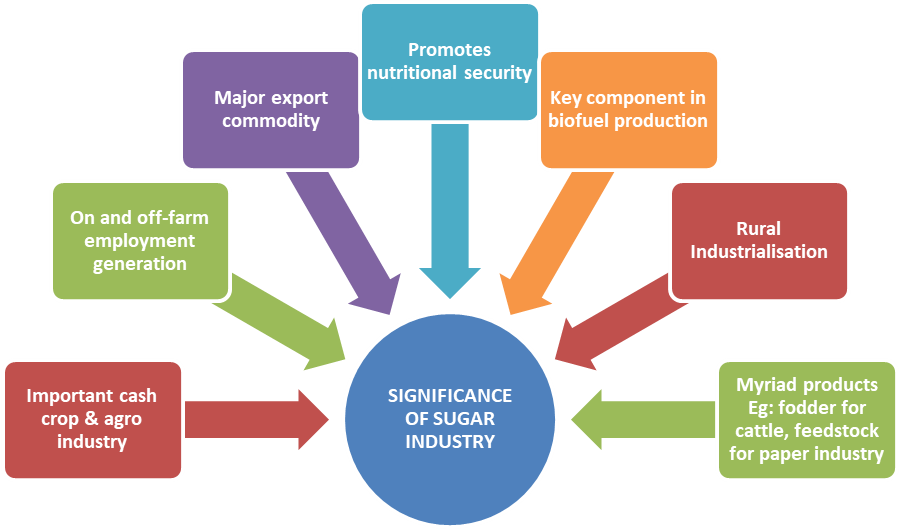

- Sugarcane and sugar industry is the country’s second largest agro-based industry in India, next to cotton.

- The crop occupies around 50 lakh hectares, ie. 2.57% of the gross cropped area.

- The industry employs around 50 million sugarcane farmers and around 5 lakh workers in sugar mills.

Production:

- India has emerged as the world’s largest producer and consumer of sugar, overtaking Brazil in production.

- The production in India stood at 35.8 million tonnes during the 2021-22 marketing season. It is projected to be 36.5 million tonnes in the 2022-23 marketing season.

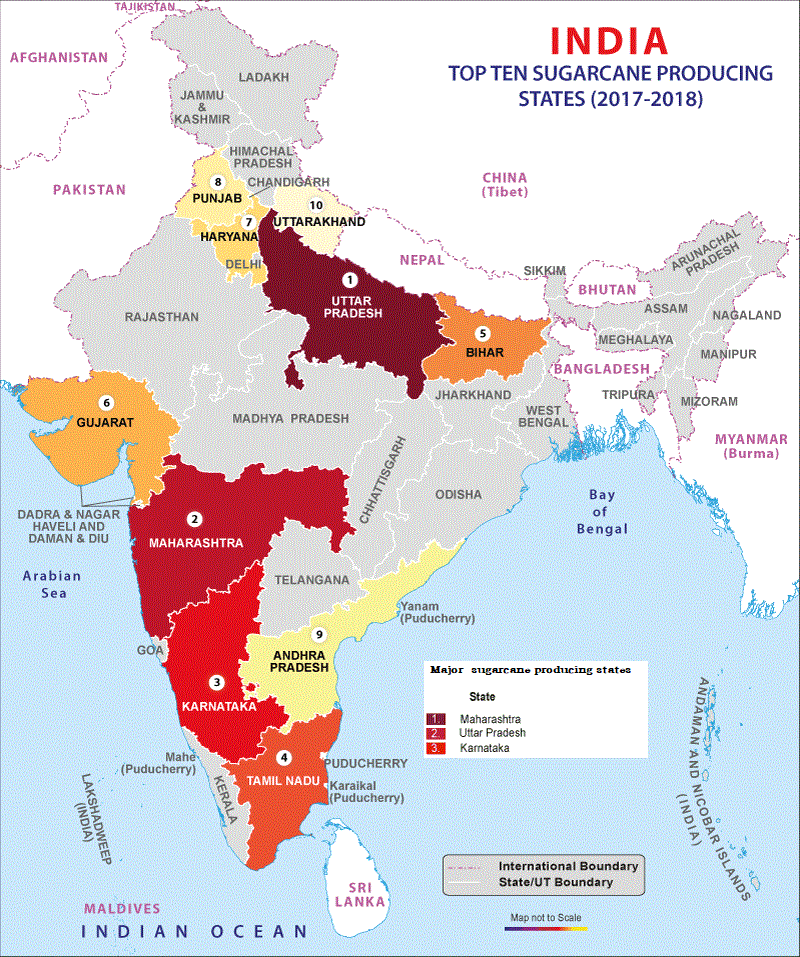

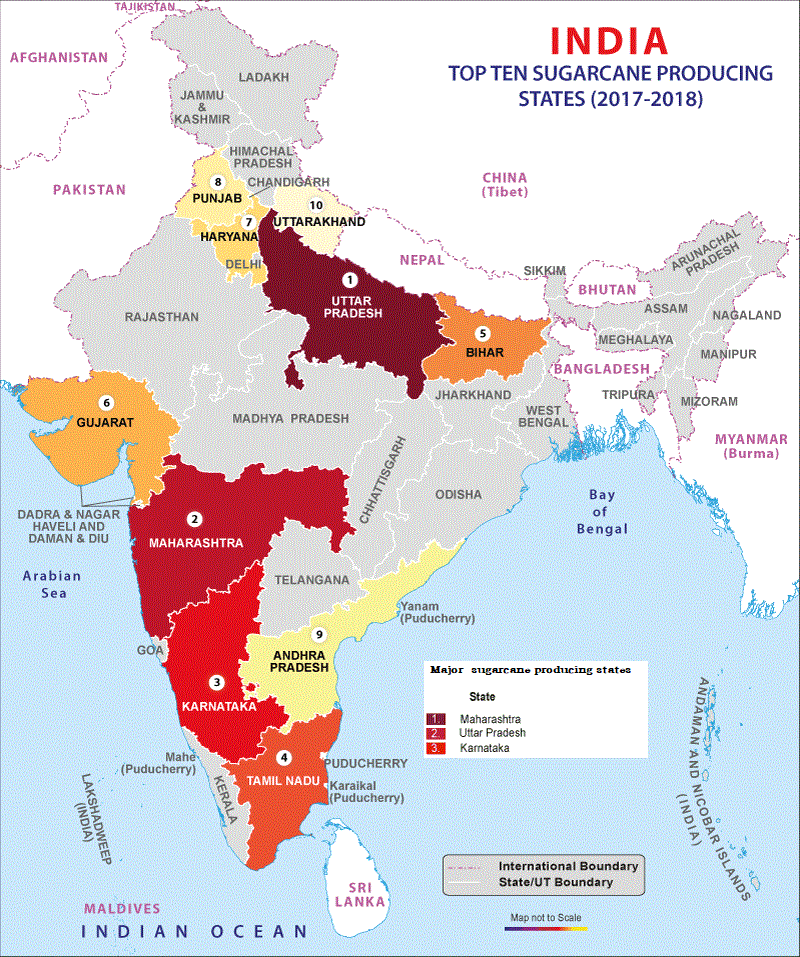

- In 2022, Maharashtra has overtaken Uttar Pradesh to regain its position as India’s top sugar producer.

Consumption:

- Sugar and jaggery are the cheapest source of energy, supplying around 10% of the daily calorie intake. The domestic demand is around 27 million tons per annum.

- Besides sugar production, sugarcane is also being used for ethanol production.

LOCATION OF SUGAR INDUSTRIES:

|

Important regions/ zones for sugarcane cultivation:

Broadly there are two distinct agro-climatic regions of sugarcane cultivation in India:

- Tropical Sugarcane region: consists of the peninsular and coastal regions which includes the states of Maharashtra, Andhra Pradesh, Tamil Nadu, Karnataka, Gujarat, Madhya Pradesh, Goa, Pondicherry and Kerala.

- Sub-tropical sugarcane region: Uttar Pradesh, Bihar, Haryana and Punjab come under this region.

|

- Sugar industry in India is based on sugarcane, which is a heavy and perishable commodity. It cannot be stored for long, as it leads to loss of sucrose content. Hence, to ensure continuous supply of sugarcane and to reduce the transportation cost, the industries are located close to the sugarcane producing areas.

- Entrepreneurship plays a role in the growth of the industry. Private sugar mill ownership is widespread in UP. The remaining sugar mills run as cooperatives, whereby the farmers are collective owners of those mills. This kind of sugar-mill ownership is prevalent in Maharashtra.

GOVERNMENT EFFORTS:

- Assured price and procurement:

- Fair and Remunerative Pricing (FRP):

- It is the price declared by the government, which mills are legally bound to pay to farmers for the cane procured from them.

- FRP is based on the recovery of sugar from the cane. (Sugar recovery is the ratio between sugar produced versus cane crushed, expressed as a percentage.)

- In addition, some state governments announce State Advised Price (SAP) at levels higher than FRP.

- Cane Reservation Area:

- Sugar mills that buy sugarcane are mandated to purchase crops from farmers within a specified radius known as the Cane Reservation Area.

- Buffer Stocks for Sugar:

- To alleviate the problem of the industry on account of surplus production and depressed sugar prices, government created a buffer stock for sugar.

- Unlike the buffer stocks of wheat and rice, which are maintained by the Government through FCI, the buffer stock of sugar is collectively maintained by the mills themselves.

- Deregulation of sugar sector:

- Based on the recommendations of the committee headed by Dr. C. Rangarajan, the sugar sector was partially de-regulated in 2013. Subsequently, levy on sugar and curbs on curbs on open market sale have been abolished.

- Financial assistance:

- Working capital loans with interest subvention were provided under the Scheme for Extending Financial Assistance to Sugar Undertakings (SEFASU 2014) as well as the soft loan scheme.

- Financial assistance to sugar mills was extended for defraying expenditure towards internal transport, freight and other charges to facilitate export of sugar.

- Research and development:

- Several institutions for research and development of new cane varieties and cultivation practices have been established in India.

- Eg: ICAR-Indian Institute of Sugarcane Research at Lucknow in the sub-tropical region and ICAR-Sugarcane Breeding Institute at Coimbatore, Tamil Nadu in the tropical region.

- ICT solutions:

- Mobile applications such as the Cane Advisor developed by ICAR-SBI, Coimbatore to help in nutrient management.

- Sugarcane Information System (SIS) developed by the Government of Uttar Pradesh to make post-harvest activities like sale, and procurement easier.

- Other efforts:

- Ethanol Blending programme:

- Ethanol Blended Petrol (EBP) programme was launched primarily to promote environment-friendly fuels (by increasing the usage of ethanol) and reduce energy imports.

- The EBP programme injects liquidity into the sugarcane sector by providing sustained demand for ethanol.

- Extra read: https://ilearncana.com/details/Ethanol-Blending/3222

- National Biofuel Policy, 2018:

- The Policy expands the scope of raw material for ethanol production by allowing use of sugarcane juice and sugar containing materials like sugar beet, sweet sorghum, among others.

- Pradhan Mantra Krishi Sinchayee Yojana

CHALLENGES:

- Low productivity:

- The yield per hectare in India is around 80 tonnes, while the same in Philippines and Ethiopia are >100 tonnes yield per hectare.

- Sugar recovery in India is approximately 10% while countries like Australia, Brazil and South Africa are obtaining 11-14%.

- Short crushing sason:

- Sugar accumulation in cane is highest when the weather is dry with low humidity; bright sunshine hours, cooler nights with wide diurnal variations and very little rainfall during ripening period. Hence, the crushing season, especially in North Indian mills, is restricted to 4-7 months a year.

- Water intensive crop:

- Sugarcane is a water intensive crop. On average, 1 kg of sugar requires about 1500–2000 kg of water. But with the present pattern of water consumption, almost half of the demand will remain unmet in 2030.

- Poor water use efficiency:

- Water productivity indicates how much economic output is produced per cubic meter of fresh water abstracted. Economic water productivity (EWP) of sugarcane in Bihar and UP is as high as Rs. 36 and Rs. 30 per cubic metre of irrigation water applied.

- Depletion of groundwater:

- About 70% of the country’s irrigation facilities are utilised by paddy and sugarcane. As most of this is met mainly through groundwater, it has severely affected reduced the water table in many parts. Eg: Maharashtra’s Marathwada region.

- Stagnant price of Sugar:

- Cane prices on average account for about 70%–75% of the cost of sugar in India. But the falling/stagnant price of sugar despite the continuous rise in sugarcane prices is the main source of troubles faced by the sugar industry in the last few years.

- Problem of arrears for sugarcane farmers:

- Due to high Fair and Remunerative Price (FRP) and restrictions under Cane Reservation Area (CRA), sugar mills struggle to purchase sugarcane from farmers. This results in delayed payments, which affect the subsequent cropping seasons.

- Eg: According to Food Ministry data, mills procured sugarcane worth Rs 33,023 crore in UP during the 2020-21 season, of which 15.3% remained unpaid at the end of the season on September 30, 2021.

- Issues with Cane reservation area:

- Every designated mill is obligated to purchase from cane farmers within the cane reservation area, and conversely, farmers are bound to sell to the mill.

- However, this arrangement reduces the bargaining power of the farmer. He is forced to sell to a mill even if there are cane arrears. Mills are also restricted to the quality of cane that is supplied by farmers in the area.

- Low level of mechanisation:

- On an average, the extent of mechanization in sugarcane agriculture is less than 40% in our country. This makes the industry vulnerable to labour shortages and high production cost.

WAY FORWARD:

- Pricing of Sugarcane:

- To prevent the problem of arrears and to keep the sugar industry in sound financial health, sugarcane prices must be linked to sugar prices.

- The Revenue Sharing Formula (RSF) needs to be introduced, with a Price Stabilisation Fund to protect farmers from receiving prices below the FRP.

- Sugar and Sugarcane Development Fund:

- A dedicated fund may be established by charging cess on sugar to provide liquidity support to the mills.

- Encourage ethanol production:

- Required support should be extended to help upgrade and integrate technology and learn from Brazilian experience of diverting raw sugarcane juice towards ethanol blending.

- Implement key recommendations of Rangarajan committees:

- Several recommendations of the committee, relating to CRA and adoption of the Cane Price Formula have been left to State Governments for adoption and implementation. But most states have not taken any action on these. Central government should encourage the states to adopt these recommendations.

- Expansion of Drip Irrigation in Sugarcane Cultivation:

- Efforts should be made for adoption of drip irrigation in place of flood irrigation. In addition to sustained sensitization campaign, some incentive mechanisms in form of concessional access to infrastructure could also be considered for farmers.

- Diversification towards less water-intensive Crops:

- Cropping pattern in water stressed area under sugarcane cultivation should be shifted to less water-intensive crops, by providing suitable incentive to farmers.

- Encourage product diversification:

- Incentives be provided to sugarcane mills to recycle bagasse and adopt advanced technology for jaggery manufacturing.

- Revise trade Policy:

- The Department of Food and Public Distribution should coordinate with the Department of Commerce and work out suitable incentive mechanism for export of sugar while adhering to the regulations under WTO.

PRACTICE QUESTION:

Q. Analyse the challenges faced by sugar industry in India and suggest measures to overcome them.