Power Sector Crisis

2021 SEP 15

Mains >

Economic Development > Indian Economy and issues > Energy security

WHY IN NEWS

- South Eastern Coalfields Limited (SECL), the flagship arm of state-run Coal India Limited (CIL), had increased the coal supply to the power sector to avoid power crisis. The country’s power plants are witnessing huge demand for coal following a hike in coal prices in the foreign markets and domestic production affected due to the monsoon.

BACKGROUND

- India is the third-largest producer and consumer of electricity in the world as of July 2019.

- India has improved its ranking in the Energy Transition Index published by the World Economic Forum (76th position).

- Installed power generation capacity has been increased tremendously in the past decade.

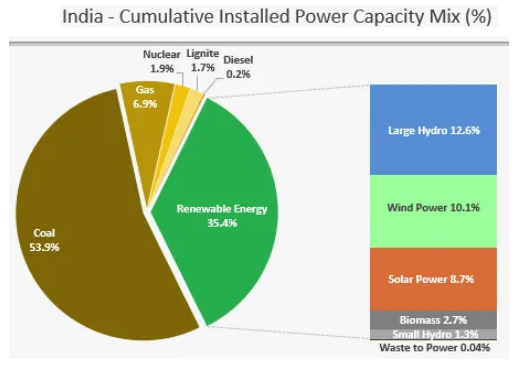

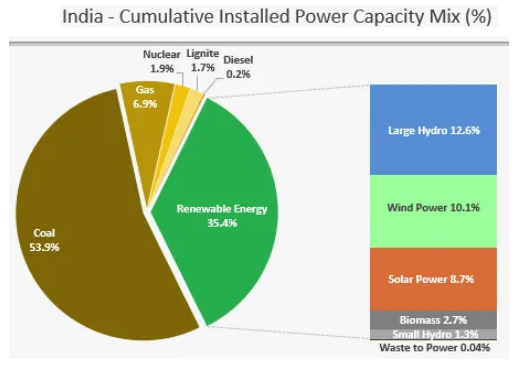

- The maximum peak demand experienced during the 2019 was around 183 GW whereas the installed generation capacity in the country is around 365 GW which is double our peak demand

- The power sector in India has three main segments:

- Generation:

- It is the process of producing power using different fuels and is done in generating plants.

- In the last two decades, India’s power generation capacity has increased considerably. This is mainly due to the delicensing of power generation in 2003, which enabled unlimited participation of private players.

- Currently, private utilities generate about 46% of the country’s power, followed by state utilities (30%) and central generating utilities (24%).

- In March 2019, the Union Cabinet announced that hydropower projects will also be classified as renewable energy projects along with wind, solar, biomass and small hydropower.

- Renewable sources could either be connected to a grid or be off-grid systems.

- As of January 2019, the total grid-interactive renewable power capacity (excluding hydro) is at 45 GW.

- Transmission

- Transmission utilities carry bulk power from the generation plants to the distribution substations through the grid at high voltages.

- It is carried out mostly by central and state companies.

- The transmission segment was separated from the central government agency in 1989 and the Power Grid Corporation was established.

- Power Grid Corporation is in charge of planning, implementation and maintenance of the interstate transmission system and operation of national and regional power grids.

- Following the implementation of the Electricity Act, 2003, consumers can buy power from any power generating plant through non-discriminatory access to transmission and distribution lines, according to the specifications set by states.

- India’s transmission lines have grown at an average annual rate of 6.5% between 2007 and 2019.

- Distribution:

- Distribution utilities supply electricity from the substations to the consumers through distribution networks.

- Distribution is the selling stage and operates at lower voltages.

- It is mainly carried out by state-owned DISCOMS.

- DISCOMS procure power from independent power producers [IPPs] and public sector undertakings [PSUs] such as the National Thermal Power Corporation [NTPC] besides their own generating stations and sell to consumers.

- Currently, the state DISCOMS are faced with poor financial health, leading to the negative effects on their ability to purchase power for supply and the ability to invest in improving the distribution infrastructure.

EVOLUTION OF THE CRISIS

- A realistic look at the power sector reveals that distribution companies (DISCOMS) are in bad shape and new power purchase agreements (PPAs) are not being floated even though there is demand for power.

- DISCOMs do not have the money to buy power. The pricing of power leaves DICOMS in a peculiar dilemma. The more they sell, the more they lose. Consequently, this lack of demand, in turn, is impacting the health of power generating companies (GENCOS).

- Poor financial conditions of DISCOMS have resulted in mounting dues that have to be paid to GENCOS.

- DISCOMS have failed to articulate the demand for electricity in the form of PPAs.

- GENCOS have been unable to service their debt

- Nonperforming assets (NPAs) in power generating companies (GENCOS) are mounting.

- There is shortage of coal and a number of power generating units are critical for want of coal.

- The DISCOMS owe more than Rs 90000 crore to GENCOS, who in turn have to pay more than Rs 25,000 crore to Coal India Limited.

- The banking industry, already under pressure, is saddled with the additional problem of potential NPAs on account of non-performing GENCOS.

- There is, thus, a vicious circle that has hit the energy sector and if the issues are not addressed expeditiously, there could be a serious crisis which can impact the entire economy.

CHALLENGES IN POWER SECTOR

- Issues with power generation:

- Continuation of the high deficit:

- In 2018-19, the Central Electricity Authority had estimated that India had an energy surplus of 4.6% and peak surplus of 2.5%.

- Yet, the energy deficit still persists in several states and Union Territories like Jammu and Kashmir and the north-eastern states.

- Also, certain states like Chhattisgarh, Odisha and Uttar Pradesh continue to face peak deficit despite having high generation capacity.

- A decline in capacity utilisation of thermal power plants:

- Despite the increase in generation capacity, the Plant Load Factor of the thermal power plants has declined from 78% in 2009-10 to 61% in 2018-19.

- Plant Load Factor (PLF) is the measure of the output of a power plant compared to the maximum output it could produce.

- Private and state-owned generators have the poorest PLF when compared with the central ones.

- Low PLF means that the thermal power plants have been lying idle, which may be due to non-availability of fuel (gas or coal), surplus capacity or low demand for power or demand being met by other sources. Even if the thermal plant is not used, it still incurs high costs.

- The Standing Committee on Energy, in 2017, stated that the inefficient capacity utilisation is due to numerous issues in the power sector like:

- Weak financial conditions of discoms, leading to a decrease in demand for power and lesser utilisation of capacities

- Significant decrease in the solar tariff and its very low gestation period

- Share of hydropower has decreased from 25% in 2007-08 to about 13% in 2018-19.

- Uneven distribution of renewable energy:

- Renewable energy is unevenly spread about in the country.

- The NITI Aayog had noted that electricity buyers in renewable-poor states are comparatively less willing to purchase renewable electricity as their cost is higher than the conventional sources.

- In contrast, discoms in renewable-rich states are willing to support additional renewable deployment if they are assured of sufficient willing buyers.

- High cost:

- For the DISCOMS, the cost of purchasing power from a thermal power plant is around 75 to 80% of the total expenditure.

- Thus, any change in the cost of power can significantly affect the retail tariff.

- The high tariff is one of the main reasons behind the decrease in demand.

- High NPAs:

- According to the RBI, the public sector banks have the highest number of NPAs, most of which are in the power and the telecom sector.

- The reasons for the large number of NPAs are as follows:

- There is insufficiency in the availability of coal in several thermal power plants.

- Payment delays by discoms: The power plants are stressed because of the delay in the payment by the discoms and the inability to cancel Power Purchase Agreements with such discoms or sell power on the power exchange

- Interstate disputes:

- Due to the river-sharing disputes, it is often difficult to construct efficient and equitable mechanisms for river sharing between states.

- This has led to non-availability of water at all times to operate hydro plants within states.

- Interstate disputes also restrict the exchange of surplus power between states.

- Issues with power distribution:

- The poor financial health of DISCOMS:

- DISCOMS purchase power from the generation companies to sell it to the consumers.

- Currently, they are incurring huge losses and are struggling with increasing debt, making it difficult for them to purchase power and invest in a distribution network.

- This situation has led to a decrease in power supply and low-quality distribution infrastructure.

- DISCOMS dues to independent power producers [IPPs] and public sector undertakings [PSUs] stood at Rs 90,000 crore in Feb 2020.

- The RBI, in its report released in October 2019, warned that with the decrease in power sector demand, economic slowdown and increasing losses of discoms, UDAY scheme is likely to put more stress on the states’ finances.

- Cross-subsidization:

- Today, different consumers purchase electricity at different rates based on their consumption category.

- This has led to a huge gap between the average cost of supply and the average revenue realised per unit.

- State governments provide subsidies to DISCOMS to push them to change such differential tariff from low paying consumers. Despite this measure, the overall revenue realisation cannot meet the total supply cost.

- During 2019-20 ACS-ARR gap of DISCOMS stood at Rs 0.42 per unit

- High AT&C losses:

- AT&C (Aggregate Technical and Commercial) loss is the measure of a combination of energy loss (technical loss, theft and inefficiency in billing) and commercial loss (default in payment and inefficiency in the collection).

- It is the difference between energy input units into the system and units for which the payment is collected.

- Low investments in distribution led to overloaded systems, resulting in higher technical losses.

- Lack of metering and poor billing and collection system contribute to commercial losses.

- Government measures in the past few years have failed to address this issue.

- During 2019-20, AT&C losses of DISCOMS were 18.9%

- Low demand for power in the economy:

- Power consumption is declining in the past few years due to economic slowdown; this decline has been aggravated by COVID situation.

- Low demand for power in the economy is having a ripple effect, both in the upstream and downstream sectors.

- The lockdown has severely impacted revenue collection, and meter reading has come to a halt

- Other issues:

- Power supply duration:

- Currently, 4.3% of villages in India do not receive electricity for domestic use. Majority of these villages are in the north-eastern region.

- 7% of villages receive electricity for one to four hours a day.

- According to the data collected under Mission Antyodaya that was implemented by the Ministry of Rural Development, in 2018, about 53% of the villages receive electricity for less than 12 hours a day.

- Low-quality rural electricity:

- The government initiatives to provide electricity to households are narrowed down to provide only for illumination.

- The electricity for illumination purpose alone does not support small electricity-based commercial activities.

- Also, the discoms that provide such connections see rural consumers as a liability with little to no scope for profitable revenue.

- Inaccessibility to power:

- About 300 million people do not have access to electricity in the country.

- India has one of the lowest per capita power consumption in the world. Equivalent to the consumption in the US of late 19th and early 20th century

- Though India has about 18% of the global population, it uses only around 6% of the world’s primary energy

- While calculating power demand, only those who are connected to the grid and have access to electricity are considered.

- Weak institutional structure of regulators:

- Central Electricity Regulation Commission (CERC) employees’ pay structure, service conditions, and other facilities are dismal.

- They lack adequate promotional prospects and better amenities

INITIATIVES TAKEN BY THE GOVERNMENT:

- Ujwal DISCOM Assurance Yojana:

- Launched in 2015, it aims to rescue the country’s ailing DISCOMS.

- Under the scheme, states can take over three-fourths of the debt of their respective DISCOMS and include them in the fiscal deficit calculations.

- The governments will then issue ‘UDAY bonds’ to banks and other financial institutions to raise money off the banks.

- The remaining 25% of the DISCOM debt will be dealt with either of the two ways:

- Conversion into lower interest rate loans by lending banks

- Be funded by money raised through discom bonds backed by State guarantee.

- In return for the bailout, DISCOMS have been given target dates by which they will have to meet efficiency parameters like:

- Reduce AT&C losses from 20.7% during 2015-16 to 15% by 2018-19

- Reduce the ACS-ARR gap (Average Cost of Supply- Average Revenue Realized) from Rs 0.59 per unit during 2015-16 to ‘zero’ by 2018-19.

- Installing smart meters

- Implementing Geographic Information System (GIS) mapping of loss-making areas.

- This scheme was optional for states.

- Those states that accepted the scheme can receive additional benefits from the Centre like:

- Additional or priority funding through Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Integrated Power Development Scheme (IPDS), Power System Development Fund (PSDF) or similar schemes

- Additional coal supply at notified prices and low-cost power from NTPC and other Central PSUs depending on the availability.

- Under the UDAY scheme, states should take certain measures like compulsory smart metering.

- Deendayal Upadhyaya Gram Jyoti Yojana:

- DDUGY aims to provide a continuous power supply to rural India.

- Its main components include:

- Feeder separation to ensure judicious supply to agricultural and non-agricultural consumers in rural areas

- Improving the sub-transmission and distribution network

- Metering at all levels (input points, feeders and distribution transformers)

- Completion of already sanctioned projects under RGGVY and rural electrification

- Solar power:

- Two national-level programmes were implemented by the Ministry of New and Renewable Energy to promote the installation of solar rooftop systems.

- These programmes include: Grid Connected Rooftop & Small Solar Power Plants Programme Off-grid & Decentralised Solar

- Integrated Power Development Scheme (IPDS):

- The scheme aims to:

- Strengthen sub-transmission and distribution network in urban areas

- Metering of distribution transformers/feeders/consumers in urban areas

- Strengthen and create IT-enabled distribution network.

- ‘One Nation-One Grid’:

- India’s power system is divided into five regional grids with each grid catering to electricity demands for one particular region.

- One Nation, One Grid aims to integrate all these grids.

- The grids are linked with one another to ensure that the surplus power is exchanged between regions.

- Saubhagya Scheme:

- Saubhagya scheme or Pradhan Mantri Sahaj Bijili Har Ghar Yojana is an initiative that aims to provide electricity to the households.

- Certain households identified via the Socio-economic and Caste Census (SECC) on 2011 will be eligible for free electricity connections, while others will be charged Rs.500.

- Though the scheme aims to provide infrastructure for providing electricity to all households in the country, the electricity supply still remains a challenge.

- SAMADHAN scheme:

- It aims to prevent the liquidation of stressed power projects as energy sector faced a financial crisis.

- This is done by pushing banks to take over the debt of power plants that are experiencing difficulties.

- The idea is to reduce the debt to a manageable level and then convert the remaining unsustainable debt into equity, which can be bided out to the interested buyers.

- Smart meters:

- The government has made it compulsory to use smart prepaid electricity from April 2020 in all parts of the country and replace the previous ones in the next three years.

- These smart meters will reduce the AT&C losses significantly and make bill payments easier.

- Electricity (Amendment) Bill, 2020:

- One of the main aims of the 2020 version of the amendment Bill is to de-license power distribution and increase competition, thereby unleashing next-generation power sector reforms in India.

- This is a path-breaking decision that has the potential not only to empower customers but also to bring huge investments into the sector and accelerate technology adoption.

- The reforms will also give more options to the consumers in choosing their discoms. Meanwhile, the introduction of Direct Benefit Transfer (DBT) of power subsidies will ensure greater transparency and accountability.

- Power System Development Fund (PSDF)

- PSDF has been approved with over Rs.6,000 crore in Budget 2020 to create and modernise transmission and distribution systems of strategic importance to relieve congestions in inter- and intrastate transmission systems.

- Two components under ‘Atmanirbhar Bharat Abhiyan’ for reforming power sector:

- First component

- It provides for special loan of Rs 90,000 crore from Rural Electrification Corporation [REC] and Power Finance Corporation [PFC] to discoms to enable them to clear their dues to independent power producers [IPPs] and public sector undertakings [PSUs] such as the National Thermal Power Corporation [NTPC]

- Second component

- It relates to hike in the borrowing limit of states from existing 3% of the State GDP to 5%. But this additional borrowing will be permitted subject to the state achieving measurable targets in four areas of reforms – one of these being power. 0.25% of SGDP borrowing space is linked to power sector reforms – such as

- State reducing aggregate technical and commercial [AT&C] losses of its DISCOMS

- Reducing the gap between average cost of supply and average revenue realisation [ACS-ARR gap] from sale of electricity.

- State will have to formulate a scheme to roll out DBT to all farmers in lieu of free electricity from 2021-22

WAY FORWARD:

- Reducing cost:

- The high generation cost can be reduced by increasing the availability of cheaper indigenous coal, rationalising coal supply sources and adopting new technology that supports indigenous coal.

- Promote cross-border electricity trade:

- The government needs to actively promote cross-border electricity trade to utilize existing/upcoming generation assets.

- The SAARC electricity grid is a step in the right direction.

- Provide 24X7 power for all:

- To achieve the goal of 24X7 power for all, the following areas should be given higher emphasis:

- Accurate monitoring of power supply at the end-user level

- Quality and maintenance service of the discoms, including efficient transmission, reduce load shedding and shutdowns.

- Human error should be reduced by ensuring tech-driven billing, metering and collection.

- Strengthening regulators:

- Central Electricity Regulation Commission (CERCs) and State Electricity Regulation Commissions (SERCs) need to be strengthened to ensure better compliance of Electricity Act

- Abolishing cross-subsidy regime:

- Letting power utilities realize full market price from all consumers by doing away with cross-subsidy provided to poor consumers.

- Poor consumers can be compensated through DBT, thus shifting burden of subsidy from DISCOMS to budget.

- Increasing constant supply of coal:

- The Coal Project Monitoring Group will need to be activated. This will help facilitate faster clearances.

- Reviving power generating companies:

- A high-level empowered committee should be set up to examine each stressed power project and work out a rehabilitation package.

- The GENCOS should also not be saddled with burden of cross subsidising the renewable energy sector.

- Managing the demand for power:

- Introduce 100% metering-net metering, smart meters, and metering of electricity supplied to agriculture.

- Introduce performance-based incentives in the tariff structure.

- Need for balancing power:

- Though the growth of renewables is a positive outcome, thermal energy is the primary source for the power sector and will continue to remain a vital source of power in the near future.

- Also, since the renewable energy sources are intermittent in nature, a balancing power is vital to support the grid and even out the fluctuations.

PRACTICE QUESTION:

Q. Comment on the important initiatives taken to reform power sector in India. Also discuss the impediments in reviving and restructuring the state-owned power distribution companies?