India and Free Trade Agreements

2022 NOV 24

Mains >

International relations > Agreements > Bilateral Agreement

IN NEWS:

- Australian parliament approved the India-Australia Free Trade Agreement (FTA), paving way for both countries to implement the trade pact on a mutually agreed date. This agreement is an outcome of India’s aggressive efforts to sign free trade agreements after exiting the RCEP.

TRADE AGREEMENTS:

- Trade agreements is an accord between two or more countries for a specific terms of trade, commerce, transit or investment. They mostly involve mutually beneficial concessions.

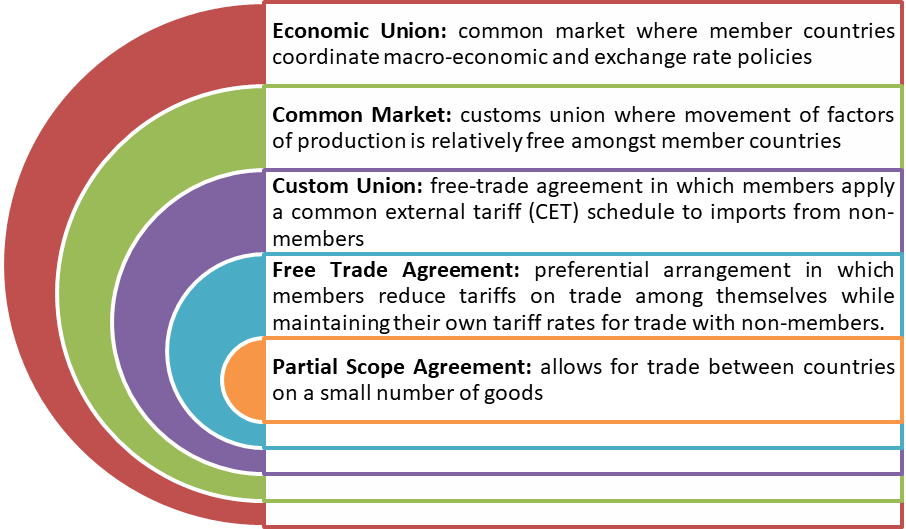

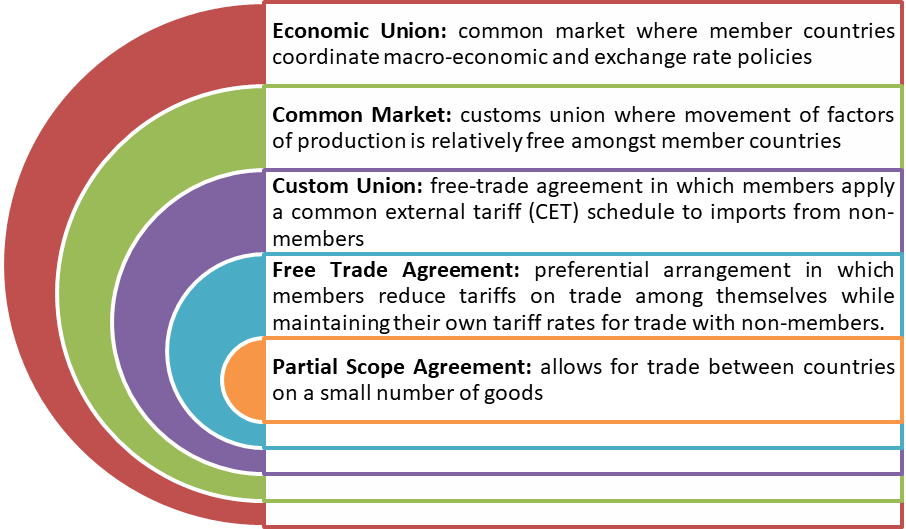

- Depending on the terms and concession agreed on by the participating bodies, there are several types of trade agreements:

|

Note:

1. Early harvest scheme:

- It is a precursor to a free trade agreement (FTA) between two trading partners. This is to help the two trading countries to identify certain products for tariff liberalisation pending the conclusion of FTA negotiation. It is primarily a confidence building measure.

2. Comprehensive Economic Partnership Agreement:

- A Comprehensive Economic Partnership Agreement (CEPA) or a Comprehensive Economic Cooperation Agreement (CECA) is different from a traditional Free Trade Agreement (FTA) on two counts:

- While a traditional FTA focuses mainly on goods, a CECA/CEPA is more ambitious in terms of a holistic coverage of many areas like services, investment, competition, government procurement, disputes etc.

- CECA/CEPA looks deeper at the regulatory aspects of trade than an FTA. It is on account of this that it encompasses mutual recognition agreements (MRAs) that covers the regulatory regimes of the partners.

|

INDIA AND FTAs:

- In addition to its long-standing commitment to multilateralism under WTO agreements and in line with global trends, India has made use of FTAs as a key component of its trade and foreign policy.

- As of April 2022, India has signed 13 Free Trade Agreements (FTAs) with its trading partners, the most recent being India-UAE Comprehensive Partnership Agreement (CEPA) and India-Australia Economic Cooperation and Trade Agreement (IndAus ECTA).

- In addition, India has signed 6 limited coverage Preferential Trade Agreements (PTAs), most notable one being the South Asia Free Trade Area (SAFTA) and Asia Pacific Trade Agreement (APTA).

- According to data provided by the Directorate General of Commercial Intelligence and Statistics, India’s merchandise exports to countries/regions with which India shares trade agreements such as FTAs have registered a growth of 20.75% in the last five years.

- Based on past learnings and changing dynamics, India’s FTA architecture has changed. While the earlier FTAs focused on eastern countries under the ‘Look East’ policy, the recent FTAs are more focused on Western geographies such as the US, the UK, the EU, and Eurasia.

MERITS OF FTAs:

- Tariff reduction:

- FTA/PTA results in reduced tariff for the offered product list. Eg: In India-MERCOSUR PTA, MERCOSUR offered preferential tariff reduction ranging from 10% to 100% on 450 listed products.

- Capitalize on the comparative advantage:

- FTAs allows a country to specialize in the goods it can produce cheaply and efficiently relative to other countries. India has comparative advantage in areas like IT-enabled services and trade agreements can boost their growth.

- Access to new markets:

- By eliminating tariffs and some non-tariff barriers FTA partners get easier market access into one another's markets.

- Diversify supply chain:

- COVID19-induced supply chain disruptions alerted India about the necessity of diversifying its sources of essential products. This, coupled with other geopolitical tensions, has accelerated the sourcing resources by connecting to multiple large economies through formal trade agreements.

- Export promotion:

- FTAs give preferential treatment and competitive access to the exporters as well as importers in the partner countries.

- For example, ASEAN's custom duty on leather shoes is 20% but under the FTA with India it reduced duties to zero. Hence, an Indian exporter will be more competitive than a non-FTA exporter of shoes.

- Industrialization:

- Trade agreements that cover various factors of production can result in the shift of low value addition industry, which are mostly labour intensive, from developed to developing world.

- Attract investment:

- Besides attracting investment from partnering nations, FTAs also increase the possibility of foreign investment from outside the FTA.

- How?

- Consider two countries A and B. Country A has high tariff and large domestic market. The firms based in country C may decide to invest in country A to cater to A's domestic market. However, once A and B sign an FTA and B offers better business environment, C may decide to locate its plant in B to supply its products to A.

- Innovation and technology transfer:

- Better market integration tends to enhance competition and pushes the industry towards innovation benefitting consumers in long run. Increased trade also tends to facilitate transfer of skills and technology.

- Faster implementation:

- Unlike multilateral negotiations, FTAs offer the possibility of reaching consensus on polarising issues much faster. Hence, it enables India to secure its national interests on matter like IP regime and rules of origin.

- Enhance people to people contact:

- FTAs can improve the flow of people between the member countries.

- For eg: The India-UAE FTA will facilitate mutual recognition of professional degrees in sectors such as architecture, engineering, medical, nursing, accountancy, and company secretaries allowing easier mobility of skilled services professionals across the two countries

CONCERNS:

- Increase trade deficit:

- Past experience with FTAs shows that following a relaxation in tariffs, India’s imports have risen at a faster pace than exports to the respective trading partners.

- Eg: Since signing an FTA in 2009, India's trade deficit with ASEAN has widened from USD 5 billion in 2010-11 to USD 23.8 billion in 2019-20. In contrast, India has achieved a rise in exports to the USA and China despite not having any FTAs with them.

- Impact on local supply chains:

- India’s exports are primarily led by MSMEs which have limited capacity and hence the trade favours the country with surplus capacity. Eg: Following the FTA with ASEAN in 2009, surge in raw material imports, especially natural rubber, nullifies India’s advantage in finished rubber products.

- Fear of dumping:

- By utilizing the lack of transparency in the rules of origin certification process, third parties have been accused of re-routing commodities to avail the benefit of trade agreement. Eg: Steel from China is re-routed through ASEAN to India.

- Lack of synergy between trade policy and FTA strategy:

- Enthusiasm for FTA seems to conflict with India’s trade-policy stance under the Aatma Nirbhar Bharat initiative, whose genesis is on "vocal for local", thereby promoting domestically produced goods over imported goods.

- Rise in protectionism:

- Developed countries are growing wary of free trade and are shunning the developing countries by blocking access to markets. This has led to glut in the global market and search for newer economies to absorb the capacity.

- Stop and go approach of India:

- In November 2019, India walked out of the Regional Comprehensive Economic Partnership (RCEP). In 2022, the government abruptly announced a ban on the export of wheat and sugar. There have also been frequent tariff tweaks. These actions affect partners’ confidence over India’s commitments.

- Extra reading: India and RCEP: https://www.ilearncana.com/details/India-and-RCEP/500

- Unresolved issues:

- There are many areas where India and its partners have conflicting views, like IP regime, opening up the services sector, shifting the base year for tariff cuts and stringent rule of origin.

- Eg: India’s hesitance to reduce tariff on wines and automobiles and UK’s reluctance to enable easy entry rules for professionals is a major impediment in finalizing the India-UK FTA.

- Lack of transparency:

- India negotiates most FTAs behind closed doors with very little information about the objectives and processes followed and negligible scrutiny.

- Furthermore, no institutional mechanisms exist that enable the scrutiny of the actions of the executive, during and after the signing of the FTA.

WAY FORWARD:

As countries and global firms are adopting a strategy to avoid investing only in China and diversify their businesses to alternative markets, Delhi has been presented with a rare opportunity to become globally integrated. To utilize this, India needs to:

- Conclude FTAs:

- A swift conclusion of Free Trade Agreement pacts being negotiated with countries like the UK and European Union could create easier market access.

- Transparency and accountability:

- The Committee on Commerce should be tasked with scrutinizing FTAs, discussing different aspects of agreements and negotiations, thus ensuring executive accountability to the legislature.

- Renegotiate exiting FTAs:

- India should encourage its partners to renegotiate existing FTAs to reduce trade deficits, prevent misuse by ‘third parties’ and remove trade restrictions as well as non-tariff barriers that hurt Indian exports disproportionately.

- Address non-tariff barriers:

- India needs to invest in infrastructure and regulatory measures to adhere to non-tariff barriers like quality control measures.

- Eg: A unified body that can handle all Sanitary-Phyto Sanitary (SPS) issues from a single window can be considered for agricultural exports.

- Focus on boosting competitiveness:

- Building infrastructure, strengthening MSMEs, reforming labour markets, higher investments in R&D, strengthen logistics sector, regulatory clarity around IP issues and creating conditions for Indian industry to compete in global markets.

- Ease of doing business:

- Streamlining regulatory compliance practices

- Stability in export policies

- Brand development:

- India should invest in developing a ‘Made in India’ brand in the global market to attract more demand.

PRACTICE QUESTION:

Q. Analyse the reasons behind India’s renewed focus on signing bilateral free trade agreements.